Cincinnati Bell 2012 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2012 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

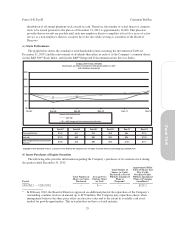

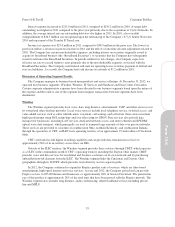

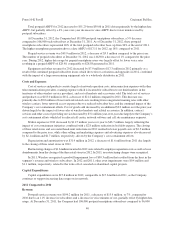

Item 6. Selected Financial Data

The Selected Financial Data should be read in conjunction with the Consolidated Financial Statements and

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in this

document.

(dollars in millions, except per share amounts) 2012 2011 2010 (a) 2009 2008

Operating Data

Revenue ....................................... $1,473.9 $1,462.4 $1,377.0 $1,336.0 $1,403.0

Cost of services and products, selling, general and

administrative, depreciation, and amortization

expense ..................................... 1,181.5 1,139.9 1,054.9 1,030.7 1,078.7

Other operating costs and losses (b) ................. 22.3 63.0 22.8 9.8 19.1

Operating income ............................... 270.1 259.5 299.3 295.5 305.2

Interest expense ................................. 218.9 215.0 185.2 130.7 139.7

Loss (gain) on extinguishment of debt ............... 13.6 — 46.5 10.3 (14.1)

Net income .................................... $ 11.2 $ 18.6 $ 28.3 $ 89.6 $ 102.6

Earnings per common share

Basic ......................................... $ 0.00 $ 0.04 $ 0.09 $ 0.37 $ 0.39

Diluted ........................................ $ 0.00 $ 0.04 $ 0.09 $ 0.37 $ 0.38

Dividends declared per common share ............... $ — $ — $ — $ — $ —

Weighted-average common shares outstanding

Basic ......................................... 197.0 196.8 201.0 212.2 237.5

Diluted ........................................ 204.7 200.0 204.0 215.2 242.7

Financial Position

Property, plant and equipment, net .................. $1,587.4 $1,400.5 $1,264.4 $1,123.3 $1,044.3

Total assets .................................... 2,872.4 2,714.7 2,653.6 2,064.3 2,086.7

Total long-term obligations (c) ..................... 3,215.2 3,073.5 2,992.7 2,395.1 2,472.2

Other Data

Cash flow provided by operating activities ............ $ 212.7 $ 289.9 $ 300.0 $ 265.6 $ 403.9

Cash flow used in investing activities ................ (371.8) (244.7) (675.5) (93.8) (250.5)

Cash flow provided by/(used in) financing activities .... 109.0 (48.8) 429.8 (155.5) (172.8)

Capital expenditures ............................. (367.2) (255.5) (149.7) (195.1) (230.9)

(a) Results for 2010 include the acquisition of CyrusOne from the acquisition date of June 11, 2010 to the end of

the year. See Note 3 to the Consolidated Financial Statements.

(b) Other operating costs and losses consist of restructuring charges, transaction costs, curtailment losses/(gains),

goodwill impairment, asset impairments, (gain)/loss on sale or disposal of assets, and an operating tax

settlement.

(c) Total long-term obligations comprise long-term debt less current portion, pension and postretirement benefit

obligations, and other noncurrent liabilities. See Notes 7, 10 and 11 to the Consolidated Financial Statements

for discussions related to 2012 and 2011.

30

Form 10-K Part II Cincinnati Bell Inc.