Cigna 2014 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2014 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

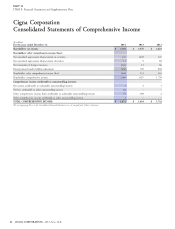

PART II

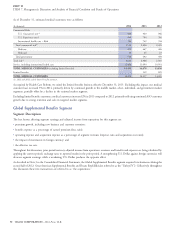

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

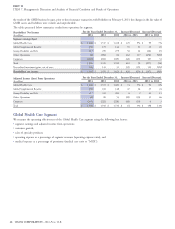

Results of Operations

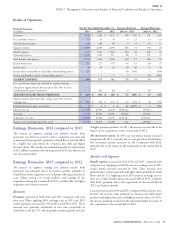

For the Years Ended December 31, Increase/(Decrease) Increase/(Decrease)

Financial Summary

(In millions)

2014 2013 2012 2014 vs. 2013 2013 vs. 2012

Premiums $ 3,549 $ 3,348 $ 3,044 $ 201 6% $ 304 10%

Fees and other revenues 86 78 65 8 10 13 20

Net investment income 335 321 300 14 4 21 7

Segment revenues 3,970 3,747 3,409 223 6 338 10

Benefit expenses 2,716 2,621 2,290 95 4 331 14

Operating expenses 797 766 724 31 4 42 6

Total benefits and expenses 3,513 3,387 3,014 126 4 373 12

Income before taxes 457 360 395 97 27 (35) (9)

Income taxes 140 101 116 39 39 (15) (13)

SEGMENT EARNINGS 317 259 279 58 22 (20) (7)

Less: special items (after-tax) included in segment earnings:

Charge for disability claims regulatory matter (See Note 23 to

the Consolidated Financial Statements) – (51) – 51 (51)

Charge for organizational efficiency plans (See Note 6 to the

Consolidated Financial Statements) – (1) (2) 1 1

ADJUSTED INCOME FROM OPERATIONS $ 317 $ 311 $ 281 $ 6 2% $ 30 11%

Realized investment gains, net of taxes $ 14 $ 40 $ 18 $ (26) (65)% $ 22 122%

Effective tax rate 30.6% 28.1% 29.4% 250bps (130)bps

Loss ratio 76.5% 78.3% 75.2% (180)bps 310bps

Loss ratio, excluding special items 76.5% 76.0% 75.2% 50bps 80bps

Operating expense ratio 21.9% 22.4% 23.3% (50)bps (90)bps

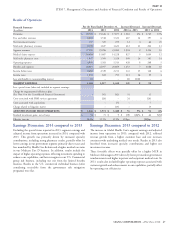

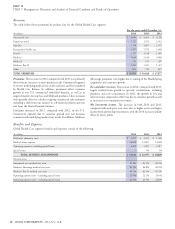

Revenues

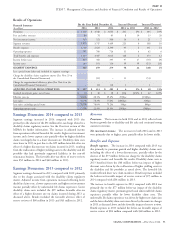

Earnings Discussion: 2014 compared to 2013

Premiums. The increases in both 2014 and in 2013 reflected new

Segment earnings increased in 2014 compared with 2013 due

business growth due to disability and life sales and continued strong

primarily to the absence of the $51 million after-tax charge related to a

customer retention.

disability claims regulatory matter. See the Overview section of this

MD&A for further information. The increase in adjusted income Net investment income. The increases in both 2014 and in 2013

from operations reflected favorable life results, higher net investment were primarily due to higher assets partially offset by lower yields.

income and a lower expense ratio partially offset by higher disability

claim costs largely due to a lower discount rate. Disability claim costs

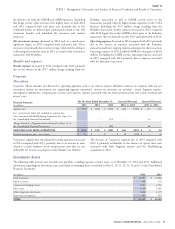

Benefits and Expenses

were lower in 2013 in part due to the $29 million favorable after-tax Benefit expenses. The increase in 2014 compared with 2013 was

effect of a higher discount rate on claims incurred in 2013, resulting due primarily to premium growth and higher disability claims costs

from the reallocation of higher yielding assets to the disability and life including the effect of a lower discount rate, partially offset by the

portfolio that had previously supported liabilities in the run-off absence of the $77 million before-tax charge for the disability claims

reinsurance business. The favorable after-tax effects of reserve reviews regulatory matter and favorable life results. Disability claim costs in

were $52 million in 2014 and $60 million in 2013. 2013 benefited from the $40 million before-tax impact of higher

discount rates driven by the reallocation of higher yielding assets to

Earnings Discussion: 2013 compared to 2012

the disability and life portfolio as noted above. The favorable life

results reflected lower new claim incidence. Benefit expenses included

Segment earnings decreased in 2013 compared with 2012 primarily

the before-tax favorable impact of reserve reviews of $75 million in

due to the charge associated with the disability claims regulatory

2014 compared with $84 million in 2013.

matter. Adjusted income from operations increased reflecting lower

disability claim costs, a lower expense ratio and higher net investment The increase in benefit expenses in 2013 compared with 2012 was

income partially offset by unfavorable life claims experience. Lower primarily due to the $77 million before-tax impact of the disability

disability claim costs included the $29 million favorable after-tax claims regulatory matter, premium growth and unfavorable life claims

effect of a higher discount rate on claims incurred during 2013 as experience partially offset by lower disability claim costs. The

discussed above. Results included the favorable after-tax effect of unfavorable life claims experience was driven by higher new claim sizes

reserve reviews of $60 million in 2013 and $43 million in 2012. and the lower disability claim costs were driven by discount rate changes

in 2013 as discussed above and the favorable impact of reserve reviews.

Benefit expenses in 2013 included the before-tax favorable impact of

reserve reviews of $84 million compared with $60 million in 2012.

CIGNA CORPORATION - 2014 Form 10-K 53