CarMax 2012 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2012 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

receivables are presented net of an allowance for estimated loan losses. See Note 7 for additional information on

fair value measurements.

(G) Inventory

Inventory is primarily comprised of vehicles held for sale or currently undergoing reconditioning and is stated at the

lower of cost or market. Vehicle inventory cost is determined by specific identification. Parts and labor used to

recondition vehicles, as well as transportation and other incremental expenses associated with acquiring and

reconditioning vehicles, are included in inventory. Certain manufacturer incentives and rebates for new car

inventory, including holdbacks, are recognized as a reduction to new car inventory when we purchase the vehicles.

(H) Auto Loan Receivables, Net

Auto loan receivables include amounts due from customers primarily related to used retail vehicle sales financed

through CAF and are presented net of an allowance for estimated loan losses. The allowance for loan losses

represents an estimate of the amount of net losses inherent in our portfolio of managed receivables as of the

applicable reporting date and anticipated to occur during the following 12 months. The allowance is primarily based

on the credit quality of the underlying receivables, historical loss trends and forecasted forward loss curves. We also

take into account recent trends in delinquencies and losses, recovery rates and the economic environment. The

provision for loan losses is the periodic expense of maintaining an adequate allowance.

An account is considered delinquent when the related customer fails to make a substantial portion of a scheduled

payment on or before the due date. In general, accounts are charged-off on the last business day of the month during

which the earliest of the following occurs: the receivable is 120 days or more delinquent as of the last business day

of the month, the related vehicle is repossessed and liquidated or the receivable is otherwise deemed uncollectible.

For purposes of determining impairment, auto loans are evaluated collectively, as they represent a large group of

smaller-balance homogeneous loans, and therefore, are not individually evaluated for impairment. See Note 4 for

additional information on auto loan receivables.

Interest income and expenses related to auto loans are included in CAF income. Interest income on auto loan

receivables is recognized when earned based on contractual loan terms. All loans continue to accrue interest until

repayment or charge-off. Direct costs associated with loan originations are not considered material. See Note 3 for

a summary of CAF income.

(I) Property and Equipment

Property and equipment is stated at cost less accumulated depreciation and amortization. Depreciation and

amortization are calculated using the straight-line method over the shorter of the asset's estimated useful life or the

lease term, if applicable. Property held under capital lease is stated at the lesser of the present value of the future

minimum lease payments at the inception of the lease or fair value. Amortization of capital lease assets is computed

on a straight-line basis over the shorter of the initial lease term or the estimated useful life of the asset and is

included in depreciation expense. Costs incurred during new store construction are capitalized as construction-in-

progress and reclassified to the appropriate fixed asset categories when the store is completed.

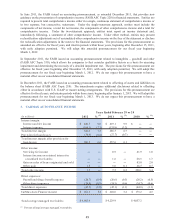

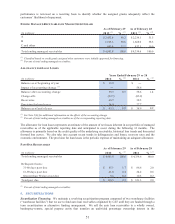

ESTIMATED USEFUL LIVES

Build ing s

Cap ital leas e

Leasehold improvements

Furniture, fixtures and equipment

Life

25 years

20 years

8 – 15 years

3 – 15 years

We review long-lived assets for impairment when circumstances indicate the carrying amount of an asset may not be

recoverable. We recognize impairment when the sum of undiscounted estimated future cash flows expected to result

from the use of the asset is less than the carrying value of the asset. We recognized impairments of $0.2 million in

fiscal 2012 and $2.1 million in fiscal 2010 related to assets within land held for sale. No impairment of long-lived

assets resulted from our impairment tests in fiscal 2011.

(J) Other Assets

Computer Software Costs. We capitalize external direct costs of materials and services used in, and payroll and

related costs for employees directly involved in the development of, internal-use software. We amortize amounts

capitalized on a straight-line basis over five years.