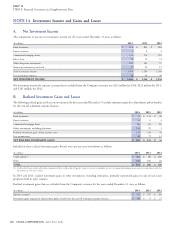

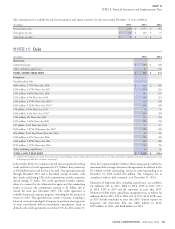

Cigna 2014 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2014 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8. Financial Statements and Supplementary Data

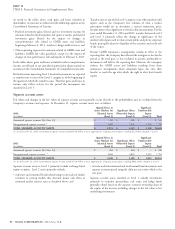

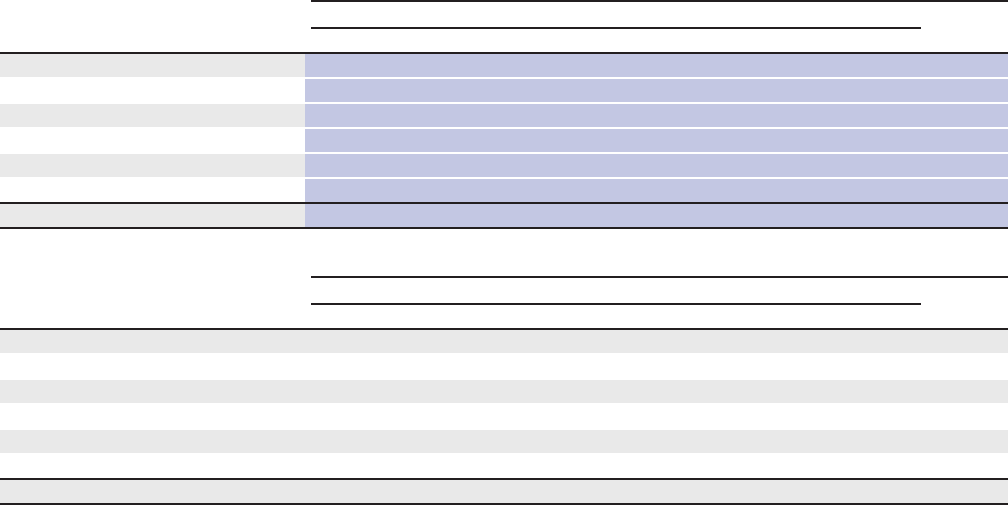

portfolio loan review. The Company evaluates and monitors credit coverage and loan-to-value ratios. The debt service coverage ratio

quality on an ongoing basis, classifying each loan as a loan in good measures the amount of property cash flow available to meet annual

standing, potential problem loan or problem loan. interest and principal payments on debt, with a ratio below 1.0

indicating that there is not enough cash flow to cover the required

Quality ratings are based on our evaluation of a number of key inputs loan payments. The loan-to-value ratio, commonly expressed as a

related to the loan, including real estate market-related factors such as percentage, compares the amount of the loan to the fair value of the

rental rates and vacancies, and property-specific inputs such as growth underlying property collateralizing the loan.

rate assumptions and lease rollover statistics. However, the two most

significant contributors to the credit quality rating are the debt service

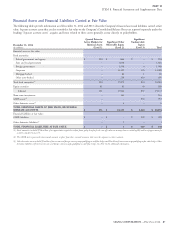

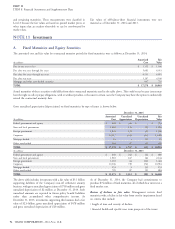

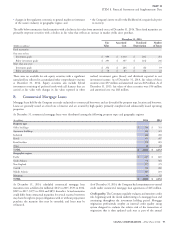

The following tables summarize the credit risk profile of the Company’s commercial mortgage loan portfolio based on loan-to-value and debt

service coverage ratios, as of December 31, 2014 and 2013:

December 31, 2014

Debt Service Coverage Ratio

(In millions)

Loan-to-Value Ratios 1.30x or Greater 1.20x to 1.29x 1.10x to 1.19x 1.00x to 1.09x Less than 1.00x Total

Below 50% $ 340 $ 17 $ – $ 6 $ – $ 363

50% to 59% 681 38 – – – 719

60% to 69% 394 – 15 – 60 469

70% to 79% 68 36 33 – 80 217

80% to 89% 6 41 – – 58 105

90% to 100% – – 55 – 153 208

TOTAL $ 1,489 $ 132 $ 103 $ 6 $ 351 $ 2,081

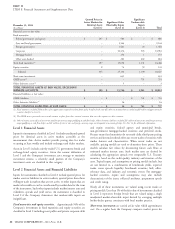

December 31, 2013

Debt Service Coverage Ratio

(In millions)

Loan-to-Value Ratios 1.30x or Greater 1.20x to 1.29x 1.10x to 1.19x 1.00x to 1.09x Less than 1.00x Total

Below 50% $ 314 $ – $ – $ 6 $ – $ 320

50% to 59% 581 131 – 18 – 730

60% to 69% 438 16 29 – 24 507

70% to 79% 79 113 – – – 192

80% to 89% 65 42 34 28 143 312

90% to 100% – – 58 50 83 191

TOTAL $ 1,477 $ 302 $ 121 $ 102 $ 250 $ 2,252

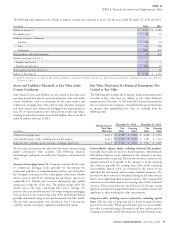

The Company’s annual in-depth review of its commercial mortgage delinquency or a borrower’s request for restructure causes

loan investments is the primary mechanism for identifying emerging management to believe that the Company’s estimate of financial

risks in the portfolio. The most recent review was completed by the performance, fair value or the risk profile of the underlying property

Company’s investment professionals in the second quarter of 2014 has been impacted.

and included an analysis of each underlying property’s most recent During 2013, the Company restructured its subordinate interest in

annual financial statements, rent rolls, operating plans, budgets, a two cross-collateralized pools of industrial loans totaling $31 million

physical inspection of the property and other pertinent factors. Based by extending the maturity dates and reducing the interest rates. This

on historical results, current leases, lease expirations and rental modification was considered a troubled debt restructuring and the

conditions in each market, the Company estimates the current year loans were classified as problem mortgage loans because the borrower

and future stabilized property income and fair value, and categorizes was experiencing financial difficulties and an interest rate concession

the investments as loans in good standing, potential problem loans or was granted. No valuation reserves were required because the fair

problem loans. Based on property valuations and cash flows estimated values of the underlying properties exceeded the carrying values of the

as part of this review, and considering updates for loans where material outstanding loans.

changes were subsequently identified, the portfolio’s average

loan-to-value ratio improved slightly to 63% at December 31, 2014 Certain other loans were modified during 2014 and 2013. However,

from 64% at December 31, 2013. The portfolio’s average debt service these were not considered troubled debt restructures and the impact of

coverage ratio was estimated to be 1.66 at December 31, 2014, a such modifications was not material to the Company’s results of

modest improvement from 1.62 at December 31, 2013. operations, financial condition or liquidity.

The Company will reevaluate a loan’s credit quality between annual

reviews if new property information is received or an event such as

96 CIGNA CORPORATION - 2014 Form 10-K