CarMax 2012 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2012 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

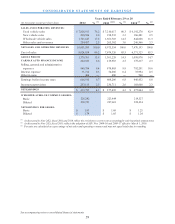

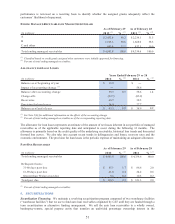

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

See accompanying notes to consolidated financial statements.

42

(In thousands)

BALANCE AS O F FEBRUARY 28, 2009 (previous) 220,392 110,196$ 685,938$ 813,793$ (16,860)$ 1,593,067$

Cumulative effect of revision of

prior years (1) ʊ ʊ ʊ (45,174) ʊ (45,174)

BALANCE AS O F FEBRUARY 28, 2009 (revised) 220,392 110,196 685,938 768,619 (16,860) 1,547,893

Comprehensive income:

Net earnings ʊ ʊ ʊ 277,844 ʊ 277,844

Retirement benefit plans,

net of taxes of $1,556 ʊ ʊ ʊ ʊ (2,686) (2,686)

To tal comp reh en s iv e in co me 275,158

Share-based compensation expense ʊ ʊ 31,589 ʊ ʊ 31,589

Exercise of common stock options 3,086 1,543 33,680 ʊ ʊ 35,223

Shares issued under stock

in c en tiv e p lans 45 23 542 ʊ ʊ 565

Shares cancelled upon reacquisition (457) (229) (3,687) ʊ ʊ (3,916)

Tax effect from the exercise of

common stock options ʊ ʊ (1,928) ʊ ʊ (1,928)

BALANCE AS O F FEBRUARY 28, 2010 223,066 111,533 746,134 1,046,463 (19,546) 1,884,584

Impact of accounting change (2) ʊ ʊ ʊ (93,234) ʊ (93,234)

Comprehensive income:

Net earnings ʊ ʊ ʊ 377,495 ʊ 377,495

Retirement benefit plans,

net of taxes of $1,215 ʊ ʊ ʊ ʊ 2,017 2,017

Cash flow hedges,

net of taxes of $398 ʊ ʊ ʊ ʊ (7,528) (7,528)

To tal comp reh en s iv e in co me 371,984

Share-based compensation expense ʊ ʊ 29,214 ʊ ʊ 29,214

Exercise of common stock options 3,126 1,563 44,067 ʊ ʊ 45,630

Shares issued under stock

in c en tiv e p lans 33 17 458 ʊ ʊ 475

Shares cancelled upon reacquisition (339) (170) (7,183) ʊ ʊ (7,353)

Tax effect from the exercise of

common stock options ʊ ʊ 7,949 ʊ ʊ 7,949

BALANCE AS O F FEBRUARY 28, 2011 225,886 112,943 820,639 1,330,724 (25,057) 2,239,249

Comprehensive income:

Net earnings ʊ ʊ ʊ 413,795 ʊ 413,795

Retirement benefit plans,

net of taxes of $13,080 ʊ ʊ ʊ ʊ (22,246) (22,246)

Cash flow hedges,

net of taxes of $244 ʊ ʊ ʊ ʊ (15,156) (15,156)

To tal comp reh en s iv e in co me 376,393

Share-based compensation expense ʊ ʊ 32,105 ʊ ʊ 32,105

Exercise of common stock options 1,519 759 24,494 ʊ ʊ 25,253

Shares issued under stock

in c en tiv e p lans 20 10 540 ʊ ʊ 550

Shares cancelled upon reacquisition (306) (153) (9,523) ʊ ʊ (9,676)

Tax effect from the exercise of

common stock options ʊ ʊ 9,238 ʊ ʊ 9,238

BALANCE AS O F FEBRUARY 29, 2012 227,119 113,559$ 877,493$ 1,744,519$ (62,459)$ 2,673,112$

Total (1)

Accumulate d

Common Capital in Other

Shares Common Excess of Retained Comprehensive

O utstanding S tock Par Value Earnings (1) Loss

(1) As discussed in Note 2(K), this reflects the revisions to correct our accounting for sale-leaseback transactions.

(2) As discussed in Note 2(E), this reflects the adoption of ASU Nos. 2009-16 and 2009-17 effective March 1, 2010.