Blackberry 2004 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2004 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

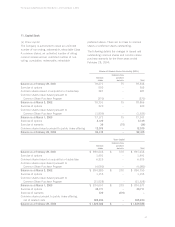

For the years ended February 28, 2004, March 1, 2003 and March 2, 2002

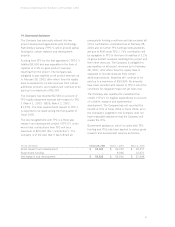

The Company is exposed to interest rate risk as a

result of holding investments of varying maturities.

The fair value of investments, as well as the

investment income derived from the investment

portfolio, will fluctuate with changes in prevailing

interest rates. The Company does not currently use

interest rate derivative financial instruments in its

investment portfolio.

The Company, in the normal course of business,

monitors the financial condition of its customers

and reviews the credit history of each new customer.

The Company establishes an allowance for doubtful

accounts that corresponds to the specific credit risk

of its customers, historical trends and economic

circumstances. The allowance as at February 28, 2004

is $2,379 (March 1, 2003 - $2,331).

While the Company sells its products and services to

a variety of customers, two customers comprised

24%, and 10% of trade receivables as at February

28, 2004 (2003 - three customers comprised 17%,

16% and 14%). Additionally, two customers

comprised 15% and 13% of the Company’s sales

(March 1, 2003 - one customer comprised 12%).

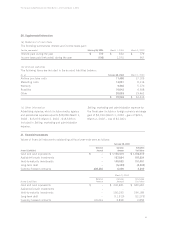

22. Segment Disclosures

The Company is organized and managed as a single

reportable business segment. The Company’s

operations are substantially all related to the

research, design, manufacture and sales of wireless

communications products.

Selected financial information is as follows:

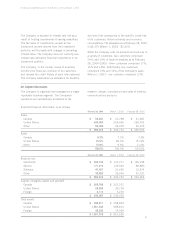

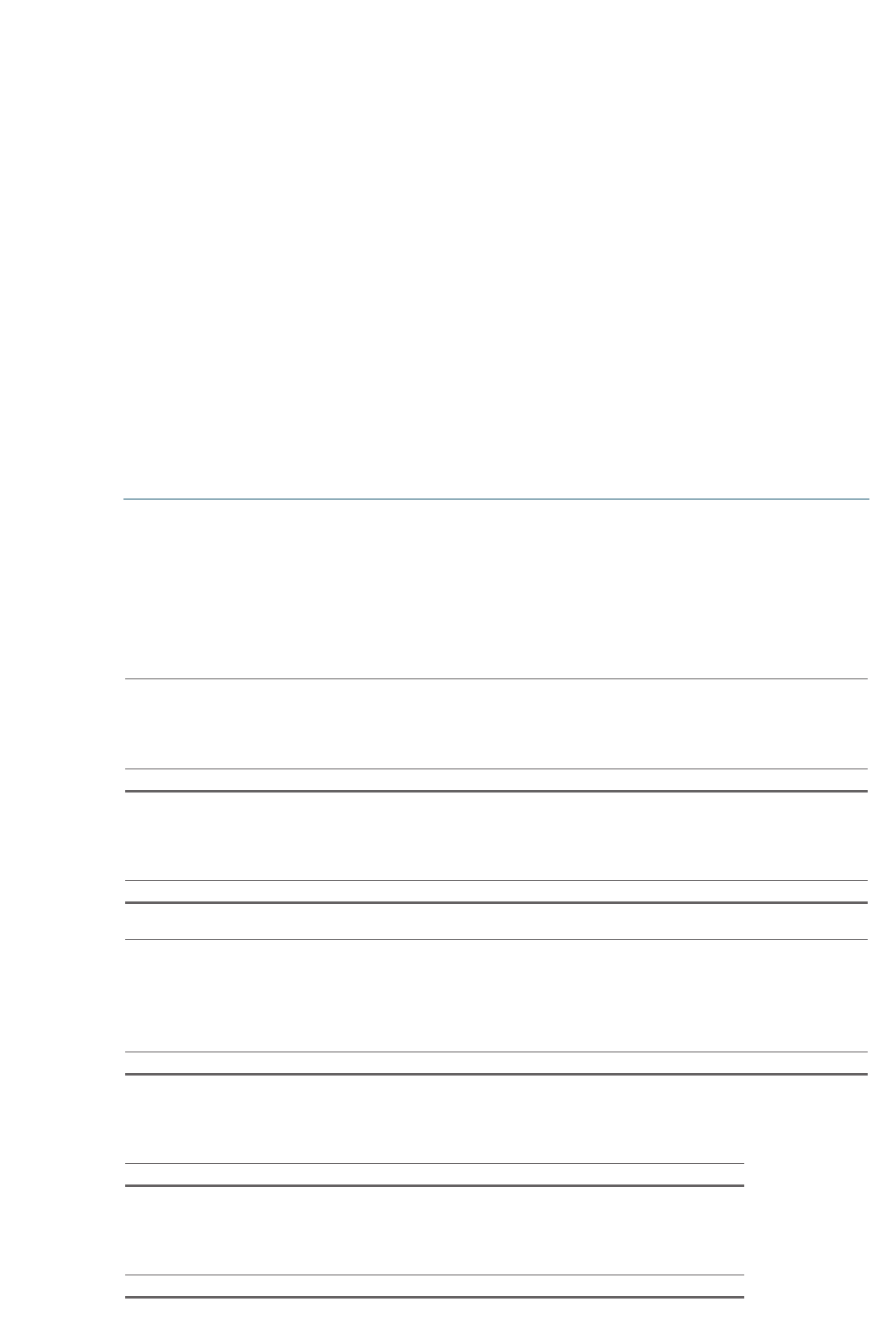

February 28, 2004 March 1, 2003 February 28, 2002

Sales

Canada $54,847 $21,788 $21,381

United States 446,000 255,466 239,702

Other 93,769 29,478 32,970

$594,616 $ 306,732 $ 294,053

Sales

Canada 9.2% 7.1% 7.3%

United States 75.0% 83.3% 81.5%

Other 15.8% 9.6% 11.2%

100.0% 100.0% 100.0%

February 28, 2004 March 1, 2003 February 28, 2002

Revenue mix

Handhelds $343,154 $ 122,711 $ 160,198

Service 171,215 129,332 88,880

Software 47,427 21,655 12,874

Other 32,820 33,034 32,101

$ 594,616 $ 306,732 $ 294,053

Capital, intangible assets and goodwill

Canada $ 209,766 $ 207,221

United States 28,206 30,759

Foreign 4,115 5,270

$ 242,087 $ 243,250

Total assets

Canada $ 333,811 $ 258,833

United States 1,561,232 588,814

Foreign 36,335 14,009

$ 1,931,378 $ 861,656