Cincinnati Bell 2012 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2012 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 10-K Part II Cincinnati Bell Inc.

by $7.0 million from 2011 driven largely by higher regulatory rates and higher franchise taxes resulting from

increased Fioptics revenue and higher property taxes from our increased data center footprint. Payroll and

employee-related costs also increased by $4.0 million compared to 2011, due primarily to the addition of new

personnel to support growth in data center operations and the higher demand for professional and managed IT

services.

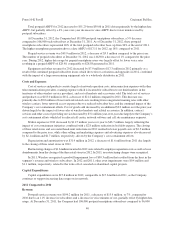

Cost of products sold was $204.7 million in 2012 compared to $213.0 million in the prior year, a decrease of

$8.3 million, or 4%, that was mainly driven by lower sales of wireless handsets and IT equipment, as discussed

above.

Selling, general and administrative (“SG&A”) expenses were $269.5 million in 2012, an increase of $6.4

million, or 2%, compared to 2011. The increase was largely due to stock compensation mark-to-market expense

of $7.9 million, up from $0.6 million in 2011, primarily associated with an 81% increase in the Company’s stock

price during 2012. The Company grants stock-based compensation, some of which are cash-payment awards

indexed to the Company’s stock price.

Depreciation and amortization was $217.4 million in 2012, an increase of $17.9 million compared to the

prior year. The higher depreciation and amortization was primarily the result of new assets placed in service for

our data center facilities.

Restructuring charges were $3.4 million in 2012 compared to $12.2 million in the prior year. In 2012,

restructuring charges represented severance associated with employee separations and lease abandonments. In

2011, restructuring costs were incurred for employee separations, lease abandonments and contract terminations.

Such costs were lower in 2012 as we completed certain restructuring activities begun in the prior year.

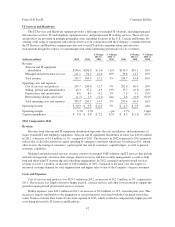

In 2011, the Company ratified a new labor agreement which curtails future pension service credits for

certain employees. As a result of this event, the bargained employees’ pension plan was remeasured and a

curtailment loss of $4.2 million was recognized. In 2012, no events occurred to trigger a remeasurement of our

pension plans or curtailment loss.

Gain on sale or disposal of assets was $1.6 million in 2012, down from $8.4 million in 2011. In 2012, a gain

was realized primarily from the sale of copper cables no longer utilized in our Wireline network. In 2011, a gain

of $8.4 million was recognized as a result of selling substantially all of the assets associated with our home

security monitoring business.

Asset impairment losses amounted to $14.2 million in 2012 compared to $52.4 million in 2011. In 2012,

impairment losses were largely driven by $13.3 million of impairment losses in the Data Center Colocation

segment on a customer relationship intangible asset and property and equipment that was primarily associated

with our 2007 acquisition of GramTel. During 2011, the Company recognized goodwill impairment losses

totaling $50.3 million that were related to the Wireless segment.

Transaction costs of $6.3 million were incurred in 2012, up from $2.6 million incurred in 2011. In 2012,

these costs represented legal and consulting costs incurred to restructure our legal entities in preparation for the

proposed IPO of the common stock of CyrusOne and to prepare CyrusOne to be a real estate investment trust. In

2011, transaction costs represented legal and consulting costs to investigate acquisition opportunities.

Interest expense was $218.9 million in 2012 compared to $215.0 million in 2011, an increase of $3.9

million. The increase was largely due to the issuance by CyrusOne LP and CyrusOne Finance Corp of $525

million of 6 3/8% Senior Notes due 2022 in the fourth quarter of 2012 which increased interest expense by $3.8

million, higher interest costs of $2.4 million from lease obligations, as well as $0.8 million of lower capitalized

interest. The impact of these increases was partially offset by lower interest expense from the redemptions of the

7% Senior Notes due 2015, certain CBT Notes and a portion of the 8 3/8% Senior Notes due 2020.

Loss on extinguishment of debt of $13.6 million was a result of the debt repayment and partial redemptions

made during the fourth quarter of 2012 as discussed in the preceding paragraph. No debt extinguishment

occurred in 2011.

33

Form 10-K