Blackberry 2004 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2004 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

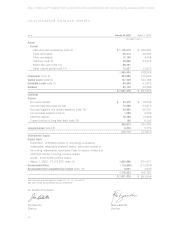

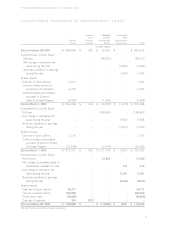

For the years ended February 28, 2004, March 1, 2003 and March 2, 2002

consolidated statement of shareholders’ equity

Common Retained Accumulated

Share Earnings Other

Common Purchase (Accumulated Comprehensive

Shares Warrants Deficit) Income (loss) Total

US GAAP (note 1)

Balance February 28, 2001 $ 890,644 $ 370 $ 10,562 $ – $ 901,576

Comprehensive income (loss):

Net loss – – (28,321) – (28,321)

Net change in derivative fair

value during the year – – – (2,803) (2,803)

Amounts classified to earnings

during the year – – – 1,325 1,325

Shares issued:

Exercise of stock options 1,491 – – – 1,491

Common shares issued on

acquisition of subsidiary 6,325 – – – 6,325

Common shares repurchased

pursuant to Common

Share Purchase Program (4,080) – (1,445) – (5,525)

Balance March 2, 2002 $ 894,380 $ 370 $ (19,204) $ (1,478) $ 874,068

Comprehensive income (loss):

Net loss – – (148,857) – (148,857)

Net change in derivative fair

value during the year – – – 5,958 5,958

Amounts classified to earnings

during the year – – – (1,041) (1,041)

Shares Issued:

Exercise of stock options 1,155 – – – 1,155

Common shares repurchased

pursuant to Common Share

Purchase Program (21,528) – (2,974) – (24,502)

Balance March 1, 2003 $874,007 $ 370 $ (171,035) $ 3,439 $ 706,781

Comprehensive income (loss):

Net Income – – 51,829 – 51,829

Net change in unrealized gains on

investments available for sale 613 613

Net change in derivative fair

value during the year – – – 11,941 11,941

Amounts classified to earnings

during the year – – – (9,912) (9,912)

Shares Issued:

Exercise of stock options 49,771 – – – 49,771

Issue of common shares 944,869 – – – 944,869

Share issue costs (39,629) – – – (39,629)

Exercise of warrants 370 (370) – – –

Balance February 28, 2004 $ 1,829,388 $ – $ (119,206) $ 6,081 $ 1,716,263

See notes to the consolidated financial statements.