Cincinnati Bell 2012 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2012 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.•the loss or significant reduction in business from one or more large customers could cause operating

revenues to decline significantly and have a materially adverse long-term impact on the Company’s

business;

•the Company depends on a number of third party providers, and the loss of, or problems with, one or more

of these providers may impede the Company’s growth or cause it to lose customers;

•a failure of back-office information technology systems could adversely affect the Company’s results of

operations and financial condition;

•the business could be negatively impacted by cybersecurity threats;

•the loss of any of the senior management team or attrition among key sales associates could adversely

affect the Company’s business, financial condition, results of operations, and cash flows;

•the Company has a significant investment in CyrusOne;

•the Company no longer controls CyrusOne;

•CyrusOne may encounter difficulties in executing its strategic plans;

•a small number of customers account for a significant portion of CyrusOne’s revenues;

•CyrusOne’s performance and value are subject to risks associated with real estate assets and with the real

estate industry;

•if CyrusOne does not qualify as a REIT, or fails to remain qualified as a REIT, they will be subject to U.S.

federal income tax as a regular corporation and could face a substantial tax liability, which will reduce the

amount of cash available for distribution to their stockholders;

•CyrusOne’s cash available for distribution to stockholders may not be sufficient to make distributions at

expected levels;

•the trading price of the Company’s common stock may be volatile, and the value of an investment in the

Company’s common stock may decline;

•the uncertain economic environment, including uncertainty in the U.S. and world securities markets, could

impact the Company’s business and financial condition;

•the Company’s future cash flows could be adversely affected if it is unable to realize its deferred tax

assets;

•adverse changes in the value of assets or obligations associated with the Company’s employee benefit

plans could negatively impact shareowners’ deficit and liquidity;

•third parties may claim that the Company is infringing upon their intellectual property, and the Company

could suffer significant litigation or licensing expenses or be prevented from selling products;

•third parties may infringe upon the Company’s intellectual property, and the Company may expend

significant resources enforcing its rights or suffer competitive injury;

•the Company could incur significant costs resulting from complying with, or potential violations of,

environmental, health, and human safety laws.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as

of the date of this report. The Company does not undertake any obligation to revise or update any forward-

looking statements, whether as a result of new information, future events or otherwise.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Interest Rate Risk

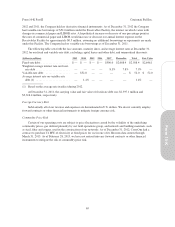

The Company has exposure to interest rate risk, primarily in the form of variable-rate borrowings from its

credit facilities and changes in current rates compared to that of its fixed rate debt. The Company’s management

periodically employs derivative financial instruments to manage exposure to interest rate risk. At December 31,

68

Form 10-K Part II Cincinnati Bell Inc.