Cincinnati Bell 2012 Annual Report Download - page 96

Download and view the complete annual report

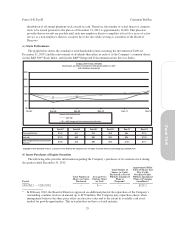

Please find page 96 of the 2012 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A small number of customers account for a significant portion of CyrusOne’s revenue. The loss or significant

reduction in business from one or more of its large customers could significantly harm its business, financial

condition and results of operations, and impact the amount of cash available for distribution to its

stockholders.

CyrusOne currently depends, and expects to continue to depend, upon a relatively small number of

customers for a significant percentage of their revenue. As a result of this customer concentration, CyrusOne’s

business, financial condition and results of operations, including the amount of cash available for distribution to

its stockholders, could be adversely affected if it loses one or more of its larger customers, if such customers

significantly reduce their business with CyrusOne or if it chooses not to enforce, or to enforce less vigorously,

any rights that it may have now or in the future against these significant customers because of its desire to

maintain relationships with them. A significant percentage of CyrusOne’s customer base is also concentrated in

industry sectors that may from time to time experience volatility including, in particular, the oil and gas sector. A

downturn in the oil and gas industry could negatively impact the financial condition of one or more of its oil and

gas company customers, including several of its larger customers. In an industry downturn, those customers

could default on their obligations, delay the purchase of new services or decline to renew expiring leases, any of

which could have an adverse effect on its business, financial condition and results of operations.

Additionally, if any customer becomes a debtor in a case under the U.S. Bankruptcy Code, applicable

bankruptcy laws may limit its ability to terminate its contract with such customer solely because of the

bankruptcy or recover any amounts owed to it under its agreements with such customer. In addition, applicable

bankruptcy laws could allow the customer to reject and terminate its agreement with CyrusOne, with limited

ability for CyrusOne to collect the full amount of its damages. CyrusOne’s business, including its revenue and

cash available for distribution to its stockholders, could be adversely affected if any of its significant customers

were to become bankrupt or insolvent.

CyrusOne’s performance and value are subject to risks associated with real estate assets and with the real

estate industry.

CyrusOne’s ability to make expected distributions to its stockholders depends on its ability to generate

revenues in excess of expenses, scheduled principal payments on debt and capital expenditure requirements.

Events and conditions generally applicable to owners and operators of real property that are beyond its control

may decrease cash available for distribution and the value of its properties. These events include:

•local oversupply, increased competition or reduction in demand for technology-related space;

•inability to collect rent from customers;

•vacancies or its inability to rent space on favorable terms;

•inability to finance property development and acquisitions on favorable terms;

•increased operating costs to the extent not paid for by its customers;

•costs of complying with changes in governmental regulations;

•the relative illiquidity of real estate investments, especially the specialized real estate properties that

CyrusOne holds and seeks to acquire and develop; and

•changing submarket demographics.

If CyrusOne fails to remain qualified as a REIT, it will be subject to U.S. federal income tax as a regular

corporation and could face a substantial tax liability, which would reduce the amount of cash available for

distribution to its stockholders.

CyrusOne intends to operate in a manner that will allow it to qualify as a REIT commencing with its taxable year

ending December 31, 2013. Its qualification as a REIT will depend on its satisfaction of certain asset, income,

22

Form 10-K Part I Cincinnati Bell Inc.