CarMax 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT FISCAL YEAR 2012

Table of contents

-

Page 1

ANNUAL REPORT FISCAL YEAR 2012 -

Page 2

... challenging market conditions that contributed to soft comparable store used unit sales. FINANCIAL HIGHLIGHTS % Change (Dollars in millions except per share data) Fiscal Years Ended February 29 or 28 (1) 2012 2011 2010 2009 2008 '11 to '12 Operating Results Net sales and operating revenues Net... -

Page 3

...experience. For most CarMax customers, this means visiting www.carmax.com. Every year we make signiï¬cant steps forward in improving the usability and expanding the content on our website. As a result, we currently estimate that more than 70% of customers who buy a vehicle from us visit our website... -

Page 4

... more of the car-buying process online, before coming to the store. This includes holding or transferring a vehicle, making an appointment, ï¬lling out necessary paperwork and applying for credit. We have already received positive feedback from customers in the test stores who have used some or all... -

Page 5

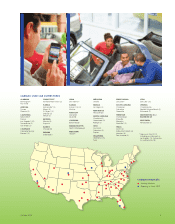

... Columbus (2) Dayton OKLAHOMA Austin (2) Dallas / Fort Worth (4) Houston (4) San Antonio (2) Oklahoma City Tulsa *Opening in fiscal 2013 (including one store each in Los Angeles, CA, Jacksonville, FL, and Nashville, TN) CARMAX MARKETS Existing Markets Opening in Fiscal 2013 CarMax 2012 4 -

Page 6

... of Building a Better CarMax. Our associates are the key to our future. One of the primary reasons I am so proud to work at CarMax is because I believe we have the most dedicated and hard-working associates. They are the reason we can offer the best customer service and the highest quality vehicles... -

Page 7

... (Address of principal executive offices) 23238 (Zip Code) Registrant's telephone number, including area code: (804) 747-0422 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock, par value $0.50 Rights to Purchase... -

Page 8

...of the Act). Yes Â... No _ The aggregate market value of the registrant's common stock held by non-affiliates as of August 31, 2011, computed by reference to the closing price of the registrant's common stock on the New York Stock Exchange on that date, was $6.36 billion. On March 31, 2012, there were... -

Page 9

...Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Certain Relationships and Related Transactions and Director Independence Principal Accountant Fees and Services PART IV Item 15. Exhibits and Financial Statement... -

Page 10

... wholesale vehicle auction operators, based on the 316,649 wholesale vehicles we sold through our on-site auctions in fiscal 2012. We were the first used vehicle retailer to offer a large selection of high quality used vehicles at competitively low, "no-haggle" prices using a customer-friendly sales... -

Page 11

...our in-store appraisal process that do not meet our retail standards are sold to licensed dealers through our on-site wholesale auctions. Unlike many other auto auctions, we own all the vehicles that we sell in our auctions, which allows us to maintain a high auction sales rate. This high sales rate... -

Page 12

... sales and finance personnel may receive higher commissions for negotiating higher prices and interest rates or steering customers to vehicles with higher gross profits. In our wholesale auctions, we compete with other automotive auction houses. In contrast with the highly fragmented used vehicle... -

Page 13

... used vehicle inventory directly from consumers through our in-store appraisal process and our car-buying centers, as well as, through other sources, including local, regional and online auctions, wholesalers, franchised and independent dealers and fleet owners, such as leasing companies and rental... -

Page 14

... on carmax.com and on applicable online classified sites on which they are listed. We extend our no-haggle philosophy to every component of the vehicle transaction, including vehicle appraisal offers, financing rates, accessories, and ESP and GAP pricing. Reconditioning and Service. An integral part... -

Page 15

... randomly test different credit offers and closely monitor acceptance rates and 3-day payoffs to assess market competitiveness. After the effect of 3-day payoffs and vehicle returns, CAF financed 37% of our retail vehicle unit sales in fiscal 2012. As of February 29, 2012, CAF serviced approximately... -

Page 16

... under the supervision of experienced buyers, and they generally will assist with the appraisal of more than 1,000 cars before making their first independent purchase. Business office associates undergo a 3- to 6-month, four-phase on-the-job certification process in order to be fully cross... -

