CarMax 2012 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2012 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1 CarMax 2012

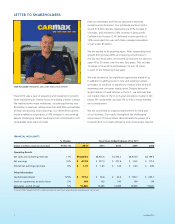

Fiscal 2012 was a year of preparing and investing for growth,

while maintaining an intense focus on building a better CarMax.

We reached some major milestones, including achieving over

$10 billion in revenues, selling more than 400,000 used vehicles

at retail and posting record earnings. Our diversified business

model enabled us to produce a 10% increase in net earnings

despite challenging market conditions that contributed to soft

comparable store used unit sales.

Both our wholesale and finance operations delivered

exceptional performance. Our wholesale auctions sold a

record 316,000 vehicles, representing a 20% increase in

unit sales, and achieved a 26% increase in gross profit.

CarMax Auto Finance (CAF) delivered income growth of

19% and ended the year with total managed receivables

of just under $5 billion.

We are excited to be growing again. After suspending store

growth during fiscal 2009, and opening only 8 stores in

the last two fiscal years, we recently announced our plans to

open 40 to 55 stores over the next four years. This includes

10 stores in fiscal 2013 and between 10 and 15 stores

in each of the following three years.

We look forward to the significant opportunity ahead of us.

In addition to adding stores in new and existing markets,

we expect to continue to expand our market share as brand

awareness and consumer loyalty grow. Despite being the

largest retailer of used vehicles in the U.S., we estimate that

our market share of the 0- to 6-year old vehicle market is still

below 3% nationwide, and just 5% to 6% in those markets

we currently serve.

We are committed to ongoing improvement in every part

of our business. Our results throughout the challenging

environment of the recession demonstrated the power of a

focused effort to increase efficiency and continuously improve

LETTER TO SHAREHOLDERS

TOM FOLLIARD PRESIDENT AND CHIEF EXECUTIVE OFFICER

FINANCIAL HIGHLIGHTS

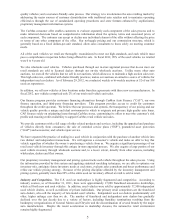

% Change Fiscal Years Ended February 29 or 28

(1)

(Dollars in millions except per share data) ’11 to ’12 2012 2011 2010 2009 2008

Operating Results

Net sales and operating revenues 11% $10,003.6 $8,975.6 $7,470.2 $6,974.0 $8,199.6

Net earnings 10% $ 413.8 $ 377.5 $ 277.8 $ 55.2 $ 177.5

Diluted net earnings per share 8% $ 1.79 $ 1.65 $ 1.24 $ 0.25 $ 0.80

Other Information

Capital expenditures 125% $ 172.6 $ 76.6 $ 22.4 $ 185.7 $ 253.1

Used car superstores, at end of year 5% 108 103 100 100 89

Associates, at end of year 6% 16,460 15,565 13,439 13,035 15,637

(1) Fiscal 2008 through fiscal 2011 reflect revisions to correct our accounting for sale–leaseback transactions.