Cigna 2014 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2014 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8. Financial Statements and Supplementary Data

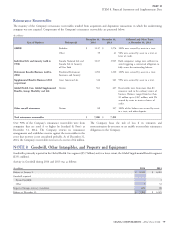

increase in the recorded reinsurance recoverable, provided the programs generated losses (included in Other Revenues) of

increased recoverable is not capped due to the overall Berkshire limit $32 million in 2013, and $105 million in 2012.

(including the GMIB assets).

The Company’s dynamic hedge programs were discontinued at the

time of the Berkshire reinsurance transaction in 2013. These hedge

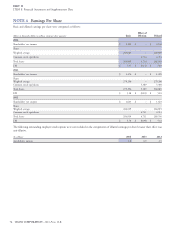

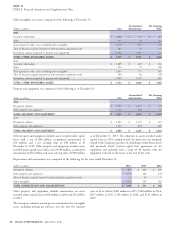

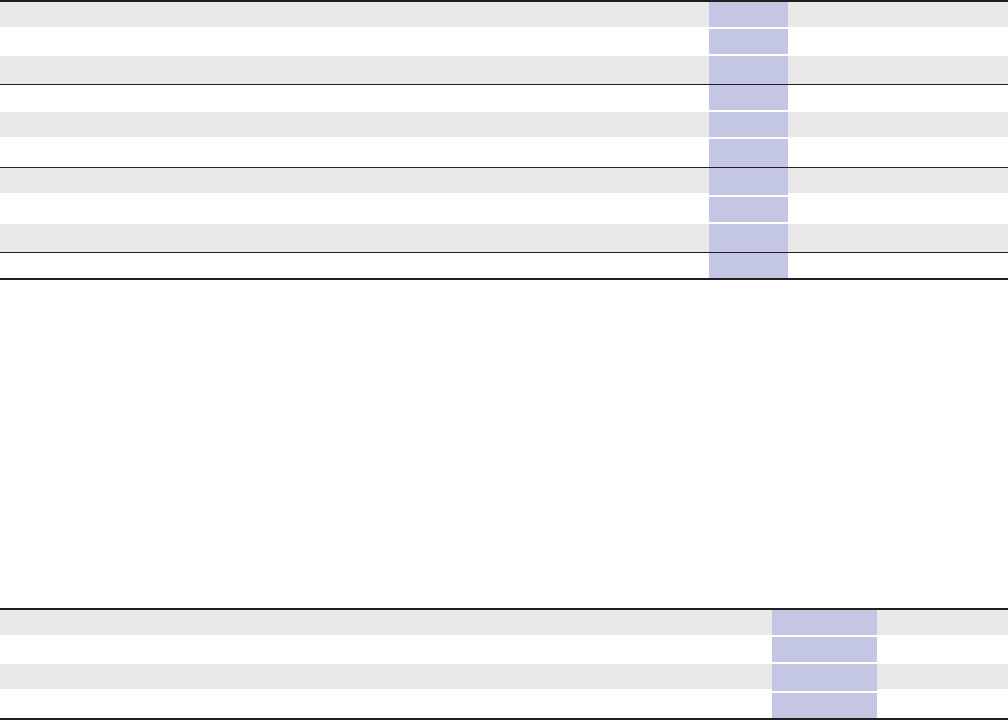

Activity in future policy benefit reserves for the GMDB business was as follows:

(In millions)

2014 2013 2012

Balance at January 1, $ 1,396 $ 1,090 $ 1,170

Add: Unpaid claims 18 24 40

Less: Reinsurance and other amounts recoverable 1,317 42 53

Balance at January 1, net 97 1,072 1,157

Add: Incurred benefits 3 699 17

Less: Paid benefits (including the $1,647 payment for Berkshire reinsurance transaction) – 1,674 102

Ending balance, net 100 97 1,072

Less: Unpaid claims 16 18 24

Add: Reinsurance and other amounts recoverable 1,186 1,317 42

Balance at December 31, $ 1,270 $ 1,396 $ 1,090

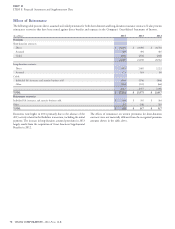

Benefits paid and incurred are net of ceded amounts, including the The majority of the exposure arises under annuities that guarantee

impact of the 2013 reinsurance transaction with Berkshire. The that the benefit received at death will be no less than the highest

ending net retained reserve as of December 31, 2014 and historical account value of the related mutual fund investments on a

December 31, 2013 covers ongoing administrative expenses, as well as contractholder’s anniversary date. Under this type of death benefit,

the few claims retained by the Company. Prior to 2013, incurred the Company is liable to the extent the highest historical anniversary

benefits reflected the favorable or unfavorable impact of a rising or account value exceeds the fair value of the related mutual fund

falling equity market on the liability, and included reserve investments at the time of a contractholder’s death.

strengthening of $43 million in 2012.

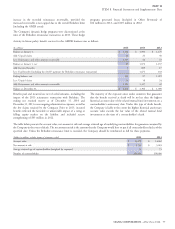

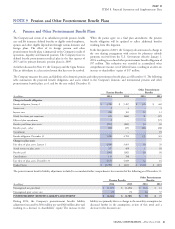

The table below presents the account value, net amount at risk and average attained age of underlying contractholders for guarantees assumed by

the Company in the event of death. The net amount at risk is the amount that the Company would have to pay if all contractholders died as of the

specified date. Unless the Berkshire reinsurance limit is exceeded, the Company should be reimbursed in full for these payments.

(Dollars in millions, excludes impact of reinsurance ceded)

2014 2013

Account value $ 13,078 $ 14,062

Net amount at risk $ 2,763 $ 3,023

Average attained age of contractholders (weighted by exposure) 73 73

Number of contractholders 354,000 390,000

CIGNA CORPORATION - 2014 Form 10-K 77