Cigna 2014 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2014 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PART II

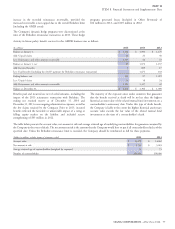

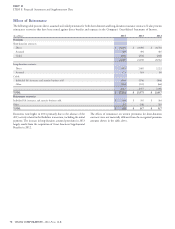

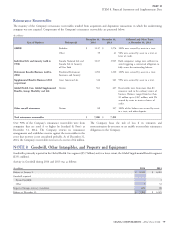

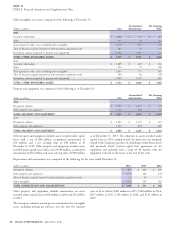

ITEM 8. Financial Statements and Supplementary Data

outcome. For strategic performance shares with payment dependent

S. Fees, Related Expenses and Mail Order

on performance conditions, expense is initially accrued based on the

Pharmacy Revenues and Costs

most likely outcome, but evaluated for adjustment each period for

updates in the expected outcome. At the end of the performance

Contract fees for administrative services only (‘‘ASO’’) programs and period, expense is adjusted to the actual outcome (number of shares

pharmacy programs and services are recognized in fees and other awarded times the share price at the grant date).

revenues as services are provided, net of pharmaceutical manufacturer

rebates payable to clients and estimated refunds under performance

guarantees. In some cases, the Company provides performance

U. Participating Business

guarantees associated with meeting certain service standards, clinical

The Company’s participating life insurance policies entitle

outcomes or financial metrics. If these service standards, clinical

policyholders to earn dividends that represent a portion of the

outcomes or financial metrics are not met, the Company may be

earnings of the Company’s life insurance subsidiaries. Participating

financially at risk up to a stated percentage of the contracted fee or a

insurance accounted for approximately 1% of the Company’s total life

stated dollar amount. The Company establishes deferred revenues for

insurance in force at the end of 2014, 2013 and 2012.

estimated payouts associated with these performance guarantees.

Approximately 12% of ASO fees reported for the year ended

December 31, 2014 were at risk, with reimbursements estimated to be

V. Income Taxes

approximately 1%. Expenses associated with these programs and

Deferred income tax assets and liabilities are recognized for differences

services are recognized in other operating expenses as incurred, net of

between the financial and income tax reporting bases of the

pharmaceutical rebates from manufacturers.

underlying assets and liabilities and established based upon enacted

Revenue for investment-related products is recognized as follows: tax rates and laws. Deferred income tax assets are recognized when

available evidence indicates that realization is more likely than not.

Net investment income on assets supporting investment-related

The deferred income tax provision generally represents the net change

products is recognized as earned.

in deferred income tax assets and liabilities during the year, exclusive

Contract fees based upon related administrative expenses are of amounts reported as adjustments to accumulated other

recognized in fees and other revenues as they are earned ratably over comprehensive income or amounts initially recorded due to business

the contract period. combinations. The current income tax provision generally represents

the estimated amounts due on the various income tax returns for the

Benefits and expenses for investment-related products consist year reported plus the effect of any uncertain tax positions. Uncertain

primarily of income credited to policyholders in accordance with tax positions are evaluated in accordance with the model set forth in

contract provisions. FASB guidance.

Mail order pharmacy revenues and the cost of prescriptions are Income tax provisions related to the Company’s foreign operations are

recognized as each prescription is shipped. generally determined based upon the local country income tax rate.

Note 19 contains detailed information about the Company’s income

T. Stock Compensation

taxes.

The Company records compensation expense for stock awards and

options over their vesting periods primarily based on the estimated fair

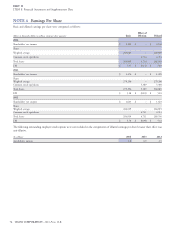

W. Earnings Per Share

value at the grant date. For stock options, fair value is estimated using

an option-pricing model, whereas for restricted stock grants and units, The Company computes basic earnings per share using the weighted-

fair value is equal to the market price of the Company’s common stock average number of unrestricted common and deferred shares

on the date of grant. Compensation expense for strategic performance outstanding. Diluted earnings per share also includes the dilutive

shares is recorded over the performance period. For strategic effect of outstanding employee stock options and unvested restricted

performance shares with payment dependent on a market condition, stock granted after 2009 using the treasury stock method and the

fair value is determined at the grant date using a Monte Carlo effect of strategic performance shares.

simulation model and not subsequently adjusted regardless of the final

72 CIGNA CORPORATION - 2014 Form 10-K

•

•