Blackberry 2004 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2004 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

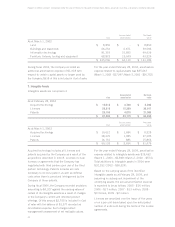

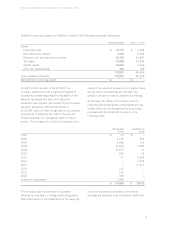

For the years ended February 28, 2004, March 1, 2003 and March 2, 2002

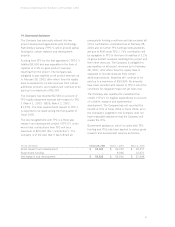

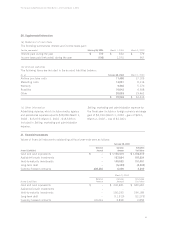

14. Government Assistance

The Company has previously entered into two

project development agreements with Technology

Partnerships Canada (“TPC”), which provide partial

funding for certain research and development

projects.

Funding from TPC for the first agreement (“TPC-1”)

totalled $3,900 and was repayable in the form of

royalties of 2.2% on gross product revenues

resulting from the project. The Company was

obligated to pay royalties on all project revenues up

to February 28, 2003, after which time the royalty

base is expanded to include revenues from certain

additional products, and royalties will continue to be

paid up to a maximum of $6,100.

The Company has recorded $2,530 on account of

TPC royalty repayment expense with respect to TPC-

1 (March 1, 2003 - $925; March 2, 2002 -

$1,575). The final payment with respect to TPC-1

is expected to be made during the first quarter of

fiscal 2005.

The second agreement with TPC is a three-year

research and development project (“TPC-2”) under

which total contributions from TPC will be a

maximum of $23,300 (the “contribution”). The

Company is of the view that it has fulfilled all

prerequisite funding conditions and has recorded all

of the contribution commitment as at February 28,

2004 and no further TPC funding reimbursements

are due to RIM under TPC-2. This contribution will

be repayable to TPC in the form of royalties of 2.2%

on gross product revenues resulting from project and

then other revenues. The Company is obligated to

pay royalties on all project revenues up to February

28, 2007, after which time the royalty base is

expanded to include revenues from certain

additional products. Royalties will continue to be

paid up to a maximum of $39,300. No amounts

have been recorded with respect to TPC-2 since the

conditions for repayment have not yet been met.

The Company also qualifies for investment tax

credits (“ITCs”) on eligible expenditures on account

of scientific research and experimental

development. The Company has not recorded the

benefit of ITCs in fiscal 2003 or fiscal 2004, as in

the Company’s judgement, the Company does not

have reasonable assurance that the Company will

realize the ITCs.

Government assistance, which includes both TPC

funding and ITCs, has been applied to reduce gross

research and development expense as follows:

For the year ended February 28, 2004 March 1, 2003 March 2, 2002

Gross research and development $ 62,638 $ 64,952 $ 49,517

Government funding –9,036 12,071

Net research and development $ 62,638 $ 55,916 $ 37,446