Blackberry 2004 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2004 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

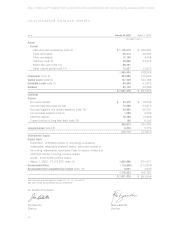

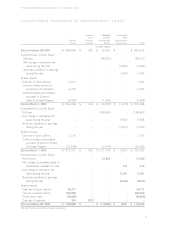

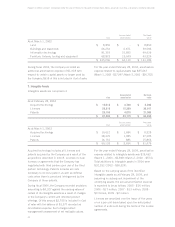

For the years ended February 28, 2004, March 1, 2003 and March 2, 2002

For the year ended February 28, 2004 March 1, 2003 March 2, 2002

US GAAP (note 1)

Cash flows from operating activities

Net income (loss) $51,829 $ (148,857) $ (28,321)

Items not requiring an outlay of cash:

Amortization 54,529 31,147 17,497

Deferred income taxes –29,244 (16,836)

Loss on disposal of capital assets 223 502 –

Loss (gain) on foreign currency translation

of long-term debt 859 (339) 4

Write-down of investments –– 5,350

Net changes in working capital items:

Trade receivables (54,410) 1,958 7,607

Other receivables (7,611) 1,473 7,918

Inventory(11,561) 6,202 30,567

Other current assets 512 (525) (3,467)

Accounts payable 16,976 7,059 1,834

Accrued liabilities 16,123 17,555 (2,333)

Accrued litigation and related expenses 33,690 50,702 –

Increase in restricted cash (36,261) – –

Income taxes payable (3,225) 2,106 (1,018)

Deferred revenue 2,162 4,563 (1,097)

63,835 2,790 17,705

Cash flows from financing activities

Issuance of share capital and warrants 994,640 1,155 1,491

Financing costs (39,629) ––

Buyback of common shares pursuant to

Common Share Purchase Program (note 11(a)) –(24,502) (5,525)

Repayment of debt (6,130) (614) (303)

948,881 (23,961) (4,337)

Cash flows from investing activities

Acquisition of investments (186,989) (190,030) –

Proceeds on sale or maturity of investments 43,746 ––

Acquisition of capital assets (21,815) (39,670) (73,917)

Acquisition of intangible assets (32,252) (30,997) (7,106)

Acquisition of subsidiaries (note 8) 478 (21,990) (9,709)

Acquisition of short-term investments (24,071) (41,900) (925,885)

Proceeds on sale and maturity of short-term investments 24,071 345,983 834,907

(196,832) 21,396 (181,710)

Foreign exchange effect on cash and cash equivalents (146) (20) (4)

Net increase (decrease) in cash and cash

equivalents for the year 815,738 205 (168,346)

Cash and cash equivalents, beginning of year 340,681 340,476 508,822

Cash and cash equivalents, end of year $ 1,156,419 $ 340,681 $ 340,476

See notes to the consolidated financial statements.

consolidated statement of cash flows