Cincinnati Bell 2012 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2012 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

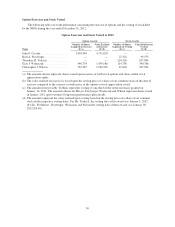

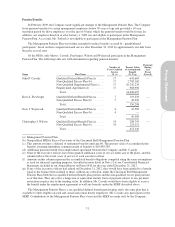

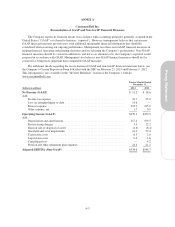

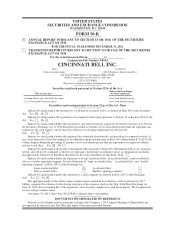

Nonqualified Deferred Compensation

The following table sets forth information concerning compensation deferred by the NEOs:

Nonqualified Deferred Compensation for 2012 Fiscal Year

Name

Executive

Contributions

in Last Fiscal

Year

($)

Company

Contributions

in Last Fiscal

Year

($) (a)

Aggregate

Earnings

in Last Fiscal

Year

($) (b)

Aggregate

Withdrawals/

Distributions

($)

Aggregate Balance

at December 31, 2012

($)

John F. Cassidy ................ — — 663,369 — 1,484,510

Kurt A. Freyberger ............. — 1,177 9,161 — 44,307

Theodore H. Torbeck ........... — — — — —

Gary J. Wojtaszek .............. — — — — —

Christopher J. Wilson ........... — — 245,000 — 548,000

(a) Amount reflects a company matching contribution on Mr. Freyberger’s contributions in 2009.

(b) For Messrs. Cassidy, Freyberger, and Wilson, the amount shown includes the difference between the closing

price of the Company’s stock ($3.03) on December 31, 2011 and the closing price of the Company’s stock

($5.48) on December 31, 2012 with respect to deferrals made prior to 2012.

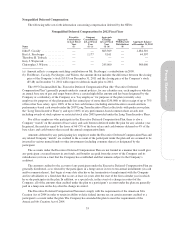

The 1997 Cincinnati Bell Inc. Executive Deferred Compensation Plan (the “Executive Deferred

Compensation Plan”) generally permits under its current policies, for any calendar year, each employee who has

an annual base rate of pay and target bonus above a certain high dollar amount and has been designated by the

Company or a subsidiary of the Company as a “key employee” for purposes of the plan (currently a key

employee for purposes of the plan generally has annual pay of more than $250,000) to defer receipt of up to 75%

of his or her base salary, up to 100% of his or her cash bonuses (including annual incentive awards and non-

performance-based cash awards under the 2007 Long Term Incentive Plan (collectively with predecessor plans,

the “Long Term Incentive Plans”)) and up to 100% of any performance-based common share awards (not

including awards of stock options or restricted stock after 2005) provided under the Long Term Incentive Plans.

For all key employees who participate in the Executive Deferred Compensation Plan, there is also a

Company “match” on the amount of base salary and cash bonuses deferred under the plan for any calendar year.

In general, the match is equal to the lesser of 66 2/3% of the base salary and cash bonuses deferred or 4% of the

base salary and cash bonuses that exceed the annual compensation limit.

Amounts deferred by any participating key employee under the Executive Deferred Compensation Plan and

any related Company “match” are credited to the account of the participant under the plan and are assumed to be

invested in various mutual funds or other investments (including common shares) as designated by the

participant.

The accounts under the Executive Deferred Compensation Plan are not funded in a manner that would give

any participant a secured interest in any funds, and benefits are paid from the assets of the Company and its

subsidiaries (or from a trust that the Company has established and that remains subject to the Company’s

creditors).

The amounts credited to the account of any participant under the Executive Deferred Compensation Plan are

generally distributed, as so elected by the participant, in a lump sum or in two to ten annual installments (in cash

and/or common shares), that begin at some date after his or her termination of employment with the Company

and its subsidiaries or a fixed date that occurs at least six years after the start of the first calendar year in which

he or she participates in the plan. In addition, as a special rule, in the event of a change in control of the

Company, all of the amounts then credited under the plan to a participant’s account under the plan are generally

paid in a lump sum on the day after the change in control.

The Executive Deferred Compensation Plan must comply with the requirements of the American Jobs

Creation Act of 2004 in order to retain its ability to defer federal income tax on certain amounts credited to a

participant’s account under the plan. The Company has amended the plan to meet the requirements of the

American Jobs Creation Act of 2004.

53

Proxy Statement