Cigna 2014 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2014 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8. Financial Statements and Supplementary Data

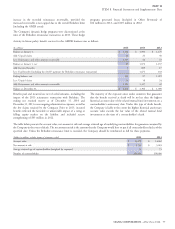

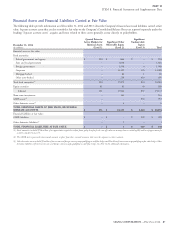

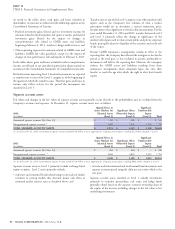

Fair Value Measurements

The Company carries certain financial instruments at fair value in the methods are performed by the Company’s investment professionals

financial statements including fixed maturities, equity securities, and generally involve using discounted cash flow analyses,

short-term investments and derivatives. Other financial instruments incorporating current market inputs for similar financial instruments

are measured at fair value under certain conditions, such as when with comparable terms and credit quality, as well as other qualitative

impaired. factors. In instances where there is little or no market activity for the

same or similar instruments, fair value is estimated using methods,

Fair value is defined as the price at which an asset could be exchanged models and assumptions that the Company believes a hypothetical

in an orderly transaction between market participants at the balance market participant would use to determine a current transaction price.

sheet date. A liability’s fair value is defined as the amount that would These valuation techniques involve some level of estimation and

be paid to transfer the liability to a market participant, not the judgment that becomes significant with increasingly complex

amount that would be paid to settle the liability with the creditor. instruments or pricing models.

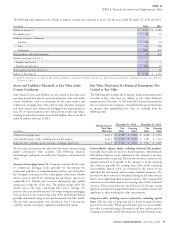

The Company’s financial assets and liabilities carried at fair value have The Company is responsible for determining fair value, as well as the

been classified based upon a hierarchy defined by GAAP. The appropriate level within the fair value hierarchy, based on the

hierarchy gives the highest ranking to fair values determined using significance of unobservable inputs. The Company reviews

unadjusted quoted prices in active markets for identical assets and methodologies, processes and controls of third-party pricing services

liabilities (Level 1) and the lowest ranking to fair values determined and compares prices on a test basis to those obtained from other

using methodologies and models with unobservable inputs (Level 3). external pricing sources or internal estimates. The Company performs

An asset’s or a liability’s classification is based on the lowest level of ongoing analyses of both prices received from third-party pricing

input that is significant to its measurement. For example, a financial services and those developed internally to determine that they

asset or liability carried at fair value would be classified in Level 3 if represent appropriate estimates of fair value. The controls completed

unobservable inputs were significant to the instrument’s fair value, by the Company and third-party pricing services include reviewing to

even though the measurement may be derived using inputs that are ensure that prices do not become stale and whether changes from

both observable (Levels 1 and 2) and unobservable (Level 3). prior valuations are reasonable or require additional review. The

Company also performs sample testing of sales values to confirm the

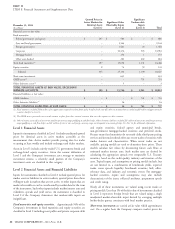

The Company estimates fair values using prices from third parties or

accuracy of prior fair value estimates. Exceptions identified during

internal pricing methods. Fair value estimates received from third-

these processes indicate that adjustments to prices are infrequent and

party pricing services are based on reported trade activity and quoted

do not significantly impact valuations.

market prices when available, and other market information that a

market participant may use to estimate fair value. The internal pricing

86 CIGNA CORPORATION - 2014 Form 10-K

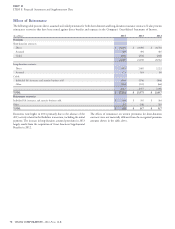

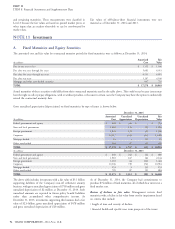

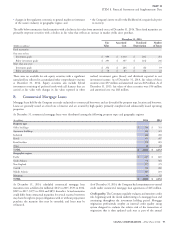

NOTE 10