CarMax 2012 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2012 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.65

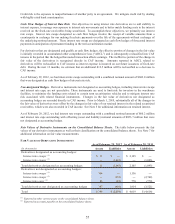

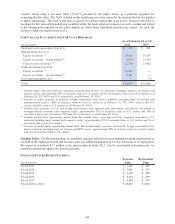

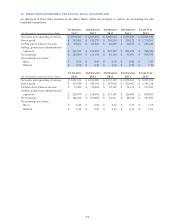

Finance and Capital Lease Obligations. Finance and capital lease obligations primarily relate to superstores

subject to sale-leaseback transactions. The leases were structured at varying interest rates with initial lease terms

ranging from 15 to 20 years with payments made monthly. Payments on the leases are recognized as interest

expense and a reduction of the obligations. In conjunction with certain of the sale-leaseback transactions, we must

meet financial covenants relating to minimum tangible net worth and minimum coverage of rent expense. We were

in compliance with all such covenants as of February 29, 2012. We have not entered into any sale-leaseback

transactions since fiscal 2009. See Note 15 for additional information on future minimum lease obligations.

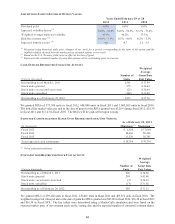

Non-Recourse Notes Payable. The timing of principal payments on the non-recourse notes payable is based on

principal collections, net of losses, on the securitized auto loan receivables. The non-recourse notes payable accrue

interest at fixed rates and mature between June 2012 and August 2018, but may mature earlier or later, depending

upon the repayment rate of the underlying auto loan receivables. As of February 29, 2012, $4.68 billion of non-

recourse notes payable was outstanding. The outstanding balance included $174.3 million classified as current

portion of non-recourse notes payable, as this represents principal payments that have been collected, but will be

distributed in the following period.

During the fourth quarter of fiscal 2012, we renewed our $800 million warehouse facility that was scheduled to

expire in February 2012 for an additional 364-day term. As of February 29, 2012, the combined warehouse facility

limit was $1.6 billion. As of that date, $553.0 million of auto loan receivables was funded in the warehouse

facilities and unused warehouse capacity totaled $1.05 billion. Of the combined warehouse facility limit, $800

million will expire in August 2012 and $800 million will expire in February 2013.

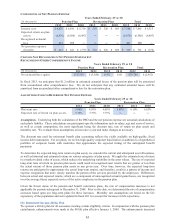

The return requirements of investors in the bank conduits could fluctuate significantly depending on market

conditions. At renewal, the cost, structure and capacity of the facilities could change. These changes could have a

significant impact on our funding costs. See Notes 4 and 5 for additional information on the related securitized auto

loan receivables.

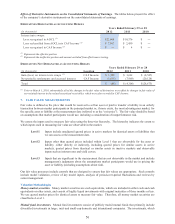

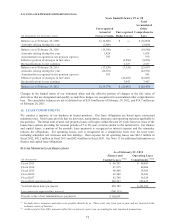

12. STOCK AND STOCK-BASED INCENTIVE PLANS

(A) Shareholder Rights Plan and Undesignated Preferred Stock

In conjunction with our shareholder rights plan, shareholders received preferred stock purchase rights as a dividend

at the rate of one right for each share of CarMax, Inc. common stock owned. The rights are exercisable only upon

the attainment of, or the commencement of a tender offer to attain, a 15% or greater ownership interest in the

company by a person or group. When exercisable, and as adjusted for our March 2007 2-for-1 stock split, each right

would entitle the holder to buy one half of one one-thousandth of a share of Cumulative Participating Preferred

Stock, Series A, $20 par value, at an exercise price of $140 per share, subject to adjustment. A total of 300,000

shares of such preferred stock, which has preferential dividend and liquidation rights, have been authorized and

designated. No such shares are outstanding. In the event that an acquiring person or group acquires the specified

ownership percentage of CarMax, Inc. common stock (except pursuant to a cash tender offer for all outstanding

shares determined to be fair by the board of directors) or engages in certain transactions with the company after the

rights become exercisable, each right will be converted into a right to purchase, for half the current market price at

that time, shares of CarMax, Inc. common stock valued at two times the exercise price. We also have an additional

19,700,000 authorized shares of undesignated preferred stock of which no shares are outstanding. Our shareholder

rights plan will expire by its terms on May 21, 2012.

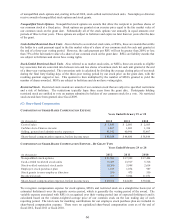

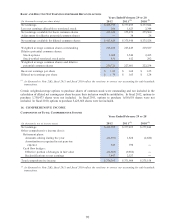

(B) Stock Incentive Plans

We maintain long-term incentive plans for management, key employees and the nonemployee members of our board

of directors. The plans allow for the granting of equity-based compensation awards, including nonqualified stock

options, incentive stock options, stock appreciation rights, restricted stock awards, stock- and cash-settled restricted

stock units, stock grants or a combination of awards. To date, we have not awarded any incentive stock options.

As of February 29, 2012, a total of 39,200,000 shares of our common stock have been authorized to be issued under

the long-term incentive plans. The number of unissued common shares reserved for future grants under the long-

term incentive plans was 4,160,641 as of February 29, 2012.

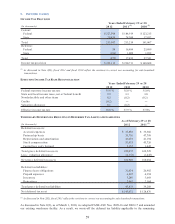

Prior to fiscal 2007, the majority of associates who received share-based compensation awards primarily received

nonqualified stock options. From fiscal 2007 through fiscal 2009, these associates primarily received restricted

stock instead of stock options, and beginning in fiscal 2010, these associates primarily received cash-settled

restricted stock units instead of restricted stock awards. Senior management and other key associates receive awards