Cincinnati Bell 2012 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2012 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Compensation Practices

The Company reviews and modifies its executive compensation programs and practices regularly to address

changes in the Company’s short- and long-term business objectives and strategies, new regulatory standards and

to implement evolving best practices. Listed below are some of the Company’s significant compensation

practices:

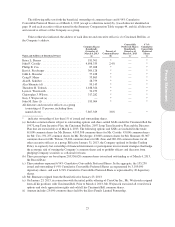

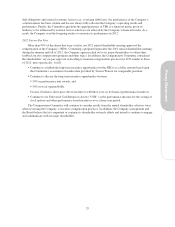

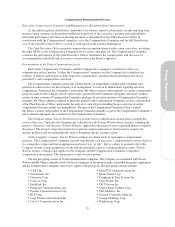

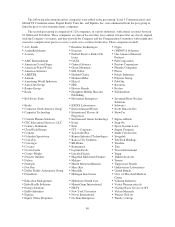

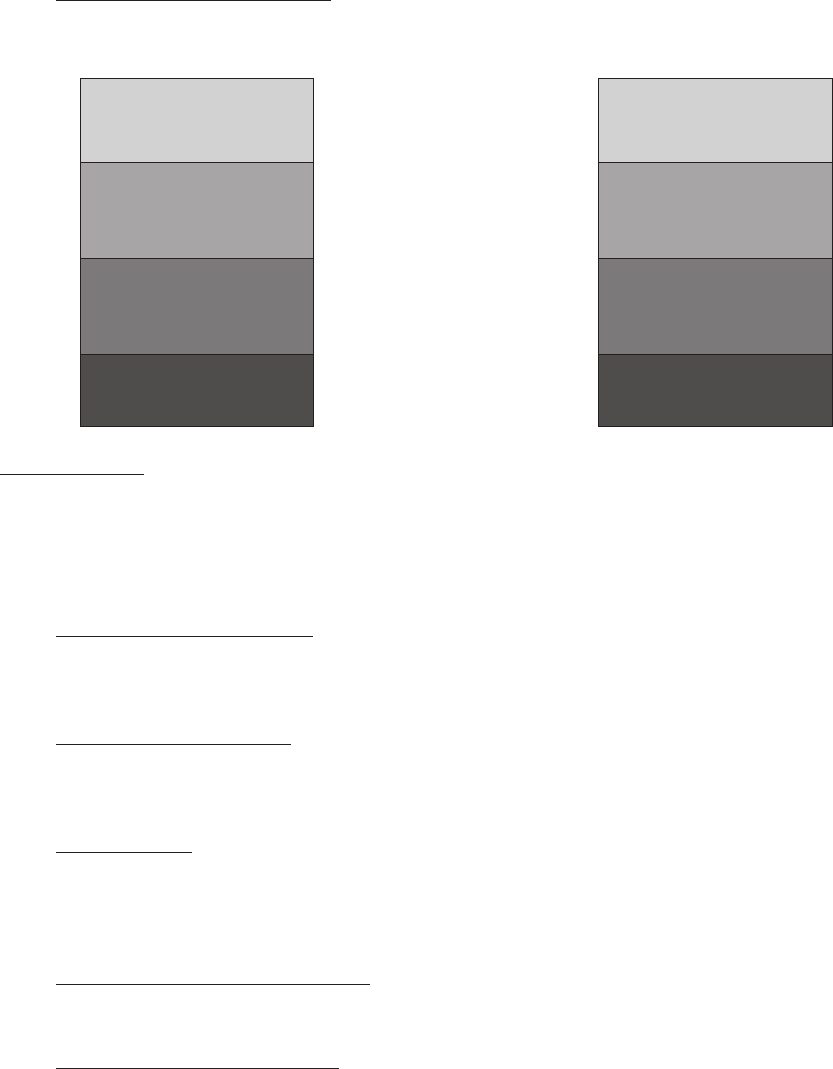

•Performance-based Compensation. The Company believes that a significant percentage of each NEO’s

total compensation should be performance-based or “at-risk.” Only 17% of the CEO’s and 35% of the

Other NEOs’ target compensation in 2012 was paid in the form of base salary. The value of the remaining

83% and 65%, respectively, was linked directly to performance-based awards.

Performance-Based Stock

Options/SARs

25%

Performance-Based Stock

Options/SARs

12%

Long-Term Performance-

Based Awards

25%

Long-Term Performance-

Based Awards

12%

Annual Performance-Based

Cash Incentive

33%

Annual Performance-Based

Cash Incentive

41%

Base Salary

17%

Base Salary

35%

Chief Executive Officer Other NEOs*

* The percentages for the Other NEOs understate the percentage of performance-based compensation. In

2012, the Company granted Mr. Torbeck an award of $1.8 million of restricted common shares that vest

over a three-year period. This award was provided to compensate him for the compensation he forfeited

when he left his previous employer to accept employment with the Company. Consequently, for 2012,

Mr. Torbeck did not receive any performance unit or stock option/SARs awards.

•Compensation Risk Assessment. The Company conducted its second annual compensation risk

assessment and concluded that the Company’s compensation policies and practices do not encourage

excessive or unnecessary risk-taking and are not reasonably likely to have a material adverse effect on the

Company.

•Hedging and Pledging Policy. Effective January 31, 2013, the Company updated its Insider Trading Policy

to expressly bar ownership of financial instruments or participation in investment strategies that hedge the

economic risk of owning the Company’s common stock and to prohibit officers and directors from

pledging Company securities as collateral for loans.

•Clawback Policy. The Company has a clawback policy that allows the Company to recover incentive

payments to or realized by certain “executive officers” in the event that the incentive compensation was

based on the achievement of financial results that are subsequently restated to correct any accounting error

due to material noncompliance with any financial reporting requirement under the federal securities laws,

and such restatement results in a lower payment or award.

•Independent Compensation Committee. Each member of the Compensation Committee is independent as

defined in the corporate governance listing standards of the NYSE and the Company’s director

independence standards mirror those of the NYSE.

•Outside Compensation Consultants. The Compensation Committee utilizes the services of an outside

independent compensation consultant to assist in its duties. The Compensation Committee’s consultant

performs no other services for the Company or its management. The Compensation Committee has

30