Page 17

... "Corporate Governance" link on our investor information home page at investor.carmax.com, as soon as reasonably practicable after filing or furnishing the material to the Securities and Exchange Commission (the "SEC"): annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on... -

Page 18

... of operations. Competition. Automotive retailing and wholesaling is a highly competitive business. Our competition includes publicly and privately owned new and used car dealers, as well as millions of private individuals. Competitors buy and sell the same or similar makes of vehicles that we offer... -

Page 19

... on our sales and results of operations. Reputation. Our reputation as a company that is founded on the fundamental principle of integrity is critical to our success. Our reputation as a retailer offering high-quality vehicles at competitive, no-haggle prices with a customerfriendly sales process in... -

Page 20

... recalls could also adversely affect used vehicle sales or valuations and could expose us to litigation and adverse publicity related to the sale of a recalled vehicle, which could have a material adverse effect on our business, sales and results of operations. Weather. The occurrence of severe... -

Page 21

..., 2012, we leased 58 of our 108 used car superstores, our new car store and our CAF office building in Atlanta, Georgia. We owned the remaining 50 stores currently in operation. We also owned our home office building in Richmond, Virginia, and land associated with planned future store openings. 15 -

Page 22

... in 1993, we have grown organically, through the construction and opening of company-operated stores. We do not franchise our operations. As of February 29, 2012, we operated 108 used car superstores in 53 U.S. markets, which represented approximately 50% of the U.S. population. We believe that... -

Page 23

... for geographic expansion, as well as to maintain maximum financial flexibility and liquidity for our business. Therefore, we do not anticipate paying any cash dividends in the foreseeable future. During the fourth quarter of fiscal 2012, we sold no CarMax equity securities that were not registered... -

Page 24

COMPARISON OF CUMULATIVE FIVE YEAR TOTAL RETURN $150 $130 $110 $90 $70 $50 $30 2007 2008 CarMax Inc 2009 S&P 500 Index 2010 2011 S&P 500 Retailing Index 2012 CarM ax S&P 500 Index S&P 500 Retailing Index 2007 $ 100.00 $ 100.00 $ 100.00 2008 $ 69.68 $ 96.41 $ 75.93 As of February 29 or 28 ... -

Page 25

...units sold Wholesale vehicle units sold Percent changes in Comp arable store used vehicle unit sales T otal used vehicle unit sales Wholesale vehicle unit sales Net sales and op erating revenues Net earnings Diluted net earnings p er share O ther year-end information Used car sup erstores Associates... -

Page 26

...We generate revenues, income and cash flows primarily by retailing used vehicles and associated items including vehicle financing, extended service plans ("ESPs"), a guaranteed asset protection ("GAP") product and vehicle repair service. GAP is designed to cover the unpaid balance on an auto loan in... -

Page 27

... randomly test different credit offers and closely monitor acceptance rates and 3-day payoffs to assess market competitiveness. After the effect of 3-day payoffs and vehicle returns, CAF financed 37% of our retail vehicle unit sales in fiscal 2012. As of February 29, 2012, CAF serviced approximately... -

Page 28

... reflecting the leverage associated with the increases in used and wholesale vehicle sales, and average selling prices. Net cash used in operating activities totaled $62.2 million in fiscal 2012 compared with $6.8 million in fiscal 2011. These amounts included increases in auto loan receivables of... -

Page 29

... customers who purchase a vehicle. Because we are not the primary obligor under these plans, we recognize commission revenue at the time of sale, net of a reserve for returns. The reserve for cancellations is recorded based on historical experience and trends, and results could be affected if future... -

Page 30

... operation. COMPARABLE STORE RETAIL VEHICLE SALES CHANGES Years Ended February 29 or 28 2012 2011 2010 Vehicle units : Us ed vehicles New vehicles Total Vehicle dollars : Us ed vehicles New vehicles Total 1% 1% 1% 7% 9% 7% 10% 5% 10% 15% 7% 15% 1% (29)% 0% 6% (29)% 5% CHANGE IN USED CAR SUPERSTORE... -

Page 31

...buy rate. Our appraisal traffic benefited from the increase in customer traffic in our stores and from the lift in new car industry sales and related used vehicle trade-in activity in fiscal 2011. We believe the strong wholesale pricing environment and the resulting increases in our appraisal offers... -

