Blackberry 2004 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2004 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

Research In Motion Limited • Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)

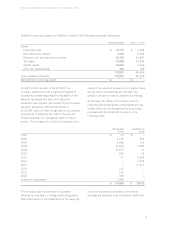

17. Write-Down of Investments

Periodically the Company undertakes a review of

the carrying value of companies in which it holds

investments. Based on such reviews, the Company

determines whether impairment in the carrying

values of its investments has occurred. The Company

further determines whether such declines are other

than temporary in nature. The Company wrote down

the value of its investments in fiscal 2002 by $5,350.

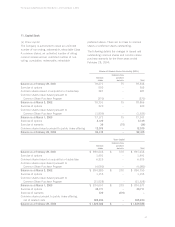

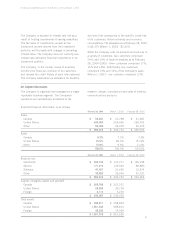

18. Earnings (Loss) Per Share

The following table sets forth the computation of basic and diluted earnings (loss) per share.

For the year ended February 28, 2004 March 1, 2003 March 2, 2002

Numerator for basic and diluted earnings (loss)

per share available to common stockholders $51,829 $ (148,857) $ (28,321)

Denominator for basic earnings (loss) per share

- weighted average shares outstanding (000’s) 79,650 77,636 78,467

Effect of dilutive securities:

Employee stock options 4,040 ––

Denominator for basic and diluted earnings

(loss) per share - weighted average shares

outstanding (000’s) 83,690 77,636 78,467

Earnings (loss) per share

Basic $ 0.65 $ (1.92) $ (0.36)

Diluted $0.62 $ (1.92) $ (0.36)

Stock options and share purchase warrants were excluded from the diluted (loss) per share figures for 2003

and 2002, as they were anti-dilutive.

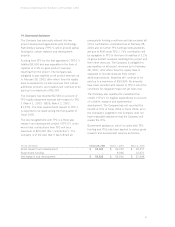

19. Comprehensive Income (Loss)

The components of comprehensive net income (loss) are shown in the following table:

For the year ended February 28, 2004 March 1, 2003 March 2, 2002

Net income (loss) $ 51,829 $ (148,857) $ (28,321)

Net change in unrealized gains on available for sale 613 ––

Net change in derivative fair value during the year 11,941 5,958 (2,803)

Amounts reclassified to earnings during the year (9,912) (1,041) 1,325

Comprehensive income (loss) $54,471 $(143,940) $(29,799)

The components of accumulated other comprehensive income are as follows:

For the year ended February 28, 2004 March 1, 2003 March 2, 2002

Accumulated net unrealized gains on available-for-sale $ 613 $ – $ –

Accumulated net unrealized gains (loss) on derivative

instruments 5,468 3,439 (1,478)

Total accumulated other comprehensive income (loss) $ 6,081 $ 3,439 $ (1,478)