Blackberry 2004 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2004 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

For the years ended February 28, 2004, March 1, 2003 and March 2, 2002

8. Acquisitions

During fiscal 2004, the purchase price related to

one of the fiscal 2003 acquisitions was revised,

resulting in a reduction to goodwill of $479 and a

return of consideration.

During fiscal 2003 the Company completed four

acquisitions. Effective June 2002, the Company

purchased the assets of a company whose

proprietary software code provides capabilities to

facilitate foreign language input and display on

handheld products. Effective July 2002, the

Company acquired 100% of the common shares of a

company that will offer a secure solution for viewing

email attachments with BlackBerry Wireless

Handhelds. Effective August 2002, the Company

acquired 100% of the common shares of a company

that has software products which enable wireless

access to major email systems including corporate,

proprietary and POP3/IMAP4 using a handheld

device. In addition, effective September 2002, the

Company also acquired 100% of the common shares

of a small company with expertise and technology

related to wireless networks. The results of the

acquirees’ operations have been included in the

consolidated financial statements for the periods from

each respective closing date to February 28, 2004.

On October 31, 2001, the Company acquired 100%

of the outstanding common shares of a company for

its technology and expertise in the wireless delivery

of rich graphical content. This company develops

Java-based media platforms for wireless devices.

The results of this company’s operations have been

included in the consolidated financial statements

since October 31, 2001. The value of the 387,353

common shares issued in 2002 was determined

based on the average of the market price of the

Company’s common shares over the two-day period

before and after the terms of the acquisition were

agreed to.

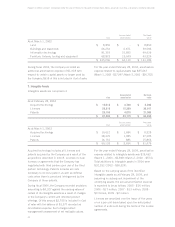

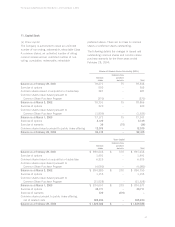

The following table summarizes the estimated fair

value of the assets acquired and liabilities assumed

at the date of acquisition.

For the year ended March 1, 2003 March 2, 2002

Assets purchased

Capital assets $ 317 $ –

Acquired technology 7,326 2,685

Goodwill 16,193 14,395

23,836 17,080

Liabilities assumed - non-cash working capital 1,275 1,046

Deferred income tax liability 357 –

1,632 1,046

Net non-cash assets acquired 22,204 16,034

Cash acquired 117 152

Net assets acquired $22,321 $ 16,186

Consideration

Cash $ 22,107 $ 9,861

Assumption of acquiree long-term debt 214 –

Capital stock – 6,325

$ 22,321 $ 16,186