Page 32

... Sales and Revenues Other sales and revenues include commissions on the sale of ESPs and GAP (reported in ESP revenues), service department sales and net third-party finance fees. For providers who pay us a fixed fee per vehicle financed, this fee varies, reflecting the differing levels of credit... -

Page 33

... directly from consumers through our appraisal process and changes in the wholesale pricing environment. Over the past several years, we have continued to refine our car-buying strategies, which we believe has benefited used vehicle gross profit per unit. Fiscal 2012 Versus Fiscal 2011. Used vehicle... -

Page 34

... decline in new car industry sales and the associated slow down in used vehicle trade-in activity, compared with pre-recession periods. The higher wholesale values increased both our vehicle acquisition costs and our average selling prices for used and wholesale vehicles. In fiscal 2012, we also... -

Page 35

... units financed Penetration rate ( 2 ) W eighted average contract rate W eighted average term (in months ) (1) (2) All information relates to loans originated net of 3-day payoffs and vehicle returns. Vehicle units financed as a percentage of total retail units sold. Fiscal 2012 Versus Fiscal 2011... -

Page 36

... are generally charged higher rates of interest. See Note 4 for additional information on the credit quality of auto loan receivables. Interest expense declined $27.7 million, despite the growth in managed receivables. The decline reflected the effects of the amortization of older, higher-cost term... -

Page 37

... rate represents the average percentage of the outstanding principal balance we receive when a vehicle is repossessed and liquidated at wholesale auction. The annual recovery rate has ranged from a low of 42% to a high of 60%, and it is primarily affected by changes in the wholesale market pricing... -

Page 38

... reflecting the leverage associated with the increases in retail and wholesale unit sales and average selling prices. Income Taxes The effective income tax rate was 38.0% in fiscal 2012, 37.9% in fiscal 2011 and 37.8% in fiscal 2010. FISCAL 2013 PLANNED SUPERSTORE OPENINGS Location Lancas ter, Penns... -

Page 39

... facility agreement represent non-cash transactions, and thus the reported cash flow information for fiscal 2011 takes into account the effect of these and other related reclassifications and adjustments. See Note 2(E) for additional information on the effects of the accounting change. Operating... -

Page 40

... notes payable and the related cash flows were not reported in the consolidated financial statements prior to fiscal 2011. Net cash provided by financing activities in fiscal 2011 also included a $121.5 million net reduction in borrowings under the revolving credit facility. In fiscal 2010, net cash... -

Page 41

... 2013. The securitization agreements related to the warehouse facilities include various financial covenants. As of February 29, 2012, we were in compliance with the financial covenants. See Notes 5 and 11 for additional information on the warehouse facilities. Finance and capital lease obligations... -

Page 42

... or expected cash payments principally related to the funding of our auto loan receivables. Disruptions in the credit markets could impact the effectiveness of our hedging strategies. Other receivables are financed with working capital. Generally, changes in interest rates associated with underlying... -

Page 43

... 2012. KPMG LLP, the company's independent registered public accounting firm, has issued a report on our internal control over financial reporting. Their report is included herein. THOMAS J. FOLLIARD PRESIDENT AND CHIEF EXECUTIVE OFFICER THOMAS W. REEDY EXECUTIVE VICE PRESIDENT AND CHIEF FINANCIAL... -

Page 44

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM The Board of Directors and Shareholders CarMax, Inc.: We have audited the accompanying consolidated balance sheets of CarMax, Inc. and subsidiaries (the Company) as of February 29, 2012 and February 28, 2011, and the related consolidated ... -

Page 45

... discussed in Note 2(E), fiscal 2011 reflects the adoption of ASU Nos. 2009-16 and 2009-17 effective March 1, 2010. Percents are calculated as a percentage of net sales and operating revenues and may not equal totals due to rounding. See accompanying notes to consolidated financial statements. 39 -

Page 46

CONSOLIDATED BALANCE SHEETS As of February 29 or 28 (In thousands except share data) AS S ETS C URRENT AS S ETS : 2012 2011 (1 ) Cas h and cas h equivalents Res tricted cas h from collections on auto loan receivables A ccounts receivable, net Inventory Deferred income taxes Other current as s ... -

