Cincinnati Bell 2012 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2012 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 10-K Part II Cincinnati Bell Inc.

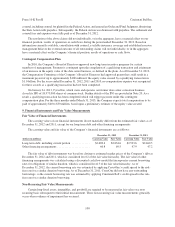

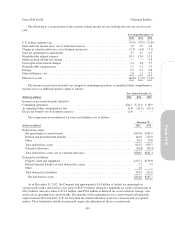

During 2012, the following assets were remeasured at fair value in connection with impairment tests:

Fair Value Measurements Using

(dollars in millions)

Year Ended

December 31,

2012

Quoted Prices

in Active

Markets for

Identical Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Impairment

Losses

Customer relationship intangible ......... $2.8 $ — $ — $2.8 $ (1.5)

Property:

Leasehold improvements ........... 2.4 — — 2.4 (11.8)

Network equipment ............... 0.4 — — 0.4 (0.5)

Other ........................... — — — — (0.4)

Impairment of assets .................. $(14.2)

In 2012, the customer relationship intangible obtained in the GramTel acquisition was deemed impaired.

The fair value of this asset was estimated at $2.8 million, resulting in an impairment loss of $1.5 million. The fair

value of this asset was estimated by management with the assistance of a third-party valuation specialist.

Management estimated the fair value using the income approach, which discounted the expected future earnings

attributable to the acquired customer contracts, and included estimates of future expenses, capital expenditures

and a discount rate of 12%. This fair value measurement is considered a Level 3 measurement due to the

significance of its unobservable inputs.

In addition, certain leasehold improvements at data centers acquired in the GramTel acquisition were

deemed impaired. Prior to recognizing the impairment, these assets had a net book value of $14.2 million as of

June, 30, 2012. The fair value of the assets was written down to the estimated fair value of $2.4 million, resulting

in an impairment loss of $11.8 million. The fair value of these assets was estimated by management with the

assistance of a third-party valuation specialist. Management estimated the fair value using an income approach.

Projected discounted cash flows utilized under the income approach included estimates regarding future revenues

and expenses, projected capital expenditures and a discount rate of 12%. This fair value measurement is

considered a Level 3 measurement due to the significance of its unobservable inputs.

In 2012, property associated with an out-of-territory fiber network was deemed impaired. The fair value of

this asset was estimated at $0.4 million, resulting in an impairment loss of $0.5 million. Management estimated

the fair value using an income approach. Projected discounted cash flows utilized under the income approach

included estimates regarding future revenues and expenses, projected capital expenditures and a discount rate of

12%. This fair value measurement is considered a Level 3 measurement due to the significance of its

unobservable inputs. In addition, properties associated with abandoned assets having no resale market were

deemed impaired, resulting in an impairment loss of $0.4 million.

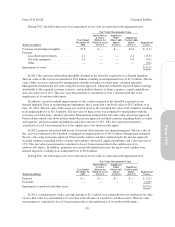

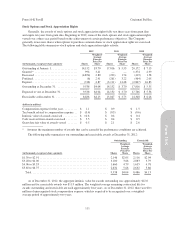

During 2011, the following assets were remeasured at fair value in connection with impairment tests:

Fair Value Measurements Using

(dollars in millions)

Year Ended

December 31,

2011

Quoted Prices

in Active

Markets for

Identical Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Impairment

Losses

Property ............................ $— $— $— $— $ (2.1)

Goodwill ............................ — — — — (50.3)

Impairment of goodwill and other assets . . . $(52.4)

In 2011, certain property with a carrying amount of $2.1 million was written down to its estimated fair value

of zero. Fair value was determined to be zero due to the absence of a market to sell these assets. This fair value

measurement is considered a Level 3 measurement due to the significance of its unobservable inputs.

101

Form 10-K