Blackberry 2004 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2004 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

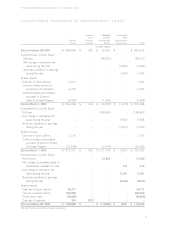

For the years ended February 28, 2004, March 1, 2003 and March 2, 2002

Liquidity and Capital Resources

Summary of Cash Flows

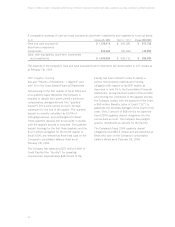

The following table summarizes the Company’s cash flows for the periods indicated:

Fiscal 2004 Fiscal 2003

Net income (loss) $ 51,829 $(148,857)

Amortization 54,529 31,147

Deferred income taxes –29,244

Working capital and other (42,523) 91,256

Cash flows from operating activities 63,835 2,790

Cash flows from financing activities 948,881 (23,961)

Cash flows from investing activities (196,832) 21,396

Other (146) (20)

Net increase in cash and cash equivalents $ 815,738 $ 205

Operating Activities

For fiscal 2004, cash flow generated from operating

activities was $63.8 million compared to $2.8 million

in fiscal 2003. Net income plus amortization was

$106.4 million for the current year. The majority of

cash applied to cash working capital for the current

fiscal year resulted from increases in trade

receivables of $54.4 million (generally consistent

with the Company’s revenue growth), other receivables

of $7.6 million and inventory of $11.6 million.

These increases were partially offset by an increase

in accounts payable of $17.0 million and accrued

liabilities of $16.1 million. The increase in accrued

litigation of $33.7 million is more than offset by the

increase in restricted cash of $36.3 million, which

relates to the Company’s funding requirement to

deposit funds into an escrow account with respect

to the NTP matter. See “NTP Litigation Funding”.

Financing Activities

During fiscal 2004, cash flow generated from

financing activities was $948.9 million including

$905.2 million in net proceeds from the Company’s

public offering of 12.1 million shares at $78.25 per

share, and $49.8 million of proceeds upon the

issuance of share capital related to the exercise of

stock options. The Company repaid $6.1 million of

debt in fiscal 2004. This compares to $24.0 million

used in financing activities in the prior fiscal year,

which was primarily for the buyback of 1.9 million

common shares pursuant to the Company’s Common

Share Purchase Program.

Investing Activities

For the current fiscal year, cash flow used for

investing activities equalled $196.8 million, which

included the acquisition of investments, net of

proceeds on disposition, of $143.2 million, and the

acquisitions of capital assets and intangible assets

of $21.8 million and $32.3 million, respectively.

For the prior fiscal year, cash flow generated by

investing activities was $21.4 million. Uses

included the acquisition of investments of $190.0

million, acquisitions of capital assets and intangible

assets of $39.7 million and $31.0 million,

respectively, and acquisitions of subsidiaries of

$22.0 million. There were net proceeds from the

sale of investments of $304.1 million.

Cash and cash equivalents, short-term investments

and investments increased by $959.6 million to

$1,490.3 million as at February 28, 2004 from

$530.7 million as at March 1, 2003.