Page 47

...e) in accru ed cap ital expen ditures Increas e in fin ance and cap ital leas e ob ligation s (1) As discussed in Note 2(K), fiscal 2011 and fiscal 2010 reflect the revisions to correct our accounting for sale-leaseback transactions. See accompanying notes to consolidated financial statements. 41 -

Page 48

... (1) (2) As discussed in Note 2(K), this reflects the revisions to correct our accounting for sale-leaseback transactions. As discussed in Note 2(E), this reflects the adoption of ASU Nos. 2009-16 and 2009-17 effective March 1, 2010. See accompanying notes to consolidated financial statements. 42 -

Page 49

...service. Vehicles purchased through the appraisal process that do not meet our retail standards are sold to licensed dealers through on-site wholesale auctions. 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (A) Basis of Presentation and Use of Estimates The consolidated financial statements include... -

Page 50

... as a reduction to new car inventory when we purchase the vehicles. (H) Auto Loan Receivables, Net Auto loan receivables include amounts due from customers primarily related to used retail vehicle sales financed through CAF and are presented net of an allowance for estimated loan losses. The... -

Page 51

... includes money market securities primarily associated with certain insurance programs and mutual funds held in a rabbi trust established in May 2011 to fund informally our executive deferred compensation plan. Due to the short-term nature and/or variable rates associated with these financial... -

Page 52

... portion of finance and capital leas e obligations Long-term debt, excluding current portion Finance and capital leas e obligations , excluding current portion Other liabilities Retained earnings CONSOLIDATED STATEMENTS OF CASH FLOWS Year Ended February 28, 2011 Previous ly Reported Adjus tments... -

Page 53

... revenue when the earnings process is complete, generally either at the time of sale to a customer or upon delivery to a customer. As part of our customer service strategy, we guarantee the retail vehicles we sell with a 5-day, money-back guarantee. If a customer returns the vehicle purchased... -

Page 54

... at fair value as either current assets or current liabilities on the consolidated balance sheets. Where applicable, such contracts covered by master netting agreements are reported net. Gross positive fair values are netted with gross negative fair values by counterparty. The accounting for changes... -

Page 55

... 1, 2012. In September 2011, the FASB issued an accounting pronouncement related to intangibles - goodwill and other (FASB ASC Topic 350), which allows for companies to first consider qualitative factors as a basis for assessing impairment and determining the necessity of a detailed impairment test... -

Page 56

...services, marketing, information systems, accounting, legal, treasury and executive payroll. 4. AUTO LOAN RECEIVABLES Auto loan receivables include amounts due from customers primarily related to used retail vehicle sales financed through CAF and are presented net of an allowance for estimated loan... -

Page 57

... los s es Balance as of end of year (1) (2) Balance after accounting change See Note 2(E) for additional information on the effects of the accounting change. Percent of total ending managed receivables as of the corresponding reporting date. The allowance for loan losses represents an estimate... -

Page 58

... As of February 29, 2012, and February 28, 2011, there was no retained interest, as all transfers of auto loan receivables were accounted for as secured borrowings. As part of the adoption of ASU Nos. 2009-16 and 2009-17, as of March 1, 2010, any retained interest related to term securitizations was... -

Page 59

... See Note 11 for additional information on our warehouse facilities. Fiscal 2010 Securitization Information Except as noted, the following disclosures apply to our securitization activities prior to March 1, 2010, when transfers of auto loan receivables were accounted for as sales. The fair value of... -

Page 60

...used to manage differences in the amount of our known or expected cash receipts and our known or expected cash payments principally related to the funding of our auto loan receivables. We do not anticipate significant market risk from derivatives as they are predominantly used to match funding costs... -

Page 61

... investors in the warehouse facilities, to minimize the funding costs related to certain term securitization vehicles and to mitigate interest rate risk associated with related financial instruments. Changes in the fair value of derivatives not designated as accounting hedges are recorded directly... -

Page 62

... management. Valuation Methodologies Money market securities. Money market securities are cash equivalents, which are included in either cash and cash equivalents or other assets, and consist of highly liquid investments with original maturities of three months or less. We use quoted market prices... -

Page 63

... 29, 2012, or February 28, 2011. Derivative Instruments. The fair values of our derivative instruments are included in either other current assets or accounts payable. As described in Note 6, as part of our risk management strategy, we utilize derivative instruments to manage differences in the... -

