Cincinnati Bell 2012 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2012 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

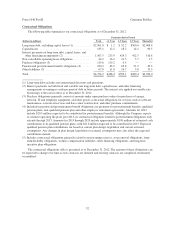

Cash flows used in financing activities were $48.8 million in 2011. Cash was used to pay $10.4 million of

preferred stock dividends, repurchase 3.4 million shares of common stock for $10.4 million, repay $11.5 million

of long-term debt, and settle $16.0 million of other financing obligations.

Cash flows provided by financing activities for 2010 were $429.8 million. During 2010, the Company issued

$2.1 billion of debt consisting of $625 million of 8

3

⁄

4

% Senior Subordinated Notes due 2018, a $760 million

secured term loan credit facility due 2017, and $775 million of 8

3

⁄

8

% Senior Notes due 2020. The net proceeds from

these borrowings were used to redeem the $560 million of outstanding 8

3

⁄

8

% Senior Subordinated Notes due 2014,

repay the Company’s previous credit facility of $204.3 million, fund the acquisition of Cyrus Networks, repay the

secured term loan facility totaling $756.2 million and to pay debt issuance fees and expenses. The Company paid

$42.6 million of debt issuance costs related to the various issuances of these instruments in 2010. Also, during 2010,

the Company repaid $85.9 million of borrowings under the Receivables Facility, repurchased approximately

4 million shares of common stock for $10.0 million, and paid $10.4 million of preferred stock dividends.

Future Operating Trends

Wireline

The Company expects to increase revenues from its Fioptics suite of products, high speed data transmission,

managed voice and data, cloud computing and professional services. Fioptics is a fiber-based product offering

that provides one of the fastest internet speeds in the Company’s operating territory, as well as entertainment and

voice services. At year end 2012, the Company passed and can provide Fioptics service to 205,000 homes and

businesses, or approximately 26% of Greater Cincinnati, and had 55,100 entertainment, 56,800 high-speed

internet, and 40,800 voice Fioptics customers. The penetration rate of this product is approximately 28% of the

total units that have been passed with the Fioptics network. Management plans to continue its investment in

Fioptics and expects to pass an additional 72,000 units by year end 2013.

Wireline legacy products with declining future revenues include local voice, DSL, and long distance. In

2012, Wireline suffered a 7% loss of ILEC access lines and a 7% loss of long distance subscribers as additional

customers elected to use wireless communication in lieu of the traditional local service, purchased service from

other providers, or service was disconnected due to non-payment. DSL subscribers decreased from 218,000 in

2011 to 202,600 in 2012 and are projected to continue to decline as customers switch to higher speed services,

such as our Fioptics product. We expect revenues from these legacy products to become a smaller percentage of

our total revenues over the next few years.

Wireless

Churn in our Wireless postpaid subscribers accelerated in the last few months of 2012. As of December 31,

2012, Wireless postpaid subscribers decreased to 251,300, down 19% compared to the prior year. Our operating

territory is well saturated with competitors, which include Verizon, AT&T, Sprint Nextel, T-Mobile, Leap and

TracFone. Both Verizon and AT&T have implemented LTE networks within our operating territory. In 2013, both

T-Mobile and Sprint Nextel are expected to begin to offer LTE service in our operating territory. LTE provides

higher-speed data transmission which is attractive to smartphone users. The Company has piloted an LTE network

trial program in limited operating territories, and has not yet determined whether it will upgrade its network to LTE

or, if it does upgrade, the timing of the LTE upgrade and the extent of its network that it will upgrade with LTE. Our

limited handset offerings are also a factor in our ability to attract and retain customers. Although we believe our

handsets are technologically equivalent to those being offered by the national carriers, we do not carry the premium

brand-name handsets such as the iPhoneTM. These competitive factors will likely result in a continued loss of

wireless subscribers and adversely affect our wireless revenues and operating margins.

IT Services and Hardware

Growth in managed services and professional services was strong in 2012, up 18%, driven by strong

demand from one of our largest customers. We expect growth in 2013 to be more moderate. Investment in this

segment has generally been limited by the availability of cash and the deployment of capital to support other

business initiatives, such as the expansion of our Fioptics service territory.

50

Form 10-K Part II Cincinnati Bell Inc.