CarMax 2012 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2012 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

of nonqualified stock options and, starting in fiscal 2010, stock-settled restricted stock units. Nonemployee directors

receive awards of nonqualified stock options and stock grants.

Nonqualified Stock Options. Nonqualified stock options are awards that allow the recipient to purchase shares of

our common stock at a fixed price. Stock options are granted at an exercise price equal to the fair market value of

our common stock on the grant date. Substantially all of the stock options vest annually in equal amounts over

periods of three to four years. These options are subject to forfeiture and expire no later than ten years after the date

of the grant.

Cash-Settled Restricted Stock Units. Also referred to as restricted stock units, or RSUs, these are awards that entitle

the holder to a cash payment equal to the fair market value of a share of our common stock for each unit granted at

the end of a three-year vesting period. However, the cash payment per RSU will not be greater than 200% or less

than 75% of the fair market value of a share of our common stock on the grant date. RSUs are liability awards that

are subject to forfeiture and do not have voting rights.

Stock-Settled Restricted Stock Units. Also referred to as market stock units, or MSUs, these are awards to eligible

key associates that are converted into between zero and two shares of common stock for each unit granted at the end

of a three-year vesting period. The conversion ratio is calculated by dividing the average closing price of our stock

during the final forty trading days of the three-year vesting period by our stock price on the grant date, with the

resulting quotient capped at two. This quotient is then multiplied by the number of MSUs granted to yield the

number of shares awarded. MSUs are subject to forfeiture and do not have voting rights.

Restricted Stock. Restricted stock awards are awards of our common stock that are subject to specified restrictions

and a risk of forfeiture. The restrictions typically lapse three years from the grant date. Participants holding

restricted stock are entitled to vote on matters submitted to holders of our common stock for a vote. No restricted

stock awards have been granted since fiscal 2009.

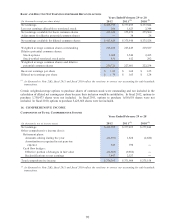

(C) Share-Based Compensation

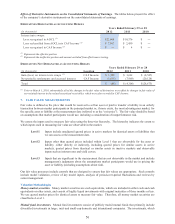

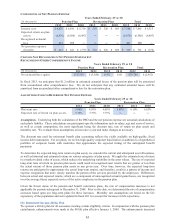

COMPOSITION OF SHARE-BASED COMPENSATION EXPENSE

(In thousands)

Cost of sales 1,845$ 2,081$ 2,103$

CarM ax A uto Finance income 1,867 1,603 1,334

Selling, general and administrative expenses 45,392 40,996 35,407

Share-based compensation expense, before income taxes 49,104$ 44,680$ 38,844$

Ye ar s Ende d Fe br uar y 2 9 or 2 8

2012 2011 2010

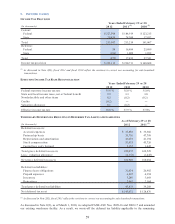

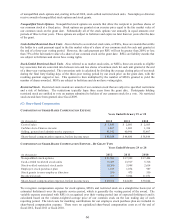

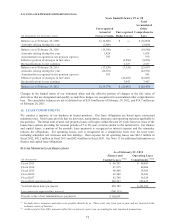

COMPOSITION OF SHARE-BASED COMPENSATION EXPENSE – BY GRANT TYPE

(In thousands)

Nonqualified stock options 21,581$ 17,302$ 17,404$

Cash-settled restricted stock units 15,435 13,917 5,718

Stock-s ettled res tricted s tock units 10,360 5,948 2,614

Employee stock purchase plan 1,015 1,074 987

Stock grants to non-employee directors 550 475 550

Restricted stock 163 5,964 11,571

Share-based compensation expense, before income taxes 49,104$ 44,680$ 38,844$

Ye ar s En de d Fe br uar y 2 9 or 2 8

2012 2011 2010

We recognize compensation expense for stock options, MSUs and restricted stock on a straight-line basis (net of

estimated forfeitures) over the requisite service period, which is generally the vesting period of the award. The

variable expense associated with RSUs is recognized over their vesting period (net of expected forfeitures) and is

calculated based on the volume-weighted average price of our common stock on the last trading day of each

reporting period. The total costs for matching contributions for our employee stock purchase plan are included in

share-based compensation expense. There were no capitalized share-based compensation costs as of the end of

fiscal 2012, fiscal 2011 or fiscal 2010.