CarMax 2012 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2012 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

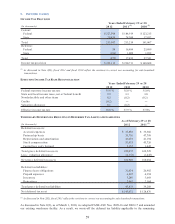

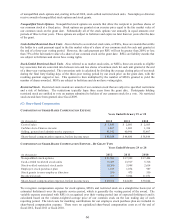

9. INCOME TAXES

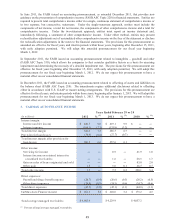

INCOME TAX PROVISION

(In thousands)

Current:

Federal 223,548$ 184,919$ 123,215$

State 30,439 28,300 17,852

Total 253,987 213,219 141,067

Deferred:

Federal 54 16,484 25,689

State (926) 1,009 1,852

Total (872) 17,493 27,541

Income tax provision 253,115$ 230,711$ 168,608$

Years Ended February 29 or 28

2012 2011 (1) 2010 (1)

(1) As discussed in Note 2(K), fiscal 2011 and fiscal 2010 reflect the revisions to correct our accounting for sale-leaseback

transactions.

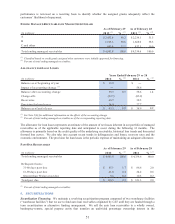

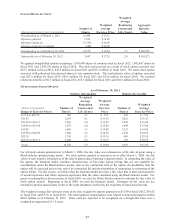

EFFECTIVE INCOME TAX RATE RECONCILIATION

Federal statutory income tax rate 35.0 % 35.0 % 35.0%

State and local income taxes, net of federal benefit 2.9 3.3 3.0

Nondeductible and other items 0.2 (0.2) (0.2)

Credits (0.2) ʊʊ

Valuation allowance 0.1 (0.2) ʊ

Effective income tax rate 38.0 % 37.9 % 37.8%

2012 2011 2010

Ye ar s Ende d Fe bruar y 2 9 or 2 8

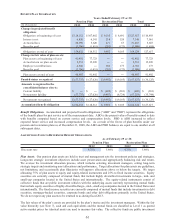

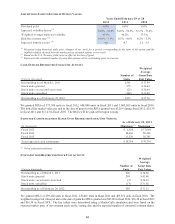

TEMPORARY DIFFERENCES RESULTING IN DEFERRED TAX ASSETS AND LIABILITIES

(In thousands)

Deferred tax as s ets:

Accrued expenses 33,888$ 33,366$

Partnership basis 55,710 47,798

Depreciation and amortization 43,672 41,194

Stock compensation 53,635 45,726

Capital loss carry forward 2,152 1,445

Total gross deferred tax assets 189,057 169,529

Less : valuation allowance (2,152) (1,445)

Net gros s deferred tax as sets 186,905 168,084

Deferred tax liabilities :

Finance lease obligations 31,634 26,982

Prepaid expenses 6,892 6,394

Inventory 3,240 3,668

Derivatives 2,067 2,164

Total gro s s deferred tax liab ilities 43,833 39,208

Net deferred tax asset 143,072$ 128,876$

As of February 29 or 28

2012 2011 (1)

(1) As discussed in Note 2(K), fiscal 2011 reflects the revisions to correct our accounting for sale-leaseback transactions.

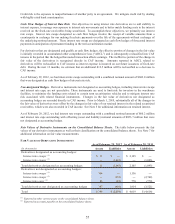

As discussed in Note 2(E), as of March 1, 2010, we adopted FASB ASU Nos. 2009-16 and 2009-17 and amended

our existing warehouse facility. As a result, we wrote-off the deferred tax liability applicable to the remaining