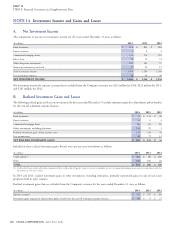

Cigna 2014 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2014 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8. Financial Statements and Supplementary Data

changes in the regulatory, economic or general market environment the Company’s intent to sell or the likelihood of a required sale prior

of the issuer’s industry or geographic region; and to recovery.

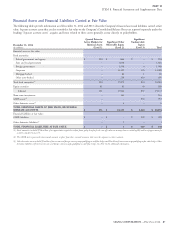

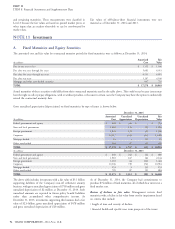

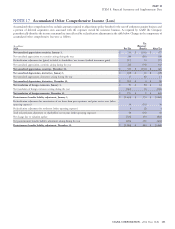

The table below summarizes fixed maturities with a decline in fair value from amortized cost as of December 31, 2014. These fixed maturities are

primarily corporate securities with a decline in fair value that reflects an increase in market yields since purchase.

December 31, 2014

Fair Amortized Unrealized Number

(Dollars in millions)

Value Cost Depreciation of Issues

Fixed maturities:

One year or less:

Investment grade $ 999 $ 1,010 $ (11) 251

Below investment grade $ 293 $ 307 $ (14) 236

More than one year:

Investment grade $ 256 $ 264 $ (8) 93

Below investment grade $ 78 $ 87 $ (9) 22

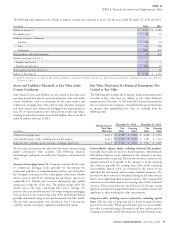

There were no available for sale equity securities with a significant realized investment gains (losses) and dividends reported in net

unrealized loss reflected in accumulated other comprehensive income investment income. As of December 31, 2014, fair values of these

at December 31, 2014. Equity securities also include hybrid securities were $57 million and amortized cost was $69 million. As of

investments consisting of preferred stock with call features that are December 31, 2013, fair values of these securities were $56 million

carried at fair value with changes in fair value reported in other and amortized cost was $68 million.

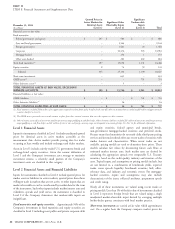

B. Commercial Mortgage Loans

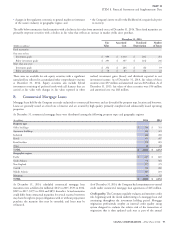

Mortgage loans held by the Company are made exclusively to commercial borrowers and are diversified by property type, location and borrower.

Loans are generally issued at a fixed rate of interest and are secured by high quality, primarily completed and substantially leased operating

properties.

At December 31, commercial mortgage loans were distributed among the following property types and geographic regions:

(In millions)

2014 2013

Property type

Office buildings $ 700 $ 761

Apartment buildings 264 321

Industrial 466 450

Hotels 351 407

Retail facilities 272 285

Other 28 28

TOTAL $ 2,081 $ 2,252

Geographic region

Pacific $ 637 $ 805

South Atlantic 572 564

New England 277 379

Central 214 260

Middle Atlantic 287 201

Mountain 94 43

TOTAL $ 2,081 $ 2,252

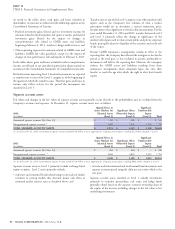

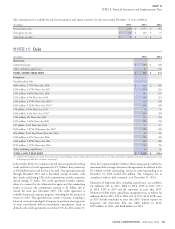

At December 31, 2014, scheduled commercial mortgage loan As of December 31, 2014, the Company had commitments to extend

maturities were as follows (in millions): $247 in 2015, $533 in 2016, credit under commercial mortgage loan agreements of $65 million.

$229 in 2017, $179 in 2018 and $893 thereafter. Actual maturities Credit quality. The Company regularly evaluates and monitors credit

could differ from contractual maturities for several reasons: borrowers risk, beginning with the initial underwriting of a mortgage loan and

may have the right to prepay obligations with or without prepayment continuing throughout the investment holding period. Mortgage

penalties; the maturity date may be extended; and loans may be origination professionals employ an internal credit quality rating

refinanced. system designed to evaluate the relative risk of the transaction at

origination that is then updated each year as part of the annual

CIGNA CORPORATION - 2014 Form 10-K 95

••