Blackberry 2004 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2004 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

For the years ended February 28, 2004, March 1, 2003 and March 2, 2002

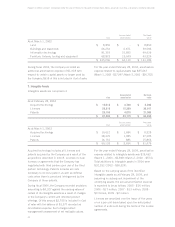

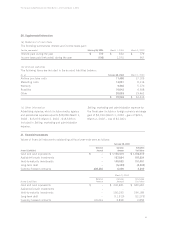

The weighted average characteristics of options outstanding as at February 28, 2004 are as follows:

Options Outstanding (000’s) Options Exercisable (000’s)

Number Weighted Number

Range of Outstanding at average remaining Weighted average Outstanding at Weighted average

exercise prices February 28, 2004 life in years exercise price February 28, 2004 exercise price

$ 2.43 - $ 3.62 1,192 2.7 $ 2.66 1,143 $ 2.62

$ 3.88 - $ 5.66 945 1.4 4.13 401 4.23

$ 5.93 - $ 8.78 498 2.0 7.75 191 7.78

$ 8.97 - $ 13.12 291 4.4 10.38 62 9.95

$ 13.55 - $ 20.29 2,010 5.4 16.40 74 16.87

$ 20.39 - $ 30.51 1,459 4.8 23.24 244 22.94

$ 30.68 - $ 45.51 423 4.3 37.41 69 37.65

$46.55 - $ 68.48 669 3.6 51.97 314 50.95

$70.44 and over 522 5.4 80.33 142 87.00

Total 8,009 4.0 $ 21.64 2,640 $ 16.90

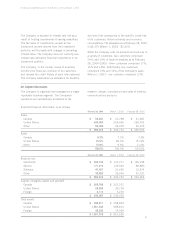

12. Commitments and Contingencies

(a) Lease commitment

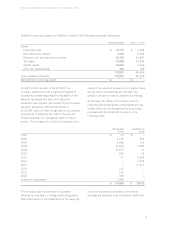

The Company is committed to annual lease payments under operating leases for premises as follows:

Real Estate Equipment Total

For the year ending

2005 $ 1,952 $ 213 $ 2,165

2006 1,842 75 1,917

2007 1,526 15 1,541

2008 1,382 – 1,382

2009 1,003 – 1,003

Thereafter 6,082 – 6,082

$ 13,787 $ 303 $ 14,090

For the period ended February 28, 2004, the Company incurred rental expense of $2,197

(March 1, 2003 - $2,272; March 2, 2002 - $1,857).

(b) Other Litigation

In addition to the NTP matter discussed in note 16,

the Company has been involved in patent litigation

with Good Technology, Inc. (“GTI”).

The Company and GTI (the “parties”) entered into

an agreement on March 26, 2004 whereby the

parties have signed a settlement and license

agreement and will consequently dismiss a series of

pending lawsuits between the two companies. The

companies have entered a royalty-bearing license

agreement whereby RIM will receive a lump-sum

settlement during the first quarter of fiscal 2005 as

well as ongoing quarterly royalties. The lump-sum

settlement amount was received subsequent to

February 28, 2004 and will be credited to

Intangible Assets in the first quarter of fiscal 2005,

as a recovery of costs incurred by the Company. The

settlement of this dispute will not be material to the

Company’s financial position.