Cincinnati Bell 2012 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2012 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 10-K Part II Cincinnati Bell Inc.

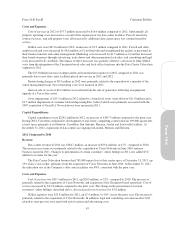

Costs and Expenses

Cost of services in 2012 of $75.7 million increased by $16.0 million compared to 2011. Substantially all

property operating costs increased as a result of the expansion of our data center facilities. Payroll, electricity,

contract services, rent and property taxes all increased as additional data center space was commissioned for

service.

SG&A costs were $31.0 million in 2012, an increase of $7.2 million compared to 2011. Payroll and other

employee-related costs increased by $8.6 million as CyrusOne built and strengthened the quality of personnel in

their finance function and senior management. Marketing costs increased by $1.5 million as CyrusOne increased

their brand awareness through advertising, trade shows and other promotional activities, and consulting and legal

costs increased by $1.4 million. The impact of these increases was partially offset by a decrease in other SG&A

costs from the integration of the Cincinnati-based sales and back office functions into the Data Center Colocation

segment in 2012.

The $15.8 million increase in depreciation and amortization expense for 2012 compared to 2011 was

primarily due to new data center facilities placed into service in 2011 and 2012.

Restructuring charges of $0.5 million in 2012 were primarily related to the separation of a member of the

senior management team. No restructuring costs were incurred in 2011.

Gain on sale of assets of $0.2 million was realized from the sale of generators following an equipment

upgrade at a Texas data center.

Asset impairments of $13.3 million in 2012 related to a long-lived assets write-down of $11.8 million and a

$1.5 million impairment of customer relationship intangibles, both of which were primarily associated with the

2007 acquisition of GramTel. No such losses were incurred in 2011.

Capital Expenditures

Capital expenditures were $228.2 million in 2012, an increase of $109.7 million compared to the prior year.

During 2012, CyrusOne continued its development of real estate, completing construction on 199,000 square feet

of new space primarily at its Houston, Carrollton, San Antonio, Phoenix, Austin and Lewisville facilities. At

December 31, 2012, expansions of data centers are ongoing in London, Phoenix and Houston.

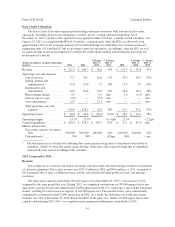

2011 Compared to 2010

Revenue

Data center revenue in 2011 was $184.7 million, an increase of $59.4 million, or 47%, compared to 2010.

The increase in revenue was primarily related to the acquisition of Cyrus Networks in June 2010 and new

business earned in 2011. Changes to presentation of certain customers’ utility billings in 2011 also added $7.6

million to revenue for the year.

The Data Center Colocation business had 763,000 square feet of data center space at December 31, 2011, up

19% from a year earlier, primarily from the acquisition of Cyrus Networks in June 2010. At December 31, 2011

the utilization rate of the Company’s data center facilities was 88%, consistent with the prior year.

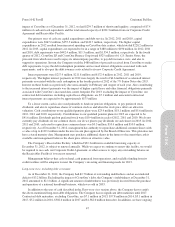

Costs and Expenses

Cost of services was $59.7 million for 2011, up $20.5 million, or 52%, compared to 2010. The increase is

primarily related to the acquisition of Cyrus Networks and expansion of the Cincinnati-based operations. Cost of

services increased by $13.4 million compared to the prior year. The change in the presentation of certain

customers’ utility billings, described above, also increased cost of services by $7.6 million.

SG&A expenses were $23.8 million for 2011, up $7.9 million, or 50%, versus the prior year. The increase is

primarily related to the acquisition of Cyrus Networks. In addition, legal and consulting costs increased in 2011

related to start-up costs associated with new locations and advertising costs.

45

Form 10-K