Cincinnati Bell 2012 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2012 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

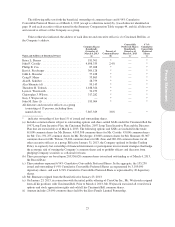

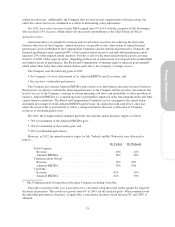

The following table sets forth the beneficial ownership of common shares and 6 3/4% Cumulative

Convertible Preferred Shares as of March 4, 2013 (except as otherwise noted) by (i) each director identified on

page 14 and each executive officer named in the Summary Compensation Table on page 44, and (ii) all directors

and executive officers of the Company as a group.

Unless otherwise indicated, the address of each director and executive officer is c/o Cincinnati Bell Inc. at

the Company’s address.

Name and Address of Beneficial Owner

Common Shares

Beneficially

Owned as of

March 4, 2013

(a)

Percent of

Common Shares

(b)

Convertible

Preferred Shares

Beneficially

Owned as of

March 4, 2013

(c)

6

3

⁄

4

%

Cumulative

Convertible

Preferred

Shares

(c)

Bruce L. Byrnes ........................... 181,501 * — *

John F. Cassidy ............................ 4,898,335 2.4% — *

Phillip R. Cox ............................. 87,268 * — *

Kurt A. Freyberger ......................... 309,128 * — *

Jakki L. Haussler .......................... 57,438 * — *

Craig F. Maier ............................ 55,863 * — *

Alan R. Schriber ........................... 28,759 * — *

Alex Shumate (d) .......................... 99,145 * — *

Theodore H. Torbeck ....................... 1,188,326 * — *

Lynn A. Wentworth ........................ 54,279 * — *

Christopher J. Wilson ....................... 317,282 * — *

Gary J. Wojtaszek (e) ....................... — * — *

John M. Zrno (f) ........................... 183,004 * — *

All directors and executive officers as a group

(consisting of 15 persons, including those

named above) ........................... 7,807,329 3.8% — *

* indicates ownership of less than 1% of issued and outstanding shares.

(a) Includes common shares subject to outstanding options and share-settled SARs under the Cincinnati Bell Inc.

1997 Long Term Incentive Plan, the Cincinnati Bell Inc. 2007 Long Term Incentive Plan and the Directors

Plan that are exercisable as of March 4, 2013. The following options and SARs are included in the totals:

61,000 common shares for Mr. Byrnes; 4,095,508 common shares for Mr. Cassidy; 45,000 common shares

for Mr. Cox; 191,255 common shares for Mr. Freyberger; 43,000 common shares for Mr. Shumate; 81,907

common shares for Mr. Wilson; 93,400 common shares for Mr. Zrno and 280,130 common shares for all

other executive officers as a group. Effective January 31, 2013, the Company updated its Insider Trading

Policy to expressly bar ownership of financial instruments or participation in investment strategies that hedge

the economic risk of owning the Company’s common shares and to prohibit officers and directors from

pledging Company securities as collateral for loans.

(b) These percentages are based upon 203,536,620 common shares issued and outstanding as of March 4, 2013,

the Record Date.

(c) These numbers represent 6 3/4% Cumulative Convertible Preferred Shares. In the aggregate, the 155,250

issued and outstanding 6 3/4% Cumulative Convertible Preferred Shares are represented by 3,105,000

depositary shares, and each 6 3/4% Cumulative Convertible Preferred Share is represented by 20 depositary

shares.

(d) Mr. Shumate resigned from the Board effective January 23, 2013.

(e) On January 23, 2013, in connection with the initial public offering of CyrusOne Inc., Mr. Wojtaszek resigned

from all his positions with Cincinnati Bell. Prior to March 4, 2013, Mr. Wojtaszek exercised all vested stock

options and stock appreciation rights and sold all his Cincinnati Bell common shares.

(f) Amount includes 25,000 common shares held by the Zrno Family Limited Partnership.

25

Proxy Statement