Blackberry 2004 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2004 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

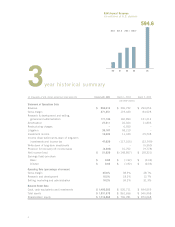

4

3year historical summary

(In thousands of U.S. dollars except per share amounts)

February 28, 2004 March 1, 2003 March 2, 2002

US GAAP (note 1)

Statement of Operations Data

Revenue $ 594,616 $ 306,732 $ 294,053

Gross margin 271,251 119,443 84,528

Research & development and selling,

general and administration 171,130 160,894 131,212

Amortization 27,911 22,324 11,803

Restructuring charges –6,550 –

Litigation 35,187 58,210 –

Investment income 10,606 11,430 25,738

Income (loss) before write-down of long-term

investments and income tax 47,629 (117,105) (32,749)

Write-down of long-term investments –– (5,350)

Provision for (recovery of) income taxes (4,200) 31,752 (9,778)

Net income (loss) $ 51,829 $ (148,857) $ (28,321)

Earnings (loss) per share

Basic $ 0.65 $ (1.92) $ (0.36)

Diluted $ 0.62 $ (1.92) $ (0.36)

Operating Data (percentage of revenue)

Gross margin 45.6% 38.9% 28.7%

Research and development 10.5% 18.2% 12.7%

Selling, marketing and administration 18.2% 34.2% 31.9%

Balance Sheet Data

Cash, cash equivalents and investments $ 1,490,305 $ 530,711 $ 644,559

Total assets $ 1,931,378 $ 861,656 $ 946,958

Shareholders’ equity $ 1,716,263 $ 706,781 $ 874,068

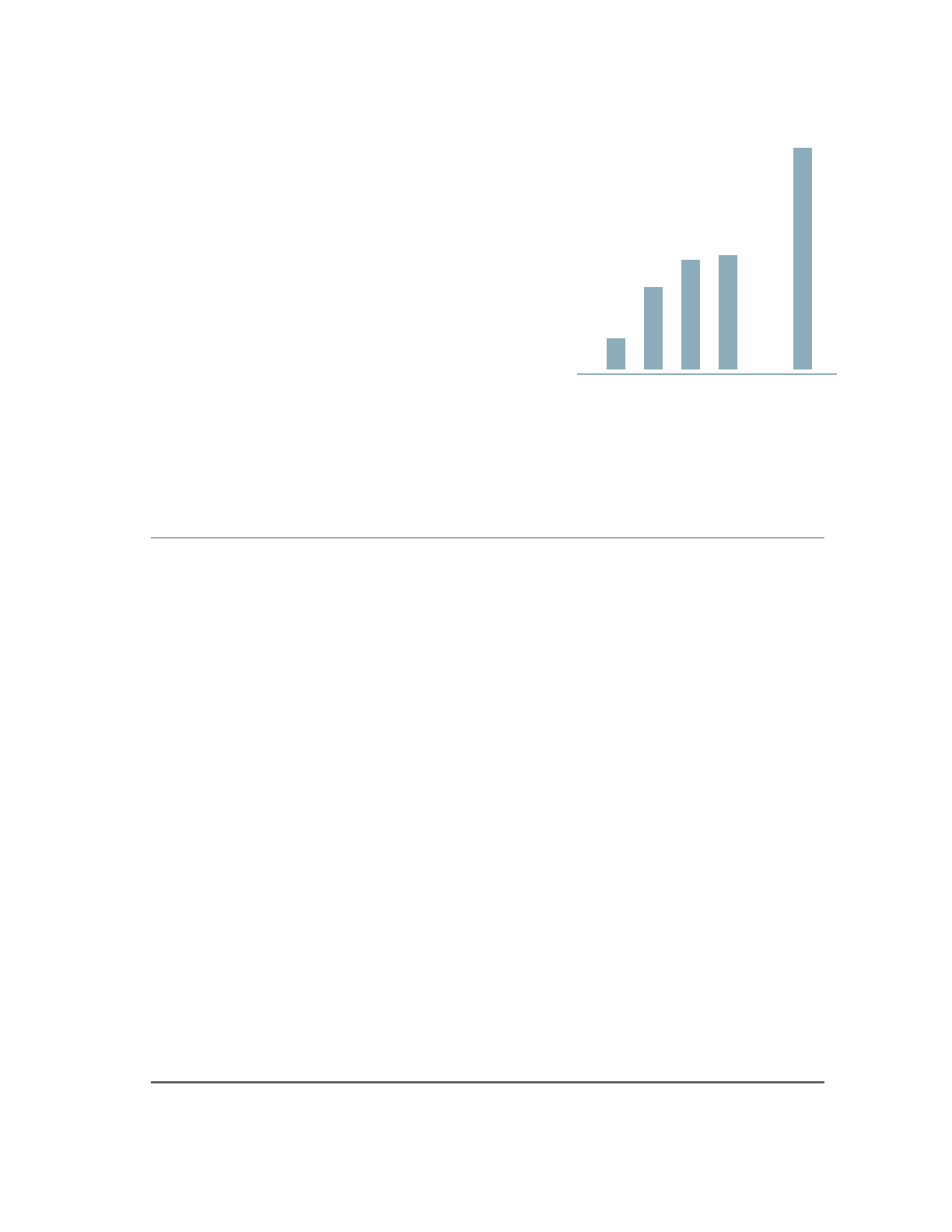

RIM Annual Revenue

(in millions of U.S. dollars)

594.6

85.0 221.3 294.1 306.7

00 01 02 03 04