Cigna 2014 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2014 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8. Financial Statements and Supplementary Data

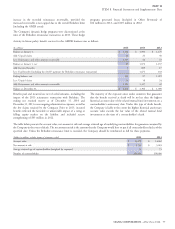

Third, changes in reserves for the Company’s retrospectively The determination of liabilities for Global Health Care medical

experience-rated business for accounts in surplus do not usually claims payable requires the Company to make critical accounting

impact shareholders’ net income because such amounts are generally estimates. See Note 2(N) for further information about the

offset by a change in the liability to the policyholder. An account is in assumptions and estimates used to establish this liability.

surplus when the accumulated premium received exceeds the

accumulated medical costs and administrative charges, including

profit charges.

Organizational Efficiency Plans

The Company is regularly evaluating ways to deliver its products and in the fourth quarter of 2013, primarily for severance costs. The

services more efficiently and at a lower cost. During 2013 and 2012, Company expects most of the severance to be paid by the end of 2015.

the Company adopted specific plans to increase its organizational 2012 Plan. During the third quarter of 2012, in connection with the

efficiency as follows: execution of its strategy, the Company committed to a series of actions

2013 Plan. During the fourth quarter of 2013, the Company to further improve its organizational alignment, operational

committed to a plan to increase its organizational efficiency and effectiveness, and efficiency. As a result, the Company recognized

reduce costs through a series of actions that includes employee charges in other operating expenses of $77 million pre-tax

headcount reductions. As a result, the Company recognized charges in ($50 million after-tax) in the third quarter of 2012 consisting

other operating expenses of $60 million pre-tax ($40 million after-tax) primarily of severance costs. The costs associated with this plan were

substantially paid as of March 31, 2014.

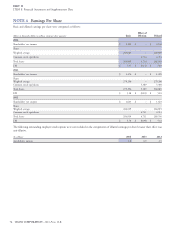

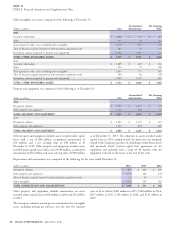

Summarized below is the activity for the 2013 plan described above.

(In millions)

Severance Real estate Total

Fourth quarter 2013 charge $ 47 $ 13 $ 60

Less: 2013 payments 112

Balance, December 31, 2013 46 12 58

Less: 2014 payments 26 2 28

Balance, December 31, 2014 $ 20 $ 10 $ 30

Reinsurance

The Company’s insurance subsidiaries enter into agreements with pre-tax reported as follows: $727 million in other benefit expenses;

other insurance companies to assume and cede reinsurance. $45 million in GMIB fair value loss; and $9 million in other operating

Reinsurance is ceded primarily to limit losses from large exposures and expenses). The payment to Berkshire under the agreement was

to permit recovery of a portion of direct or assumed losses. $2.2 billion and was funded from the sale of investment assets, tax

Reinsurance is also used in acquisition and disposition transactions benefits related to the transaction and available parent cash.

when the underwriting company is not being acquired. Reinsurance Because this effective exit was accomplished via a reinsurance contract,

does not relieve the originating insurer of liability. The Company the amounts related to the reinsured GMDB and GMIB contracts

regularly evaluates the financial condition of its reinsurers and cannot be netted, so the gross assets and liabilities must continue to be

monitors concentrations of its credit risk. measured and reported. The following disclosures provide further

context to the methods and assumptions used to determine these

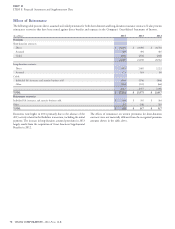

Effective Exit of GMDB and GMIB Business

assets and liabilities.

On February 4, 2013, the Company entered into an agreement with

Berkshire Hathaway Life Insurance Company of Nebraska

GMDB

(‘‘Berkshire’’) to effectively exit the GMDB and GMIB businesses via The Company estimates this liability with an internal model based on

a reinsurance transaction. Berkshire reinsured 100% of the the Company’s experience and future expectations over an extended

Company’s future claim payments in these businesses, net of period, consistent with the long-term nature of this product. Because

retrocessional arrangements existing at that time. The reinsurance the product is premium deficient, the Company records increases to

agreement is subject to an overall limit with approximately the reserve if it is inadequate based on the model. Prior to the

$3.7 billion remaining. reinsurance transaction with Berkshire, any such reserve increases were

This transaction resulted in an after-tax charge to shareholders’ net recorded as a charge to shareholders’ net income. Reserve increases

income in the first quarter of 2013 of $507 million ($781 million after the reinsurance transaction are expected to have a corresponding

76 CIGNA CORPORATION - 2014 Form 10-K

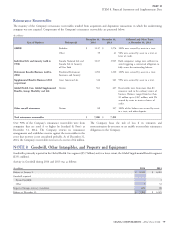

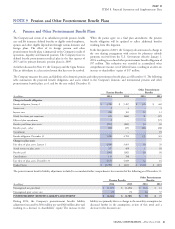

NOTE 6

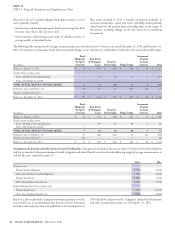

NOTE 7