Cigna 2014 Annual Report Download - page 146

Download and view the complete annual report

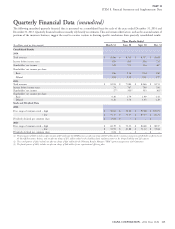

Please find page 146 of the 2014 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PART II

ITEM 8. Financial Statements and Supplementary Data

that the legal actions, regulatory matters, proceedings and v. Connecticut General Life Insurance Company, et al., pending in the

investigations currently pending against it should not have a material U.S. District Court for the District of New Jersey. The consolidated

adverse effect on the Company’s results of operation, financial amended complaint, filed in 2009 on behalf of subscribers, health care

condition or liquidity based upon current knowledge and taking into providers and various medical associations, asserted claims related to

consideration current accruals. The Company had pre-tax reserves as benefits and disclosure under ERISA, the Racketeer Influenced and

of December 31, 2014 of $189 million ($123 million after-tax) for Corrupt Organizations (‘‘RICO’’) Act, the Sherman Antitrust Act and

the matters discussed below. Due to numerous uncertain factors New Jersey state law and seeks recovery for alleged underpayments

presented in these cases, it is not possible to estimate an aggregate from 1998 through the present. Other major health insurers have

range of loss (if any) for these matters at this time. In light of the been the subject of, or have settled, similar litigation.

uncertainties involved in these matters, there is no assurance that their In September 2011, the District Court (1) dismissed all claims by the

ultimate resolution will not exceed the amounts currently accrued by health care provider and medical association plaintiffs for lack of

the Company. An adverse outcome in one or more of these matters standing; and (2) dismissed the antitrust claims, the New Jersey state

could be material to the Company’s results of operations, financial law claims and the ERISA disclosure claim. In January 2013 and again

condition or liquidity for any particular period. in April 2014, the District Court denied separate motions by the

plaintiffs to certify a nationwide class of subscriber plaintiffs. The

Litigation Matters

Third Circuit denied plaintiff’s request for an immediate appeal of the

Amara cash balance pension plan litigation. In December 2001, January 2013 ruling. As a result, the case is proceeding on behalf of

Janice Amara filed a class action lawsuit in the U.S. District Court for the named plaintiffs only. In June 2014, the District Court granted

the District of Connecticut against Cigna Corporation and the Cigna the Company’s motion for summary judgment to terminate all claims,

Pension Plan (the ‘‘Plan’’) on behalf of herself and other similarly and denied the plaintiffs’ partial motion for summary judgment. In

situated participants in the Plan affected by the 1998 conversion to a July 2014, the plaintiffs appealed all of the District Court’s decisions

cash balance formula. The plaintiffs allege various ERISA violations, in favor of the Company, including the class certification decision, to

including, that the Plan’s cash balance formula discriminates against the Third Circuit. The Company will continue to vigorously defend

older employees; that the conversion resulted in a wear-away period its position.

(when the pre-conversion accrued benefit exceeded the

post-conversion benefit); and that the Plan communications

Regulatory Matters

contained inaccurate or inadequate disclosures about these Disability claims regulatory matter. During the second quarter of

conditions. 2013, the Company finalized an agreement with the Departments of

In 2008, the District Court (1) found for plaintiffs on the disclosure Insurance for Maine, Massachusetts, Pennsylvania, Connecticut and

claim only; (2) affirmed the Company’s right to convert to a cash California (together, the ‘‘monitoring states’’) related to an

balance plan prospectively beginning in 1998; and (3) required the examination of the Company’s long-term disability claims handling

Company to pay pre-1998 benefits under the pre-conversion practices. The agreement requires, among other things: (1) enhanced

traditional annuity formula and post-1997 benefits under the claims handling procedures related to documentation and disposition;

post-conversion cash balance formula. The Second Circuit upheld (2) monitoring the Company’s implementation of these procedures

this decision. In 2011, the Supreme Court reversed the lower court during a two-year period following the execution date of the

decisions in this matter and returned the case to the District Court, agreement; and (3) a reassessment of claims denied or closed during a

which ordered the Company to pay substantially the same benefits as two-year prior period, except California for which the reassessment

had been ordered in 2008 and denied the Company’s motion to period is three years.

decertify the class. The parties again appealed, with the plaintiffs In connection with the terms of the agreement, the Company

challenging the District Court’s denial of their request to return to the recorded a charge of $77 million before-tax ($51 million after-tax) in

prior annuity benefit plan formula, and Cigna and the Plan appealing the first quarter of 2013. The charge is comprised of two elements:

the District Court’s order and the denial of a motion to decertify the (1) $48 million of benefit costs and reserves from reassessed claims

class. In December 2014, the Second Circuit upheld the District expected to be reopened, and (2) $29 million in additional costs for

Court ruling. In January 2015, the plaintiffs filed a petition for open claims as a result of the claims handling changes being

re-hearing with the Second Circuit. The Company will continue to implemented. The Company is actively implementing the terms of

vigorously defend its position. the agreement and continues to communicate with the monitoring

states on progress. If the monitoring states find material

Ingenix. In April 2004, the Company was sued in a number of

non-compliance with the agreement upon re-examination, the

putative nationwide class actions alleging that the Company

Company may be subject to additional costs and penalties. Most other

improperly underpaid claims for out-of-network providers through

jurisdictions have joined the agreement as participating,

the use of data provided by Ingenix, Inc., a subsidiary of one of the

non-monitoring states.

Company’s competitors. These actions were consolidated into Franco

114 CIGNA CORPORATION - 2014 Form 10-K