Page 64

... s ettlements , net Balance at end of year (1) (2) See Note 2(E) for additional information on the effects of the accounting change. Reported in CarMax Auto Finance income in the consolidated statements of earnings. 8. PROPERTY AND EQUIPMENT As of February 29 or 28 (1 ) 2012 2011 $ 232,274 $ 221... -

Page 65

... fiscal 2011 reflects the revisions to correct our accounting for sale-leaseback transactions. As discussed in Note 2(E), as of March 1, 2010, we adopted FASB ASU Nos. 2009-16 and 2009-17 and amended our existing warehouse facility. As a result, we wrote-off the deferred tax liability applicable to... -

Page 66

..., we do not expect the change to have a significant effect on our results of operations, financial condition or cash flows. As of February 28, 2011, we had $18.7 million of gross unrecognized tax benefits, $3.5 million of which, if recognized, would affect our effective tax rate. As of February 28... -

Page 67

... dates. ASSUMPTIONS USED TO DETERMINE BENEFIT OBLIGATIONS As of February 29 or 28 Pens ion Plan Res toration Plan 2012 2011 2012 2011 4.75% 5.80% 4.75% 5.80% Dis count rate Plan Assets. Our pension plan assets are held in trust and management sets the investment policies and strategies. Long-term... -

Page 68

... divided by the number of shares outstanding. The NAV's unit price is quoted on a private market that is not active. However, the NAV is based on the fair value of the underlying securities within the fund, which are traded on an active market and valued at the closing price reported on the active... -

Page 69

...these assumptions at least once a year and make changes as necessary. The discount rate used for retirement benefit plan accounting reflects the yields available on high-quality, fixed income debt instruments. For our plans, we review high quality corporate bond indices in addition to a hypothetical... -

Page 70

...Note 2(K), fiscal 2011 reflects the revisions to correct our accounting for sale-leaseback transactions. Revolving Credit Facility. During the second quarter of fiscal 2012, we entered into a new 5-year, $700 million unsecured revolving credit facility (the "credit facility") with various financial... -

Page 71

...any sale-leaseback transactions since fiscal 2009. See Note 15 for additional information on future minimum lease obligations. Non-Recourse Notes Payable. The timing of principal payments on the non-recourse notes payable is based on principal collections, net of losses, on the securitized auto loan... -

Page 72

... average price of our common stock on the last trading day of each reporting period. The total costs for matching contributions for our employee stock purchase plan are included in share-based compensation expense. There were no capitalized share-based compensation costs as of the end of fiscal 2012... -

Page 73

... actual future events or the value ultimately realized by the recipients of share-based awards. The weighted average fair value per share at the date of grant for options granted was $13.80 in fiscal 2012, $10.82 in fiscal 2011 and $5.30 in fiscal 2010. The unrecognized compensation costs related to... -

Page 74

...in fiscal 2010. The weighted average fair value per unit at the date of grant for MSUs granted was $45.48 in fiscal 2012, $36.28 in fiscal 2011 and $16.34 in fiscal 2010. The fair values were determined using a Monte-Carlo simulation and were based on the expected market price of our common stock on... -

Page 75

... purchased on the open market on behalf of associates totaled 260,927 during fiscal 2012, 301,195 during fiscal 2011 and 452,936 during fiscal 2010. The average price per share for purchases under the plan was $30.02 in fiscal 2012, $25.80 in fiscal 2011 and $16.71 in fiscal 2010. The total costs... -

Page 76

...25 1.24 As discussed in Note 2(K), fiscal 2011 and fiscal 2010 reflect the revisions to correct our accounting for sale-leaseback transactions. Certain weighted-average options to purchase shares of common stock were outstanding and not included in the calculation of diluted net earnings per share... -

Page 77

... 29, 2012, and $10.7 million as of February 28, 2011. 15. LEASE COMMITMENTS We conduct a majority of our business in leased premises. Our lease obligations are based upon contractual minimum rates. Most leases provide that we pay taxes, maintenance, insurance and operating expenses applicable to the... -

Page 78

... these arrangements. As part of our customer service strategy, we guarantee the used vehicles we retail with at least a 30-day limited warranty. A vehicle in need of repair within this period will be repaired free of charge. As a result, each vehicle sold has an implied liability associated with it... -

