CarMax 2012 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2012 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

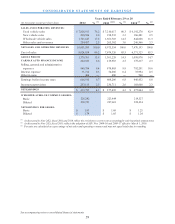

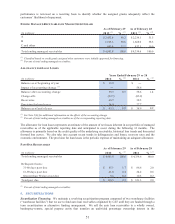

(In thousands except per share data)

Selling, general and administrative expens es 818,691$ (26,490)$ 792,201$

Interest expense 3,460$ 32,534$ 35,994$

Earnings before income taxes 452,496$ (6,044)$ 446,452$

Income tax provision 170,828$ (2,220)$ 168,608$

Net earnings 281,668$ (3,824)$ 277,844$

Net Earnings Per Share:

Bas ic 1.27$ (0.02)$ 1.25$

Diluted 1.26$ (0.02)$ 1.24$

Ye ar Ende d Fe br uar y 2 8 , 2 0 1 0

Reported

Previously

Adjustments Revised

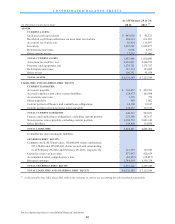

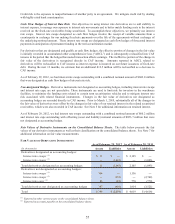

CONSOLIDATED BALANCE SHEET

(In thousands)

Property and equipment, net 920,045$ 255,272$ 1,175,317$

Deferred income taxes 92,278$ 31,407$ 123,685$

Other as sets 96,913$ (1,039)$ 95,874$

Accrued expenses and other current liabilities 103,389$ 2,609$ 105,998$

Current portion of long-term debt 772$ (772)$ ʊ$

Current portion of finance and capital lease obligations ʊ$ 12,617$ 12,617$

Long-term debt, excluding current portion 28,350$ (28,350)$ ʊ$

Finance and capital lease obligations, excluding current

portion ʊ$ 367,617$ 367,617$

Other liabilities 130,570$ (15,700)$ 114,870$

Retained earnings 1,383,105$ (52,381)$ 1,330,724$

Reported Adjustments Revised

As of February 28, 2011

Previously

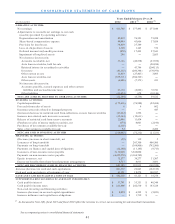

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

Net cas h us ed in operating activities (17,198)$ 10,440$ (6,758)$

Net cash provided by financing activities 112,253$ (10,440)$ 101,813$

Increase in cash and cash equivalents 22,843$ ʊ$ 22,843$

Previously

Reported Adjustments Revised

Ye ar Ende d Fe bruar y 2 8 , 2 0 1 1

(In thousands)

Net cash provided by operating activities 50,290$ 9,232$ 59,522$

Net cas h us ed in financing activities (151,288)$ (9,232)$ (160,520)$

Decreas e in cas h and cas h equivalents (122,319)$ ʊ$ (122,319)$

Previously

Reported Adjustments Revised

Ye ar Ende d Fe br uar y 2 8 , 2 0 1 0

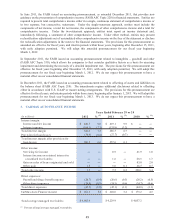

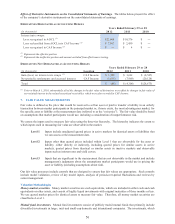

(L) Other Accrued Expenses

As of February 29, 2012 and February 28, 2011, accrued expenses and other current liabilities included accrued

compensation and benefits of $87.9 million and $65.9 million, respectively, and loss reserves for general liability

and workers’ compensation insurance of $23.0 million and $21.6 million, respectively.

(M) Defined Benefit Plan Obligations

The recognized funded status of defined benefit retirement plan obligations is included both in accrued expenses and

other current liabilities and in other liabilities. The current portion represents benefits expected to be paid from our

benefit restoration plan over the next 12 months. The defined benefit retirement plan obligations are determined by

independent actuaries using a number of assumptions provided by CarMax. Key assumptions used in measuring the

plan obligations include the discount rate, rate of return on plan assets and mortality rate.