Cincinnati Bell 2012 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2012 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

counsel, including counsel for plaintiff in the Federal Action, and entered an Order and Final Judgment, dismissing

the State Action with prejudice. Subsequently, the Federal Action was dismissed with prejudice. The settlement and

counsel fees and expenses were fully paid as of December 31, 2012.

The resolution of the above claims did not individually, or in the aggregate, have a material effect on our

financial position, results of operations or cash flows during the period ended December 31, 2012. Based on

information currently available, consultation with counsel, available insurance coverage and established reserves,

management believes the eventual outcome of all outstanding claims will not individually, or in the aggregate,

have a material effect on the Company’s financial position, results of operations or cash flows.

Contingent Compensation Plan

In 2010, the Company’s Board of Directors approved new long-term incentive programs for certain

members of management. Payment is contingent upon the completion of a qualifying transaction and attainment

of an increase in the equity value of the data center business, as defined in the plans. As of December 31, 2012,

the Compensation Committee of the Company’s Board of Directors had approved grants that could result in a

maximum payout of up to approximately $100 million if the equity value created by a qualifying transaction is

$1.0 billion. For the years ended December 31, 2012, 2011 and 2010, no compensation expense was recognized

for these awards as a qualifying transaction had not been completed.

On January 24, 2013, CyrusOne, which owns and operates our former data center colocation business,

closed its IPO of 18,975,000 shares of common stock. Further details of the IPO are provided in Note 20. As a

result, a qualifying transaction has been completed which will trigger payment under this contingent

compensation plan. For the three months ended March 31, 2013, the Company expects total compensation to be

paid of approximately $40 to $50 million, based upon a preliminary estimate of the equity value created.

9. Financial Instruments and Fair Value Measurements

Fair Value of Financial Instruments

The carrying values of our financial instruments do not materially differ from the estimated fair values as of

December 31, 2012 and 2011, except for our long-term debt and other financing arrangements.

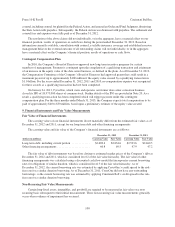

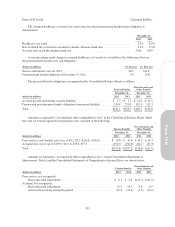

The carrying value and fair value of the Company’s financial instruments are as follows:

December 31, 2012 December 31, 2011

(dollars in millions) Carrying Value Fair Value Carrying Value Fair Value

Long-term debt, including current portion ............. $2,689.4 $2,834.6 $2,533.6 $2,460.5

Other financing arrangements ....................... 60.8 69.5 47.9 47.2

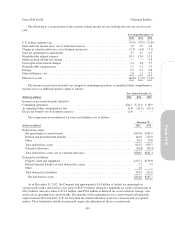

The fair value of debt instruments was based on closing or estimated market prices of the Company’s debt at

December 31, 2012 and 2011, which is considered level 2 of the fair value hierarchy. The fair value of other

financing arrangements was calculated using a discounted cash flow model that incorporates current borrowing

rates for obligations of similar duration, which is considered level 3 of the fair value hierarchy. As of

December 31, 2012, the current borrowing rate was estimated by applying CyrusOne’s credit spread to the risk-

free rate for a similar duration borrowing. As of December 31, 2011, CyrusOne did not have any outstanding

borrowings, so the current borrowing rate was estimated by applying Cincinnati Bell’s credit spread to the risk-

free rate for a similar duration borrowing.

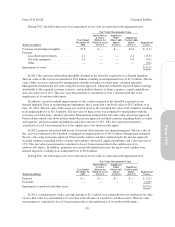

Non-Recurring Fair Value Measurements

Certain long-lived assets, intangibles, and goodwill are required to be measured at fair value on a non-

recurring basis subsequent to their initial measurement. These non-recurring fair value measurements generally

occur when evidence of impairment has occurred.

100

Form 10-K Part II Cincinnati Bell Inc.