Cigna 2014 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2014 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8. Financial Statements and Supplementary Data

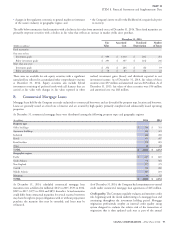

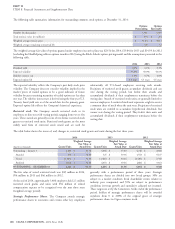

regulated by such statutory requirements. The statutory net income of the Company’s life insurance and HMO subsidiaries for the years ended,

and their statutory surplus as of December 31, were as follows:

(In millions)

2014 2013 2012

Net income $ 2,002 $ 1,631 $ 1,520

Surplus $ 7,487 $ 6,316 $ 6,109

The minimum statutory surplus required by regulators for the of insurance and other regulatory bodies with statutory carrying

Company’s life insurance and HMO company subsidiaries was values of approximately $0.4 billion. The Company’s life insurance

approximately $2.5 billion as of December 31, 2014. As of and HMO subsidiaries are also subject to regulatory restrictions that

December 31, 2014, statutory surplus for each of the Company’s life limit the amount of annual dividends or other distributions (such as

insurance and HMO subsidiaries is sufficient to meet the minimum loans or cash advances) insurance companies may extend to the parent

required by regulators. For one of the Company’s foreign insurance company without prior approval of regulatory authorities. The

subsidiaries, the regulatory authority has permitted deferral of certain maximum dividend distribution that the Company’s life insurance

policy acquisition costs that increased statutory capital and surplus by and HMO subsidiaries may make during 2015 without prior approval

approximately $0.2 billion as of December 31, 2014. There were no is approximately $1.0 billion. Restricted net assets of the Company as

other permitted practices for the Company’s insurance subsidiaries of December 31, 2014, were approximately $8.8 billion. Certain life

that significantly differed from prescribed regulatory accounting insurance subsidiaries of the Company are permitted to loan up to

practices. As of December 31, 2014, the Company’s life insurance and approximately $1.0 billion to the parent company without prior

HMO subsidiaries had investments on deposit with state departments approval.

Income Taxes

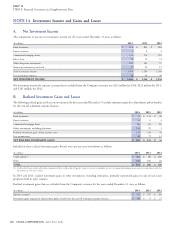

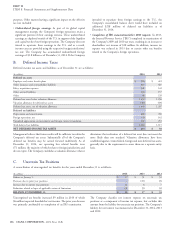

A. Income Tax Expense

The components of income taxes for the years ended December 31 were as follows:

(In millions)

2014 2013 2012

Current taxes

U.S. income taxes $ 1,068 $ 382 $ 604

Foreign income taxes 115 77 72

State income taxes 49 42 43

1,232 501 719

Deferred taxes (benefits)

U.S. income taxes 10 152 131

Foreign income taxes (22) 46 4

State income taxes (10) (1) (1)

(22) 197 134

TOTAL INCOME TAXES $ 1,210 $ 698 $ 853

Total income taxes for the years ended December 31 were different from the amount computed using the nominal federal income tax rate of 35%

for the following reasons:

(In millions)

2014 2013 2012

Tax expense at nominal rate $ 1,156 $ 761 $ 867

Effect of undistributed foreign earnings (74) (42) (37)

Health insurance industry tax 83 – –

State income tax (net of federal income tax benefit) 25 27 28

Other 20 (48) (5)

TOTAL INCOME TAXES $ 1,210 $ 698 $ 853

Consolidated pre-tax income from the Company’s foreign operations was approximately 10% in 2014, 12% in 2013 and 8% in 2012.

took effect in 2014 and that is not deductible for federal income tax

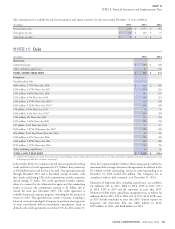

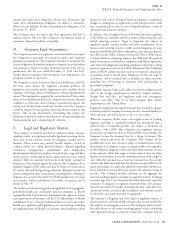

Effective Tax Rates

The consolidated effective tax rate of 36.6% in 2014 has increased

from historical levels due to the health insurance industry tax that

CIGNA CORPORATION - 2014 Form 10-K 105

NOTE 19