Blackberry 2004 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2004 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

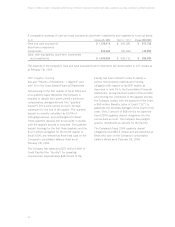

For the years ended February 28, 2004, March 1, 2003 and March 2, 2002

Fiscal 2003 Year

Fourth Quarter Third Quarter Second Quarter First Quarter

(in thousands, except per share data)

Revenue $ 87,502 $ 74,176 $ 73,418 $ 71,636

Gross margin(1) 35,894 28,988 29,098 25,463

Research and development, Selling,

marketing and administration(1),

and Amortization(1) 43,948 52,434 44,872 41,964

Restructuring charge(3) – 6,550 – –

Litigation(2) 25,540 27,760 4,910 –

Investment income (2,498) (2,901) (2,877) (3,154)

Loss before income taxes (31,096) (54,855) (17,807) (13,347)

Provision for (recovery of) income taxes(4) – 37,937 (3,575) (2,610)

Net loss $ (31,096) $ (92,792) $ (14,232) $ (10,737)

Loss per share - basic and diluted $ (0.40) $ (1.21) $ (0.18) $ (0.14)

Research and development $ 12,535 $ 16,843 $ 13,913 $ 12,625

Selling, marketing and administration(1) 24,979 29,979 25,213 24,807

Amortization(1) 6,434 5,612 5,746 4,532

$ 43,948 $ 52,434 $ 44,872 $ 41,964

Notes:

(1) During the third quarter of fiscal 2004, the Company reclassified costs associated with its BlackBerry network operations centre and its

technical and service support operations centre to Cost of sales. Such costs were previously included in Selling, marketing and administration

expense. In addition, amortization expense related to manufacturing operations and BlackBerry network operations has been reclassified to

Cost of sales. Such amortization was previously included in Amortization expense. All comparative amounts were reclassified to conform to

this new presentation. There were no adjustments to previously reported net income (loss) as a result of any of these reclassifications.

(2) See “Results of Operations – Litigation” and note 16 to the Consolidated Financial Statements.

(3) See “Results of Operations – Restructuring Charges” and note 15 to the Consolidated Financial Statements.

(4) See “Results of Operations – Income Taxes” and note 9 to the Consolidated Financial Statements.

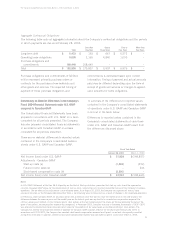

Events Subsequent to February 28, 2004 Year End

Settlement of Patent Litigation

Good Technology, Inc. (“GTI”) and the Company

entered into an agreement on March 26, 2004

whereby the parties also signed a settlement and

license agreement and a series of pending lawsuits

between the two companies were consequently

dismissed. The parties have also signed a royalty-

bearing license agreement whereby RIM will receive

a lump-sum settlement during the first quarter of

fiscal 2005 as well as ongoing quarterly royalties.

The lump-sum settlement amount was received

subsequent to February 28, 2004 and will be

credited to Intangible Assets in the first quarter of

fiscal 2005, as a recovery of costs incurred by the

Company. The settlement will resolve this matter

and the settlement amounts will not be material to

the Company’s consolidated financial statements.

Stock Split

On April 7, 2004, the Company announced that its

Board of Directors had approved a two-for-one stock

split of the Company’s outstanding common shares.

The stock split will be implemented by way of a

stock dividend whereby shareholders will receive one

common share of the Company for each common

share held. The stock dividend will be payable on

June 4, 2004 to shareholders of record at the close

of business on May 27, 2004. The total number of

common shares outstanding as of February 28,

2004 was 92.4 million. Adjusting for the stock

split, the total number of common shares

outstanding will be 184.8 million.