Blackberry 2004 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2004 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

Research In Motion Limited • Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)

Warranty

The Company provides for the estimated costs of

product warranties at the time revenue is

recognized. BlackBerry Handheld products are

generally covered by a time-limited warranty for

varying periods of time. The Company’s warranty

obligation is affected by product failure rates,

material usage and other related production costs

and service delivery expense.

The Company’s estimates of costs are based upon

historical experience and expectations of future

conditions when it is introducing new BlackBerry

Handheld products. To the extent that the Company

experiences increased warranty activity or increased

costs associated with servicing those obligations,

revisions to the estimated warranty liability would be

required.

Investments

Investments classified as available for sale under

SFAS 115 are carried at market value. Changes in

market values are accounted for through

accumulated other comprehensive income, until

such investments mature or are sold.

Investments with maturities in excess of one year

include those categorized as available-for-sale and

held-to-maturity for accounting purposes. The

Company does not exercise significant influence

with respect to any of these investments.

In the event that a decline in the fair value of a

held-to-maturity investment occurs and the decline

in value is considered to be other than temporary,

an appropriate write-down would be recorded.

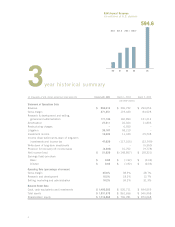

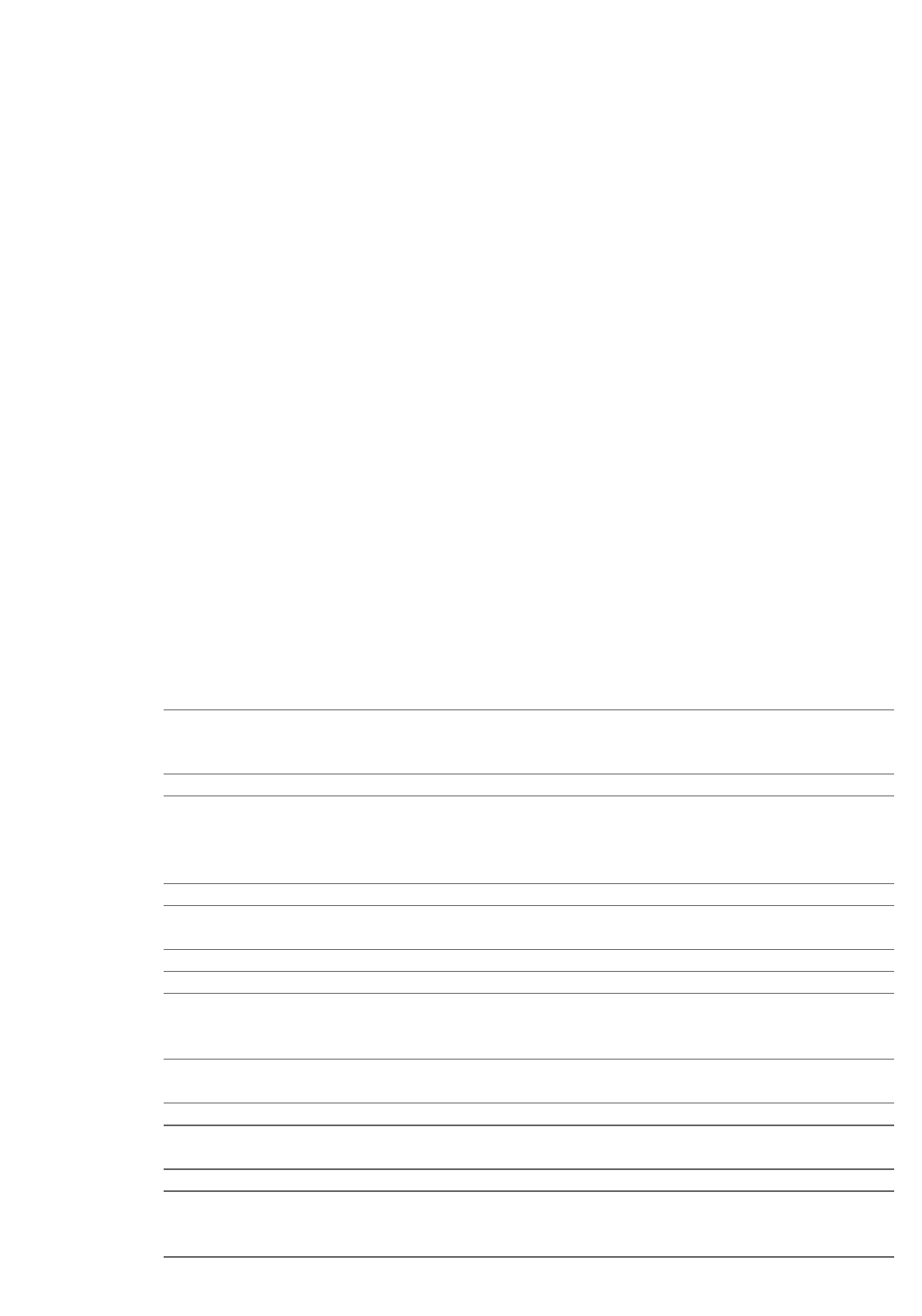

Summary Results of Operations

- Fiscal 2004, Fiscal 2003 and Fiscal 2002

The following table sets forth certain consolidated

statement of operations and consolidated balance

sheet data for the periods indicated:

As at and for the fiscal year ended February 28, 2004 March 1, 2003 Change 2004/2003 March 2, 2002

(in thousands, except for per share amounts)

Revenue $594,616 $306,732 $287,884 $294,053

Cost of sales 323,365 187,289 136,076 209,525

Gross margin 271,251 119,443 151,808 84,528

Expenses

Research and development 62,638 55,916 6,722 37,446

Selling, marketing and administration 108,492 104,978 3,514 93,766

Amortization 27,911 22,324 5,587 11,803

Sub-total 199,041 183,218 15,823 143,015

Restructuring charges –6,550 (6,550) –

Litigation 35,187 58,210 (23,023) –

Restructuring and litigation 35,187 64,760 (29,573) –

234,228 247,978 (13,750) 143,015

Income (loss) from operations 37,023 (128,535) 165,558 (58,487)

Investment income 10,606 11,430 (824) 25,738

Write-down of investments –––(5,350)

Income (loss) before income taxes 47,629 (117,105) 164,734 (38,099)

Provision for (recovery of) income tax (4,200) 31,752 35,952 (9,778)

Net income (loss) $ 51,829 $ (148,857) $ 200,686 $ (28,321)

Earnings (loss) per share

Basic $0.65 $(1.92) $2.57 $(0.36)

Diluted $ 0.62 $ (1.92) $ 2.54 $ (0.36)

Total assets $ 1,931,378 $ 861,656 $ 1,069,722 $ 946,958

Total liabilities 215,115 154,875 60,240 72,890

Shareholders’ equity $ 1,716,263 $ 706,781 $ 1,009,482 $ 874,068