Blackberry 2004 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2004 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

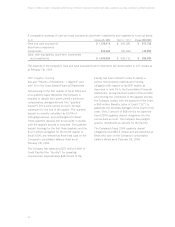

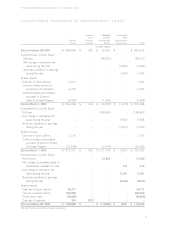

Research In Motion Limited • Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)

material adverse effect on RIM’s future results of

operations and financial condition. In addition, if

RIM is not able to overturn on the appeal the

injunction, it may be unable to continue to provide

BlackBerry service in the United States and to

continue to use, sell or manufacture its wireless

handhelds and software in, or to import them into,

the United States, which is the largest market for

RIM’s products and services, unless RIM is able

to negotiate a license with NTP at that time, which

may not be available to RIM at a reasonable cost

or at all.

Investment Income

Investment income decreased to $10.6 million in

fiscal 2004 from $11.4 million in fiscal 2003. The

decrease primarily reflects a reduction in the

average interest rate yield on the investment

portfolio during fiscal 2004 compared to fiscal

2003. Investment income increased for the period

January 21, 2004 to February 28, 2004 as a result

of the Company’s equity offering of 12.1 million

shares, which raised net proceeds of $905.2 million

that were invested for that period.

The Company expects its investment income to

increase in fiscal 2005 compared to fiscal 2004 as

a result of the inclusion of the $905.2 million in

the Company’s fiscal 2005 investment portfolio for

the entire 2005 fiscal year.

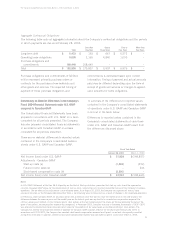

Income Taxes

The Company recorded a current tax recovery of

$4.2 million or $0.05 per share diluted in the

fourth quarter of fiscal 2004 to reflect the

resolution of certain tax uncertainties previously

provided for.

The Company recorded nil deferred income tax

expense in fiscal 2004 as the Company’s income

tax expense with respect to pre-tax income earned

was offset by the utilization of previously

unrecognized deferred tax assets. The Company

maintained its previous determination that we still

did not meet the “more likely than not” standard

under U.S. and Canadian GAAP with respect to the

realization of its deferred income tax asset balance

and that a full valuation allowance is required as at

February 28, 2004.

For fiscal 2003, during the third quarter, the

Company determined that it was no longer able to

satisfy the “more likely than not” standard with

respect to the realization of its deferred income tax

asset balance. Consequently, the Company recorded

an increase in its valuation allowance at the time,

resulting then in a net provision for deferred income

tax of $37.9 million. These net deferred tax assets

have a substantially unlimited life and remain

available for use against taxes on future profits. The

Company will continue to evaluate and examine the

valuation allowance on a regular basis and as

uncertainties are resolved, the valuation allowance

may be adjusted accordingly. See also Note 9 to the

Consolidated Financial Statements.

The Company has not provided for Canadian income

taxes or foreign withholding taxes that would apply

on the distribution of the earnings of its non-

Canadian subsidiaries, as these earnings are

intended to be reinvested indefinitely by these

subsidiaries.

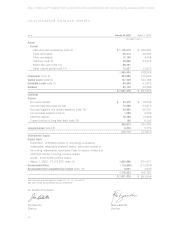

Net Income (Loss)

Net income was $51.8 million, or $0.65 per share

basic and $0.62 per share diluted, in fiscal 2004

versus a net loss of $148.9 million, or $1.92 per

share basic and diluted, in the prior year. See

“Executive Summary” for an analysis and

reconciliation of the fiscal 2004 increase in net

income and earnings per share.