CarMax 2012 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2012 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

43

1. BUSINESS AND BACKGROUND

CarMax, Inc. (“we”, “our”, “us”, “CarMax” and “the company”), including its wholly owned subsidiaries, is the

largest retailer of used vehicles in the United States. We were the first used vehicle retailer to offer a large selection

of high quality used vehicles at competitively low, no-haggle prices using a customer-friendly sales process in an

attractive, modern sales facility. At select locations we also sell new vehicles under various franchise agreements.

We provide customers with a full range of related products and services, including the appraisal and purchase of

vehicles directly from consumers; the financing of vehicle purchases through CarMax Auto Finance (“CAF”), our

own finance operation, and third-party financing providers; the sale of extended service plans (“ESP”), guaranteed

asset protection (“GAP”) and accessories; and vehicle repair service. Vehicles purchased through the appraisal

process that do not meet our retail standards are sold to licensed dealers through on-site wholesale auctions.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(A) Basis of Presentation and Use of Estimates

The consolidated financial statements include the accounts of CarMax and our wholly owned subsidiaries. All

significant intercompany balances and transactions have been eliminated in consolidation. The preparation of

financial statements in conformity with U.S. generally accepted accounting principles (“GAAP”) requires

management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and

expenses and the disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

Amounts and percentages may not total due to rounding.

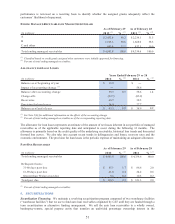

(B) Cash and Cash Equivalents

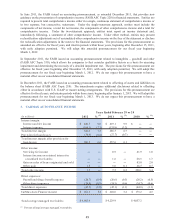

Cash equivalents of $429.3 million as of February 29, 2012, and $23.9 million as of February 28, 2011, consisted of

highly liquid investments with original maturities of three months or less.

(C) Restricted Cash from Collections on Auto Loan Receivables

Cash accounts totaling $204.3 million as of February 29, 2012, and $161.1 million as of February 28, 2011,

consisted of collections of principal and interest payments on securitized auto loan receivables that are restricted for

payment to the securitization investors pursuant to the applicable securitization agreements.

(D) Accounts Receivable, Net

Accounts receivable, net of an allowance for doubtful accounts, includes certain amounts due from third-party

finance companies and customers and other miscellaneous receivables. The allowance for doubtful accounts is

estimated based on historical experience and trends.

(E) Securitizations

As of March 1, 2010, we adopted Financial Accounting Standards Board (“FASB”) Accounting Standards Update

(“ASU”) Nos. 2009-16 and 2009-17 (formerly Statements of Financial Accounting Standards Nos. 166 and 167,

respectively) on a prospective basis. Pursuant to these pronouncements, we recognize transfers of auto loan

receivables into term securitizations as secured borrowings, which results in recording the auto loan receivables and

the related non-recourse notes payable to the investors on our consolidated balance sheets. All transfers of

receivables into our warehouse facilities on or after March 1, 2010, are also accounted for as secured borrowings.

As of March 1, 2010, we amended our warehouse facility agreement in effect as of that date. As a result, auto loan

receivables previously securitized through that warehouse facility no longer qualify for sale treatment because,

under the amendment, CarMax now has effective control over the receivables. The receivables that were funded in

the warehouse facility at that date were consolidated, at their fair value, along with the related non-recourse notes

payable to the investors.

Beginning in fiscal 2011, CAF income no longer includes a gain on the sale of loans through securitization

transactions, but instead primarily reflects the interest and certain other income associated with the auto loan

receivables less the interest expense associated with the debt issued to fund these receivables, direct CAF expenses

and a provision for estimated loan losses. See Notes 3 and 5 for additional information on securitizations.

(F) Fair Value of Financial Instruments

Due to the short-term nature and/or variable rates associated with these financial instruments, the carrying value of

our cash and cash equivalents, accounts receivable, restricted cash and investments, accounts payable, short-term

debt and long-term debt approximates fair value. Our derivative instruments are recorded at fair value. Auto loan