Blackberry 2004 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2004 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

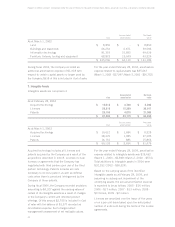

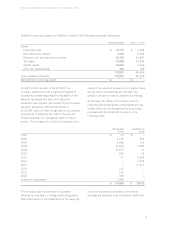

Research In Motion Limited • Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)

Accumulated Net book

Cost amortization value

As at March 1, 2003

Land $ 8,850 $ – $ 8,850

Buildings and leaseholds 66,254 6,671 59,583

Information technology 81,319 31,893 49,426

Furniture, fixtures, tooling and equipment 68,873 25,549 43,324

$ 225,296 $ 64,113 $ 161,183

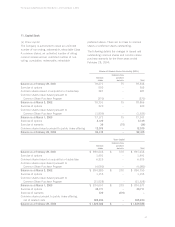

7. Intangible Assets

Intangible assets are comprised of:

Accumulated Net book

Cost amortization value

As at February 28, 2004

Acquired technology $10,012 $3,746 $6,266

Licenses 52,216 15,299 36,917

Patents 25,156 4,070 21,086

$ 87,384 $ 23,115 $ 64,269

Accumulated Net book

Cost amortization value

As at March 1, 2003

Acquired technology $ 10,012 $ 1,684 $ 8,328

Licenses 28,370 1,085 27,285

Patents 16,751 885 15,866

$ 55,133 $ 3,654 $ 51,479

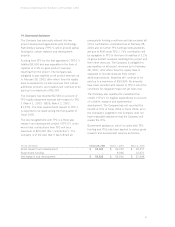

During fiscal 2004, the Company recorded an

additional amortization expense of $1,318 with

respect to certain capital assets no longer used by

the Company; $618 of this is included in Cost of sales.

For the year ended February 28, 2004, amortization

expense related to capital assets was $35,067

(March 1, 2003 - $27,997; March 2, 2002 - $16,753).

Acquired technology includes all Licenses and

patents acquired by the Company as a result of the

acquisitions described in note 8. Licenses include

licenses or agreements that the Company has

negotiated with third parties upon use of the third

parties’ technology. Patents includes all costs

necessary to record a patent, as well as defense

costs when there is perceived infringement by the

Company of those patents.

During fiscal 2004, the Company recorded provisions

amounting to $4,327 against the carrying values of

certain of its intangible assets as a result of changes

in the Company’s current and intended product

offerings. Of this amount $2,750 is included in Cost

of sales with the balance of $1,577 recorded as

Amortization expense. Such charges reflect

management’s assessment of net realizable values.

For the year ended February 28, 2004, amortization

expense related to intangible assets was $19,462

(March 1, 2003 - $2,848; March 2, 2002 - $574).

Total additions to intangible assets in 2004 were

$32,252 (2003 - $38,324).

Based on the carrying value of the identified

intangible assets as at February 28, 2004, and

assuming no subsequent impairment of the

underlying assets, the annual amortization expense

is expected to be as follows: 2005 - $16 million;

2006 - $17 million; 2007 - $13 million; 2008 -

$3 million; 2009 - $2 million.

Licenses are amortized over the lessor of five years

or on a per unit basis based upon the anticipated

number of units sold during the terms of the license

agreements.