Page 79

...) 2nd Q uarter 3rd Q uarter 4th Q uarter Fiscal Year Net s ales and operating revenues Gros s profit CarM ax A uto Finance income Selling, general and adminis trative expens es Net earnings Net earnings per s hare: Bas ic Diluted 2012 $ 2,679,417 $ 383,095 $ 69,661 $ $ $ $ 241,655 125,500 0.56... -

Page 80

... and reported within the time periods specified in the U.S. Securities and Exchange Commission's rules and forms. Disclosure controls are also designed to ensure that this information is accumulated and communicated to management, including the chief executive officer ("CEO") and the chief financial... -

Page 81

... March 2012, he was promoted to executive vice president and chief financial officer. Prior to joining CarMax, Mr. Reedy was vice president, corporate development and treasurer of Gateway, Inc., a technology retail company. Mr. Smith was the first full-time associate of CarMax, having worked on the... -

Page 82

... and Related Transactions" in our 2012 Proxy Statement. The information required by this Item concerning director independence is incorporated by reference to the sub-section titled "Director Independence" in our 2012 Proxy Statement. Item 14. Principal Accountant Fees and Services. The information... -

Page 83

...not applicable, are not required or the information required to be set forth therein is included in the Consolidated Financial Statements and Notes thereto. 3. Exhibits. The Exhibits listed on the accompanying Index to Exhibits immediately following the financial statement schedule are filed as part... -

Page 84

... Thomas J. Folliard President and Chief Executive Officer April 25, 2012 By: /s/ THOMAS W. REEDY Thomas W. Reedy Executive Vice President and Chief Financial Officer April 25, 2012 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed by the following... -

Page 85

... Stock Transfer & Trust Company, LLC, as Rights Agent, filed as Exhibit 4.2 to CarMax's Quarterly Report on Form 10-Q, filed January 8, 2009 (File No. 1-31420), is incorporated by this reference. CarMax, Inc. Employment Agreement for Executive Officer, dated December 1, 2011, between CarMax, Inc... -

Page 86

.... * CarMax, Inc. 2002 Employee Stock Purchase Plan, as amended and restated June 23, 2009, filed as Exhibit 10.1 to CarMax's Quarterly Report on Form 10-Q, filed July 9, 2009 (File No. 1-31420), is incorporated by this reference. Credit Agreement dated August 26, 2011, among CarMax Auto Superstores... -

Page 87

... Award Agreement between CarMax, Inc. and certain executive officers, filed as Exhibit 10.17 to CarMax's Annual Report on Form 10-K, filed May 13, 2005 (File No. 1-31420), is incorporated by this reference. * Form of Incentive Award Agreement between CarMax, Inc. and certain non-employee directors... -

Page 88

... Executive Vice President Chief Financial Officer Cliff Wood Executive Vice President Stores Angie Chattin Senior Vice President CarMax Auto Finance Ed Hill Senior Vice President Service Operations Joe Kunkel Senior Vice President Marketing and Strategy Eric Margolin Senior Vice President General... -

Page 89

... Assistant Vice President Process Engineering Vaughn Sigmon Region Vice President General Manager Los Angeles Region Judith Simon Assistant Vice President Service Operations David Smith Assistant Vice President Pricing and Inventory Strategy Greg Stewart Assistant Vice President Associate Relations... -

Page 90

... company) Mitchell D. Steenrod Senior Vice President, Chief Financial Officer and Chief Information Officer Pilot Travel Centers LLC (an operator of travel centers and truck stops) Thomas G. Stemberg Founder and Chairman Emeritus Staples, Inc. (an office supply superstore retailer) Managing General... -

Page 91

....com ANNUAL SHAREHOLDERS' MEETING Monday, June 25, 2012, at 1:00 p.m. ET The Richmond Marriott West Hotel 4240 Dominion Boulevard Glen Allen, Virginia 23060 STOCK INFORMATION For quarterly sales and earnings information, ï¬nancial reports, ï¬lings with the Securities and Exchange Commission... -

Page 92

CARMAX, INC. 12800 TUCKAHOE CREEK PARKWAY RICHMOND, VIRGINIA 23238 804-747-0422 WWW.CARMAX.COM