Cigna 2014 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2014 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8. Financial Statements and Supplementary Data

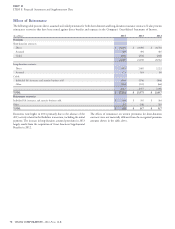

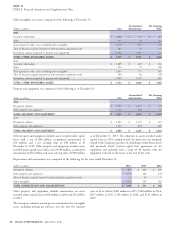

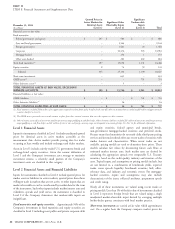

The fair values of plan assets by category and by the fair value hierarchy as defined by GAAP are as follows. See Note 10 for further details

regarding how the Company determines fair value, including the level within the fair value hierarchy and the procedures the Company uses to

validate fair value measurements.

Quoted Prices in Significant

Active Markets for Significant Other Unobservable

Identical Assets Observable Inputs Inputs

December 31, 2014

(In millions)

(Level 1) (Level 2) (Level 3) Total

Plan assets at fair value:

Fixed maturities:

Federal government and agency $ 1 $ 1 $ – $ 2

Corporate – 1,025 35 1,060

Mortgage and other asset-backed – 21 3 24

Fund investments and pooled separate accounts

(1)

– 744 3 747

TOTAL FIXED MATURITIES 1 1,791 41 1,833

Equity securities:

Domestic 640 5 73 718

International, including funds and pooled separate accounts

(1)

131 241 7 379

TOTAL EQUITY SECURITIES 771 246 80 1,097

Real estate, including pooled separate accounts

(1)

– – 331 331

Commercial mortgage loans – – 110 110

Securities partnerships – – 357 357

Hedge funds – – 283 283

Guaranteed deposit account contract – – 44 44

Cash equivalents – 115 – 115

TOTAL PLAN ASSETS AT FAIR VALUE $ 772 $ 2,152 $ 1,246 $ 4,170

(1) A pooled separate account has several participating benefit plans and each owns a share of the total pool of investments.

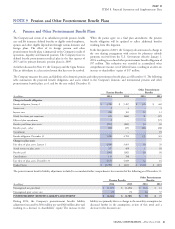

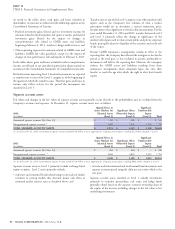

Quoted Prices in Significant

Active Markets for Significant Other Unobservable

Identical Assets Observable Inputs Inputs

December 31, 2013

(In millions)

(Level 1) (Level 2) (Level 3) Total

Plan assets at fair value:

Fixed maturities:

Federal government and agency $ – $ 2 $ – $ 2

Corporate – 725 24 749

Mortgage and other asset-backed – 18 5 23

Fund investments and pooled separate accounts

(1)

– 1,019 3 1,022

TOTAL FIXED MATURITIES – 1,764 32 1,796

Equity securities:

Domestic 824 – 35 859

International, including funds and pooled separate accounts

(1)

187 124 7 318

TOTAL EQUITY SECURITIES 1,011 124 42 1,177

Real estate, including pooled separate accounts

(1)

– – 251 251

Commercial mortgage loans – – 88 88

Securities partnerships – – 304 304

Hedge funds – – 360 360

Guaranteed deposit account contract – – 44 44

Cash equivalents – 69 – 69

TOTAL PLAN ASSETS AT FAIR VALUE $ 1,011 $ 1,957 $ 1,121 $ 4,089

(1) A pooled separate account has several participating benefit plans and each owns a share of the total pool of investments.

CIGNA CORPORATION - 2014 Form 10-K 83