Blackberry 2004 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2004 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

For the years ended February 28, 2004, March 1, 2003 and March 2, 2002

(v) Warranty

The Company estimates its warranty costs at the

time of revenue recognition based on historical

warranty claims experience and records the expense

in Cost of sales. The warranty accrual balance is

reviewed quarterly to assess whether it materially

reflects the remaining obligation based on the

anticipated future expenditures over the balance of

the obligation period. Adjustments are made when

the actual warranty claim experience differs from

estimates.

(w) Advertising costs

The Company expenses all advertising costs as

incurred. These costs are included in Selling,

marketing and administration.

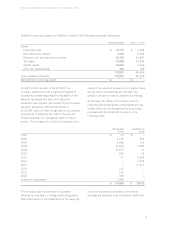

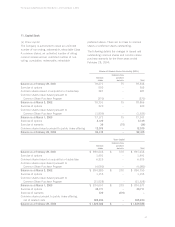

The weighted average fair value of options granted during the year was calculated using the Black-Scholes

option-pricing model with the following assumptions:

For the year ended February 28, 2004 March 1, 2003 March 2, 2002

Number of options granted (000’s) 1,574 956 2,978

Weighted average Black-Scholes value of each option $ 16.57 $ 8.58 $ 12.00

Assumptions:

Risk free interest rate 3.0% 4.5% 4.0%

Expected life in years 4.0 3.5 3.5

Expected dividend yield 0% 0% 0%

Volatility 70% 70% 75%

2. Adoption of Accounting Policies

(a) Stock-based compensation

In December 2002, the FASB issued SFAS 148,

Accounting for Stock-Based Compensation. SFAS

148 amends SFAS 123 to provide alternative

methods of transition for a voluntary change to the

fair value based method of accounting for stock-

based compensation. There was no effect on the

Company’s results of operations and financial

position for SFAS 148, as the Company has not yet

adopted the fair value based method.

(b) Derivative instruments

In May 2003, the FASB issued SFAS 149,

Amendment of Statement 133 on Derivative

Instruments and Hedging Activities. The statement

clarifies and amends accounting for derivative

instruments including certain derivative instruments

embedded in other contracts and for hedging activities

under SFAS 133. SFAS 149 is effective for contracts

entered into or modified after June 30, 2003. The

Company has determined that there was no effect

upon the adoption of SFAS 149.

(c) Financial instruments

In May 2003, the FASB issued SFAS 150,

Accounting for Certain Financial Instruments with

Characteristics of both Assets and Liabilities. SFAS

150 addresses the accounting for mandatory

redeemable shares, put options and forward

purchase contracts of the Company’s shares, and

instruments that are liabilities under this Statement

that can be settled for shares. This standard is

effective for all financial instruments entered into or

modified after May 31, 2003, and is otherwise

effective for the first interim period beginning after

June 15, 2003. There was no effect on the

Company’s results of operations and financial

position upon the adoption of SFAS 150.