Cincinnati Bell 2012 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2012 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Executive Summary

Financial Results

In 2012, we continued to execute on our plan to expand our growth products, comprised of our Fioptics,

strategic enterprise data and VoIP, and data center offerings. The additional revenue generated from these growth

products more than offset the lower revenue from declining access line and wireless subscribers, and, as a result,

the Company’s total revenue in 2012 increased by 1% year-over-year to approximately $1.5 billion, its highest

level in 10 years. Operating income in 2012 was $270 million, up 4% compared to the prior year, driven

primarily by a $50.3 million goodwill write-down in 2011, partially offset by $14.2 million of asset impairments

in 2012. Adjusted EBITDA was $535 million in 2012, down from $545 million in 2011. Adjusted EBITDA for

2012 included an $8 million mark-to-market charge on incentive awards indexed to the Company’s stock price

resulting from the increase in the Company’s stock price in 2012.

On January 24, 2013, we completed the initial public offering (“IPO”) of CyrusOne, which owns and

operates our former data center colocation business. CyrusOne conducts its data center business through

CyrusOne LP, an operating partnership. After the IPO, we own approximately 1.9 million shares, or 8.6%, of

CyrusOne’s common stock and are a limited partner in CyrusOne LP, owning approximately 42.6 million, or

66%, of its partnership units. Commencing January 17, 2014, the Company may redeem its CyrusOne LP units

for either common stock of CyrusOne on a one-to-one basis or cash, at the option of CyrusOne, based on the fair

value of a share of CyrusOne common stock. Although we effectively own approximately 69% of the economic

interests of CyrusOne through our ownership of its common stock and partnership units of CyrusOne LP, we no

longer control its operations.

See “Management’s Discussion and Analysis of Financial Conditions and Results of Operations” in the

Company’s Annual Report on Form 10-K for further details on the Company’s 2012 financial results.

The Company’s executive compensation program ties a significant portion of an executive’s annual

compensation to the Company’s achievement of performance-based financial targets. The key financial measures

utilized to assess achievement of annual goals are revenue and Adjusted EBITDA. The key financial measures

utilized to assess achievement of long-term goals are Free Cash Flow and, beginning in 2012, Unlevered Cash

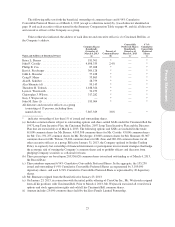

Return on Assets. The table below highlights the year-over-year comparison of some of these performance

measures:

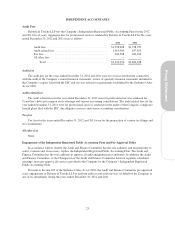

Performance Measure Fiscal Year 2012 Fiscal Year 2011 % Change

2012 Original

Guidance

Revenue ......................... $ 1.47 B $1.46 B 1% $1.5 B

Adjusted EBITDA (a) ............... $ 535M $545M (2)% $530 M +/-2%

Free Cash Flow (a) ................. $(154) M $ 11 M n/m —

Unlevered Cash Return on Assets (a) . . . 16% N/A — —

(a) See Annex A for a reconciliation of Adjusted EBITDA, Free Cash Flow and Unlevered Cash Return on

Assets to the nearest GAAP based financial measures.

In 2012, the Compensation Committee approved Unlevered Cash Return on Assets (“UCR”) as the

performance measure to be utilized in assessing achievement of long-term incentive goals, rather than Free Cash

Flow. Unlevered Cash Return on Assets is defined as operating cash flow excluding interest payments as a

percentage of average total assets. Free Cash Flow had become a less meaningful performance measure as the

Company invested significant capital in both its Fioptics and its data center business, resulting in negative free

cash flow in 2012.

Although shareholders and proxy advisory companies tend to focus on “total shareholder return” (“TSR”) as

a major factor in judging a Company’s performance, we have historically adopted other measures of the

Company’s financial performance on the theory that using TSR as a financial metric may encourage a focus on

short-term results. For example, at a time when its core telecommunications business faced intense competitive

challenges, the Company used its capital to seize the opportunity to become the premier data center colocation

provider to Fortune 1000 companies rather than pay dividends to its shareholders, which could be detrimental to

the Company’s long-term strategic opportunities. In addition, as a result of the scope of the Company’s historical

28