Cincinnati Bell 2012 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2012 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 10-K Part II Cincinnati Bell Inc.

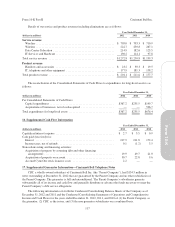

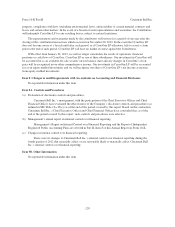

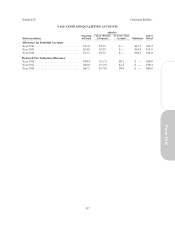

19. Quarterly Financial Information (Unaudited)

2012

First Second Third Fourth

(dollars in millions, except per common share amounts) Quarter Quarter Quarter Quarter Total

Revenue ............................... $362.8 $368.2 $368.2 $374.7 $1,473.9

Operating income ........................ 81.0 65.2 66.0 57.9 270.1

Net income (loss) ........................ 12.6 4.5 3.9 (9.8) 11.2

Basic earnings (loss) per common share ...... $ 0.05 $ 0.01 $ 0.01 $ (0.06) $ 0.00

Diluted earnings (loss) per common share ..... $ 0.05 $ 0.01 $ 0.01 $ (0.06) $ 0.00

2011

(dollars in millions, except per common share amounts)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter Total

Revenue ............................... $360.8 $367.5 $368.8 $365.3 $1,462.4

Operating income ........................ 86.4 77.6 86.3 9.2 259.5

Net income (loss) ........................ 17.9 13.5 17.6 (30.4) 18.6

Basic earnings (loss) per common share ...... $ 0.08 $ 0.06 $ 0.08 $ (0.17) $ 0.04

Diluted earnings (loss) per common share ..... $ 0.08 $ 0.05 $ 0.07 $ (0.17) $ 0.04

The effects of assumed common share conversions are determined independently for each respective quarter

and year and may not be dilutive during every period due to variations in operating results. Therefore, the sum of

quarterly per share results will not necessarily equal the per share results for the full year.

During the fourth quarter of 2012, the Company incurred a loss on extinguishment of debt of $13.6 million

from the redemption of its 7% Senior Notes due 2015, a portion of its 8

3

⁄

8

% Senior Notes due 2020, and various

CBT notes.

During the fourth quarter of 2011, the Company recognized a goodwill impairment loss of $50.3 million in

the Wireless business segment. The impairment loss arose from declines in revenues and wireless subscribers.

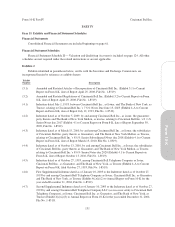

20. Subsequent Events

On January 24, 2013, CyrusOne, our data center colocation business, closed its initial public offering of

18,975,000 shares of common stock at a price of $19.00 per share, which included a 2,475,000 share over-

allotment option that was exercised by the underwriters. Following the closing of the IPO, we own a 69%

economic interest in CyrusOne through our interests in the outstanding shares of common stock of CyrusOne and

our limited partnership interests in the common units of CyrusOne’s operating partnership, CyrusOne LP.

CyrusOne LP units are exchangeable into common stock of CyrusOne on a one-to-one basis, or cash at the fair

value of a share of CyrusOne common stock, at the option of CyrusOne, commencing on January 17, 2014. We

are a limited partner in CyrusOne LP, which is controlled by CyrusOne GP, and we own less than 10% of the

common stock of CyrusOne. Although we effectively own 69% of the economic interests of CyrusOne through

our ownership of its common stock and partnership units of CyrusOne LP, we no longer control its operations.

Pursuant to a contribution agreement (“Contribution Agreement”) by and between certain Cincinnati Bell

subsidiaries, CyrusOne, and CyrusOne LP, we contributed our interests in certain properties which included

approximately 932,000 square feet of data center colocation space spread across 24 data center facilities in the

Midwest, Texas, Arizona, England, and Singapore, in exchange for limited partnership interests in CyrusOne LP

which are exchangeable into shares of common stock of CyrusOne. The operations of CyrusOne, a qualified real

estate investment trust (REIT) entity, will primarily be conducted by CyrusOne LP.

The Contribution Agreements provide that CyrusOne LP assumed or succeeded to all of the Contributors’

rights, liabilities and obligations with respect to the property entity, properties interests and assets contributed.

The Contribution Agreements contain customary representations and warranties by the Contributors with respect

to the property entity, property interests and assets contributed to CyrusOne LP, such as title to any owned

127

Form 10-K