Cigna 2014 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2014 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

with the terms of the agreement upon re-examination, we may be reductions for Medicare Advantage plans by the Centers for Medicare

subject to additional fines or penalties. In addition to the monitoring and Medicaid Services (‘‘CMS’’) and changes in requirements

states, most other jurisdictions have joined the agreement as associated with operational and performance metrics used to

participating, non-monitoring states. determine Medicare Advantage payments and benefits. For 2014,

there have been further changes resulting from Health Care Reform

and the implementing regulations including public exchanges, a

Health Care Industry Developments

non-deductible industry tax in addition to fees and assessments, and

minimum medical loss ratio requirements for Medicare Advantage

Health Care Reform and the implementing regulations have resulted

and Medicare Part D plans. Collectively, these changes have had a

in broad changes that are meaningfully impacting the industry,

significant impact on our business and customers, requiring

including relationships with customers and health care providers, the

adjustments to our business model to mitigate their effects on our

design of products and services, and pricing and delivery systems. In

results of operations and cash flows.

2013, the industry saw government-prescribed reductions to

Medicare reimbursement rates (i.e., sequestration), ongoing payment

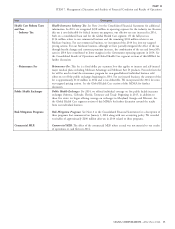

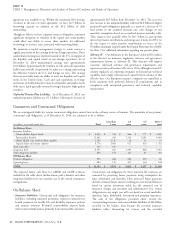

The ‘‘Regulation’’ section of this Form 10-K provides a detailed and up-to-date description of Health Care Reform provisions and other legislative

initiatives that impact our domestic health care business, including regulations issued by CMS and the Departments of the Treasury and Health

and Human Services (‘‘HHS’’). The table presented below provides a summary of the financial impacts of key provisions of Health Care Reform

in 2014 and beyond.

Item Description

Medicare Advantage (‘‘MA’’) Sequestration: As a result of sequestration, federal government reimbursement rates for MA and

and Part D Program Impacts Part D were lowered by 2% beginning April 1, 2013. This program is expected to run through

Sequestration 2023. While these rate reductions significantly impact our Government operating segment, their

MA Rates overall effect on consolidated net income and cash flows was immaterial in 2013 and 2014 and is

Medical Loss Ratio (MA expected to continue to be immaterial.

and Part D)

MA Rates: In April 2014, CMS published its notice of final federal government reimbursement rates

for calendar year 2015. Based on industry data, overall MA rates for 2015 are expected to be 2%

lower than 2014 for MA carriers. Assuming a similar book of business to 2014, we would expect a

2% rate decrease to lower full-year 2015 MA premiums by approximately $100 million. We do not

expect these lower rates to have a significant impact on our 2015 net income or cash flows based on

our 2015 bid submissions that included adjustments to our programs and services to reflect the 2015

rates.

The 2014 federal government reimbursement rates established by CMS included a variety of payment

reductions to Medicare plans. Overall, these rates were reduced by approximately 6% compared with

2013. Assuming a similar book of business to 2013, we estimated this rate decrease would lower

full-year 2014 MA premiums by approximately $300 million. In 2014, premium decreases related to

the CMS rate reductions have been partially mitigated through changes in member risk scores and

customer enrollment mix (in total, and by county).

These rate reductions, together with the impact of the health insurance industry tax, have negatively

impacted margins for the Government operating segment.

Medical Loss Ratio (‘‘MLR’’): Beginning in 2014, if our MLR for MA or Part D business is less

than the required 85% minimum, we will be required to pay a rebate to CMS. The effect of these

MLR rebates was not material to our results of operations or cash flows in 2014.

34 CIGNA CORPORATION - 2014 Form 10-K

–

–

–