Blackberry 2004 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2004 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

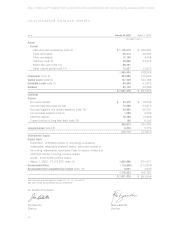

Research In Motion Limited • Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)

3. Recently Issued Pronouncements

In December 2003, the FASB amended

Interpretation No. 46 (“FIN 46”), Consolidation of

Variable Interest Entities (“FIN 46R”). FIN 46R

requires that a variable interest entity (“VIE”) be

consolidated by a company if that company is

subject to a majority of the risk of loss from the

VIE’s residual returns. For the Company, the

requirements of FIN 46R apply to VIE’s created

after January 31, 2003. For those VIE’s created

before January 31, 2003, the requirements of

FIN 46R apply as at February 29, 2004. The

adoption of FIN 46R did not have an impact to

the Company’s financial statements as at and for

the year ended February 28, 2004.

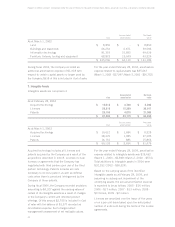

4. Cash, Cash Equivalents and Investments

(a) Cash and cash equivalents are recorded at fair value and comprise:

February 28, 2004 March 1, 2003

Balances with banks $2,644 $16,603

Money market investment funds 9,657 2,635

Certificates of deposit 255,199 111,664

Repurchase agreements 110,622 15,868

Government sponsored enterprise notes –9,999

Commercial paper and corporate notes 778,297 183,912

$1,156,419 $340,681

Cash and cash equivalents carry weighted average yields of 1.0% as at February 28, 2004 (March 1, 2003 – 1.3%).

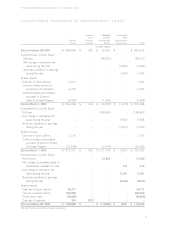

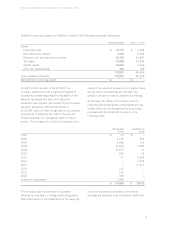

(b) Investments include securities that are held as available-for-sale and securities which the Company intends

to hold to maturity.

As of February 28, 2004, the contractual maturities of debt securities were as follows (at carrying value):

Years to Maturity

No Single

One to Five to Maturity

Five Years Ten Years Date Total

Available-for-sale $ 139,266 $ 25,164 $ 23,394 $ 187,824

Held-to-maturity 79,404 – 66,658 146,062

$ 218,670 $ 25,164 $ 90,052 $ 333,886

Securities with no single maturity date reflect asset-backed securities.

Available-for-sale investments are carried at fair value and comprise:

Amortized Unrealized Unrealized

Cost Gains Losses Fair Value

As at February 28, 2004

Government sponsored enterprise notes $ 80,086 $ 300 $ – $ 80,386

Asset-backed securities 23,385 25 (16) 23,394

Corporate bonds 83,740 323 (19) 84,044

$ 187,211 $ 648 $ (35) $ 187,824

As at March 1, 2003 $–$–$–$–