Cincinnati Bell 2012 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2012 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

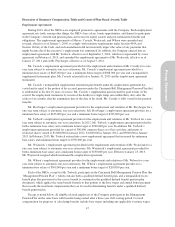

Employment Agreements, Severance and Change in Control Payments and Benefits

The Company generally enters into employment agreements with the named executive officers for several

reasons. Employment agreements give the Company flexibility to make changes in key executive positions with

or without a showing of cause, if terminating the executive is determined by the Company or the Board to be in

the best interests of the Company. The agreements also minimize the potential for litigation by establishing

separation terms in advance and requiring that any dispute be resolved through an arbitration process. The

severance, change in control payments and benefits provided under the employment agreements as described in

more detail beginning on page 54 were important to ensure the retention of the named executive officers.

Depending on the circumstances of their termination, the NEOs are eligible to receive severance benefits in

the form of a multiple of annual base salary as a lump sum payment, continued access to Company-provided

benefits for a defined period post employment, healthcare benefits and accelerated vesting of all equity as

determined by the provisions in their employment agreements, which are discussed in detail starting on page 54.

Under a dismissal without cause or constructive discharge following a change of control, the Company provides

the severance benefits because it serves the best interest of the Company and its shareholders to have executives

focus on the business merits of possible change in control situations without undue concern for their personal

financial outcome. In the case of a without cause termination or constructive discharge absent a change in

control, the Company believes it is appropriate to provide severance at these levels to ensure the financial

security of these executives, particularly in view of the non-compete provisions which state that for 12 months

following termination, the executive will not compete with the Company or solicit customers or employees of the

Company. Because these potential payments are triggered under very specific circumstances, such payments are

not considered in setting pay for other elements of executive compensation. The Compensation Committee has a

policy that the Company will not enter into any new or materially amended employment agreements with named

executive officers providing for excise tax gross-up provisions with respect to payments contingent upon a

change in control.

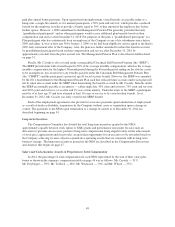

Adjustments and Recovery of Award Payments and Clawback Policy

The Company is subject to the requirements of Section 304 of the Sarbanes-Oxley Act of 2002. Therefore, if

the Company were required to restate its financial results due to any material noncompliance of the Company, as

a result of misconduct, with any financial reporting requirement under the securities laws, the Securities and

Exchange Commission could act to recover from the Chief Executive Officer and Chief Financial Officer any

bonus or other incentive-based or equity-based compensation received during the 12-month period following the

date the applicable financial statements were issued and any profits from any sale of securities of the Company

during that 12-month period.

In addition, the Board has adopted an interim executive compensation recoupment/clawback policy that

reflects the preliminary requirements of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the

“Dodd-Frank Act”), with the intention that the policy will be modified when final regulations required by the

Dodd-Frank Act are adopted by the SEC. The policy was effective as of January 1, 2011, for any current

executive officer or former executive officer that terminates employment after January 1, 2011 and applies to

cash and equity-based compensation that is approved, granted or awarded on or after January 1, 2011. The policy

allows the Company to recover incentive payments to, or realized by, certain executive officers in the event that

the incentive compensation was based on the achievement of financial results that were subsequently restated to

correct any accounting error due to material noncompliance with any financial reporting requirement under

federal securities laws and such restatement results in a lower payment or award.

Compensation Limitation

Section 162(m) of the Code generally limits to $1,000,000 the available deduction to the Company for

compensation paid to any of the Company’s NEOs, except for performance-based compensation that meets

certain technical requirements. Although the Compensation Committee considers the anticipated tax treatment to

the Company of its compensation payments, the Compensation Committee has determined that it will not

necessarily seek to limit executive compensation to amounts deductible under Section 162(m) of the Code.

43

Proxy Statement