Blackberry 2004 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2004 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

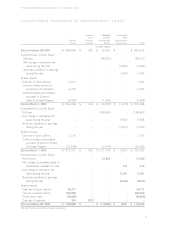

For the years ended February 28, 2004, March 1, 2003 and March 2, 2002

customers and reviews the credit history of each

new customer. The Company establishes an

allowance for doubtful accounts that corresponds to

the specific credit risk of its customers, historical

trends and economic circumstances. The Company

also places insurance coverage for a portion of its

foreign trade receivables. The allowance as at

February 28, 2004 is $ 2.4 million (March 1, 2003

- $2.3 million).

While the Company sells to a variety of customers,

two customers comprised 24% and 10% of trade

receivables as at February 28, 2004 (March 1,

2003 - three customers comprised 17%, 16% and

14%). Additionally, two customers comprised 15%

and 13% of the Company’s sales (fiscal 2003 - one

customer comprised 12%).

The Company is exposed to credit risk on derivative

financial instruments arising from the potential for

counterparties to default on their contractual

obligations to the Company. The Company

minimizes this risk by limiting counterparties to

major financial institutions and by continuously

monitoring their creditworthiness. As at February

28, 2004, the maximum exposure to a single

counter-party was 43% of outstanding derivative

instruments (March 1, 2003 - 37%).

The Company is exposed to market and credit risk

on its investment portfolio. The Company limits this

risk by investing only in liquid, investment grade

securities and by limiting exposure to any one entity

or group of related entities. As at February 28,

2004, no single issuer represented more than 4% of

the total cash, cash equivalents and investments

(March 1, 2003 - no single issuer represented more

than 5% of the total cash, cash equivalents and

short-term investments).

Impact of Accounting Pronouncements

Not Yet Implemented

In December 2003, the FASB amended

Interpretation No. 46 (“FIN 46”), Consolidation of

Variable Interest Entities (“FIN 46R”). FIN 46R

requires that a variable interest entity (“VIE”) be

consolidated by a company if that company is

subject to a majority of the risk of loss from the

VIE’s residual returns. For the Company, the

requirements of FIN 46R apply to VIE’s created

after January 31, 2003. For those VIE’s created

before January 31, 2003, the requirements of FIN

46R apply as at February 29, 2004. The adoption

of FIN 46R did not have an impact to the

Company’s financial statements as at and for the

year ended February 28, 2004.

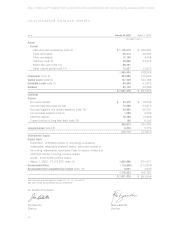

Outlook and Strategy

RIM’s strategy is to continue to leverage the

technology and infrastructure investments made

over the past several years to drive BlackBerry

subscriber growth and financial performance. RIM

plans to extend its technical and market lead by

continuing to invest in core research and

development to enhance the BlackBerry product

portfolio, by fostering new international business

relationships, by licensing the BlackBerry platform

to key handset vendors and by strengthening our

infrastructure to support global subscriber growth.

RIM will continue to pursue growth opportunities

with global carriers to further expand BlackBerry’s

global footprint and to extend our enterprise market

leadership into the prosumer market. Through the

BlackBerry Connect program, RIM plans to increase

the addressable market for BlackBerry through the

strategic licensing of the BlackBerry platform.

RIM anticipates strong revenue and net earnings

growth for the balance of fiscal 2005 compared to

fiscal 2004 and is targeting substantial increases in

the BlackBerry subscriber base. RIM intends to

realize this growth while continuing to manage its

financial resources prudently and fostering a culture

of innovation and achievement for its employees.